The Bench Accounting Crisis: Recovery Strategies for Affected Businesses

in CFO, Fractional CFO, Affected Businesses, CFO Services, Financial Modeling, Functions of a CFO, Strategies, All Posts

As a leading provider of CFO services with over two decades of experience helping businesses navigate financial challenges, CFO Pro+Analytics has successfully guided dozens of companies through critical transitions and crises. Our team of certified financial professionals have extensive experience in emergency response situations and system migrations. Within hours of Bench Accounting’s shutdown announcement, our firm began receiving calls from affected businesses, and we’ve already initiated discussions with Bench clients.

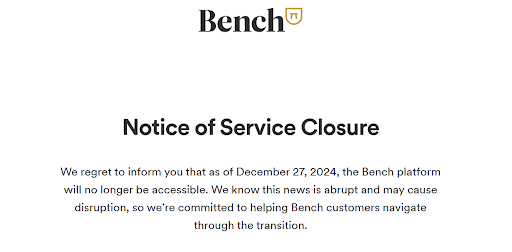

The Bench Crisis: Understanding What Happened

On December 27, 2024, Bench Accounting, a venture-backed bookkeeping platform that served over 35,000 U.S. businesses, abruptly announced its shutdown. Despite raising $113 million in venture capital and being valued at over $500 million, Bench gave its customers just three days’ notice to download their financial data before the platform would become inaccessible. Former Bench clients must now rapidly reconstruct their entire financial infrastructure during the most critical period of the year.

Immediate Impact on Bench Clients

The timing of Bench’s shutdown couldn’t be worse for businesses. Former Bench clients face multiple urgent challenges:

- Loss of access to historical financial records after December 30

- Disruption of year-end closing processes

- Uncertainty about tax document availability

- Interrupted accounting workflows

- Potential compliance issues

- Cash flow management concerns

Many Bench users relied entirely on the platform for their financial operations, making this shutdown particularly devastating. The comprehensive nature of Bench’s services means that businesses must now quickly replace multiple critical functions.

Critical Areas Requiring Immediate Action

Year-End Financial Close

Former Bench clients must urgently address the following:

- Recovery of Q4 2024 financial records before access expires

- Completion of December reconciliations

- Year-end adjustment entries and accruals

- Financial statement preparation

- Documentation gathering for potential audits

Tax Compliance

With tax season approaching, former Bench users need to:

- Download all tax-related records from the Bench platform

- Ensure complete documentation for 2024 returns

- Address 1099 preparation requirements

- Maintain state and local tax compliance

- Review sales tax reporting obligations

Operational Finance

Businesses must quickly restore systems that Bench previously handled:

- Accounts payable processes

- Customer billing systems

- Payroll management

- Employee expense tracking

- Banking reconciliations

CFO Pro+Analytics Recovery Process

We’ve developed a systematic approach specifically for former Bench clients:

Phase 1: Emergency Data Recovery (Days 1-3)

- Immediate download of all available data from Bench

- Critical documentation inventory

- Compliance deadline review

- Cash flow assessment

- Review of pending payment obligations

Phase 2: System Implementation (Days 4-7)

- QuickBooks setup and configuration

- Chart of accounts migration from Bench format

- Banking connection restoration

- Vendor database recreation

- Customer database migration

Phase 3: Process Reconstruction (Week 2)

- New accounting workflow establishment

- Approval process implementation

- Internal control setup

- Reporting system configuration

- Staff training on new procedures

Phase 4: Historical Data Integration (Weeks 2-4)

- Migration of historical Bench transactions

- Account balance reconciliation

- Data verification and cleanup

- Gap analysis and documentation

- Audit trail creation

Addressing Critical Risk Areas

Payroll and Benefits

Former Bench clients must maintain:

- Uninterrupted payroll processing

- Benefits administration continuity

- Year-end bonus processing

- W-2 and 1099 preparation

- Contractor payment systems

Vendor Management

Businesses need to:

- Identify and prioritize critical vendor payments

- Communicate changes to key suppliers

- Maintain payment schedules

- Update vendor information

- Preserve important vendor relationships

Loan Compliance

Organizations must:

- Review loan covenant requirements

- Prepare required financial reports

- Maintain payment schedules

- Document ongoing compliance

- Communicate with lenders about the Bench situation

Lessons Learned: The Risk of Startup Platforms

The Bench shutdown highlights a critical warning about fintech startups in the accounting space. Many of these companies, like Bench, operate with unsustainable business models:

- Below-market pricing that doesn’t cover operational costs

- Heavy reliance on venture capital funding

- Growth prioritized over profitability

- Insufficient financial reserves

- Incomplete risk management systems

The Path Forward: Choosing Stability

Instead of risking another Bench-like situation, we strongly recommend businesses choose established platforms and professional services:

Platform Stability

- QuickBooks’ proven track record and financial stability

- Regular system updates and improvements

- Comprehensive technical support

- Extensive integration capabilities

- Robust data security

Professional Oversight

- Experienced CFO guidance

- Technical expertise

- Industry-specific knowledge

- Regulatory compliance management

- Strategic risk management

Conclusion

The Bench shutdown serves as a stark reminder that financial infrastructure decisions should prioritize stability over cost savings. While emerging fintech solutions may offer attractive pricing, the risks of disruption far outweigh potential savings, as thousands of former Bench clients are now discovering.

CFO Pro+Analytics stands ready to help affected Bench clients recover and establish stable, professional financial management systems. Our combination of QuickBooks expertise and professional CFO services provides the security and sophistication modern businesses require.

For immediate assistance in recovering from the Bench shutdown or to discuss upgrading your financial management systems, contact CFO Pro+Analytics today. Time is critical in these situations, and early action can prevent significant complications.

Remember: Your financial infrastructure is too important to trust to unproven platforms. Choose established solutions backed by professional expertise.

About the Author

Salvatore Tirabassi is a seasoned Chief Financial Officer and change agent with over 25 years of success transforming finance to innovate, grow, and increase shareholder value. Based in or operating out of the New York City Area, Salvatore specializes in providing Fractional CFO services to businesses, offering strategic financial guidance to drive growth and success. Connect with Salvatore on LinkedIn or CFO PRO+Analytics for more financial management and strategic planning insights.