Practical Strategies to Improve Cash Flow For Small – Medium Sized Businesses

in Cash Flow Management, CFO, Finance, Fractional CFO, Cash Flow Management, Fractional CFO Services, Outsourced CFO services, saas fractional cfo, All Posts

Meta reported $164.5 billion in revenue in 2024, with a net profit of $62.4 billion, a 59% increase from the previous year. Clearly, Meta is getting its cash flow management right. The company operates a free-for-user model but generates most of its revenue through digital advertising due to its enormous social media reach through Facebook, Instagram, WhatsApp, and Threads. Meta also generates additional cash flow from sales of its Oculus VR headsets and is poised for future income from massive AI investments.

Founder-owned and small businesses don’t have the luxury of such massive product success, but on a smaller scale, with effective tools and management, they must continue to tinker with ways to improve their business cash flow.

From our perspective as a Fractional CFO company, in this article, we offer practical strategies businesses can use to improve their cash flow.

Cash flow is the lifeblood of any business, and every business needs a sustainable cash flow to survive and thrive. Therefore, businesses must think creatively about sustaining existing cash flow and generating more income. Cash flow keeps a business operation running smoothly, employees paid, and supports growth initiatives. Here are some short—and long-term strategies for improving business cash flow.

Short-term Strategies

- Cut Unnecessary Expenses

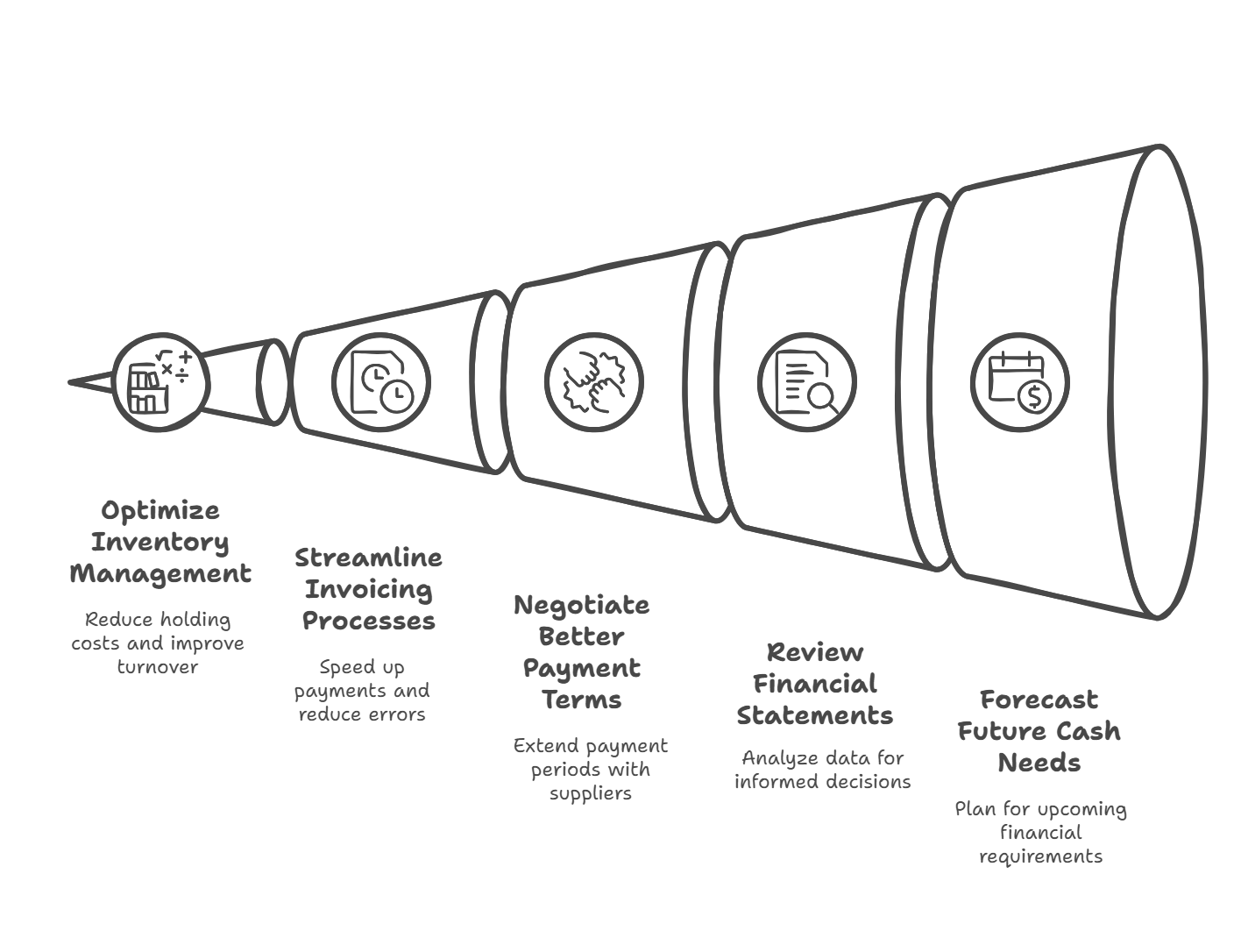

This is the first line of action for businesses to improve short-term cash flow. Similar to personal expenses, there are areas that a business can trim down to free up some extra cash, even if it’s only temporarily. Businesses can limit spending on non-essential items and embrace some initiatives to conserve cash. Simple Google searches can come up with a variety of alternatives to existing services you pay for at a lower cost. For example, just make sure to thoroughly research the changes in suppliers, as unreliable vendors are never worth the discount - Reduce Inventory Level

Businesses could apply the Just-in-time methodology popularized by Toyota in the 1970s to minimize excess stock and free up cash. Small businesses could also consider using inventory management software that enhances their management capabilities to manage inventory efficiently for optimal ordering. Check out the Quickbooks App Store for inexpensive inventory modules to help you achieve results. SOS Inventory and Katana are two examples of such plugins for Quickbooks. - Improved Accounting System

An efficient accounting system will help a business keep adequate records of inflows and outflows, giving businesses a bird’s eye view of their finances. It will also allow them to understand the nitty-gritty of finances and check for leakages. We are big fans of Quickbooks Online because it is cost-effective, and the Quickbooks App Store has many inexpensive additions. Cash Flow Frog is an app that you might find helpful for weekly cash flow planning and analysis. - Block Financial Leakages

A leaking boat would sail nowhere, just as a business with financial leakages will continue to sink. Businesses, with the aid of a trustworthy Fractional CFO, should continually identify cash leakages and block them as soon as possible. Cash leakages could be caused by overpayment, fraud, unused or underutilized subscriptions, unnecessary security deposits, and poor project time tracking. For security deposits, for example, consider putting up a letter of credit instead of cash. This way you can keep the cash for your own growth. - Optimize invoicing Processes

Implement efficient invoicing and follow-up systems for timely payments for customers. A good CRM with invoicing capabilities can help you do this. For example, services businesses could use the invoicing capabilities of HoneyBook, which tracks invoices, sends reminders and makes billing more fluid. Quickbooks is also great for this. Just remember, systems like Honeybook and Quickbooks charge very high fees for payments you receive, but you can work around this by instructing customers to make payments using their bank’s ACH services.

Long-Term Strategies

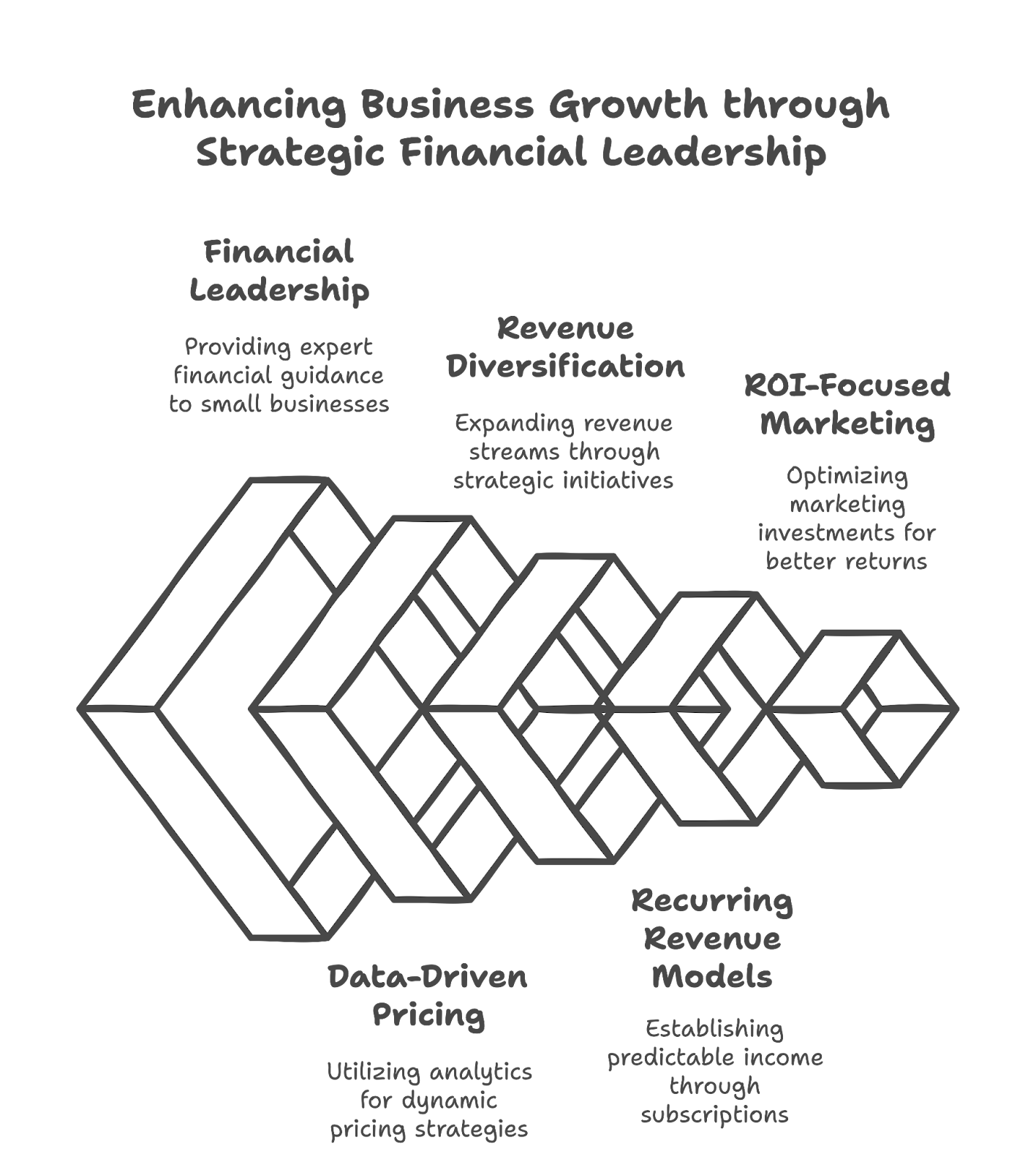

I. Strategic Financial Leadership Through Fractional CFO Services

Small businesses can access enterprise-grade financial leadership without enterprise-level costs. For example, one of our clients implemented sophisticated forecasting systems that improved working capital efficiency by 40%, enabling rapid expansion without additional funding. Another manufacturing client optimized their supply chain costs through advanced analytics, saving $2M annually.

II. Data-Driven Pricing Optimization

Modern pricing strategies require sophisticated analysis. A specialty food manufacturer we worked with implemented dynamic pricing analytics, which improved margins by 25% while growing market share. Starbucks demonstrates this concept well, using data analytics to adjust pricing based on location, demand patterns, and customer preferences.

III. Strategic Revenue Diversification

Revenue diversification must be strategic and measurable. One professional services client leveraged their expertise to create a training division, generating 30% additional revenue with minimal investment. Consider how Peloton expanded from hardware to subscription content, creating multiple revenue streams from their core customer base.

IV. Building Sustainable Recurring Revenue

Revenue Implementing recurring revenue models requires sophisticated systems and analytics. We helped a commercial cleaning business transition to a subscription model, increasing predictable monthly revenue by 40%. DocuSign exemplifies this approach, transforming document signing in to a recurring revenue platform.

V. ROI-Focused Marketing Investment

Modern marketing requires precise measurement and optimization. Using our analytics platform, a direct-to-consumer client reduced customer acquisition costs by 30% while increasing lifetime value. Consider how Warby Parker used data-driven marketing to disrupt the eyewear industry, achieving remarkable growth through carefully measured customer acquisition strategies.

Each strategy builds on proven financial leadership principles, implemented through sophisticated yet practical systems scaled for growing businesses. The key is combining enterprise-grade financial expertise with hands-on execution tailored to your business needs.

Case Study: Tech Startup’s Cash Flow Transformation

Background

A tech startup specializing in software development was experiencing rapid growth. However, this expansion brought significant cash flow challenges. The company struggled to manage its finances effectively while trying to scale operations. Furthermore, delayed payments from clients and rising operational costs compounded the issue, leading to uncertainty about funding future projects.

The Challenge

The startup’s leadership recognized that they needed expert financial guidance but could not afford a full-time CFO. So, they engaged a fractional CFO at a rate they could afford, with expertise sufficient to navigate their troubled waters. This Fractional CFO became a part-time member of the CEO’s trusted executive team, ensuring a strong relationship to help guide the business.

To address these issues, the Fractional CFO began by thoroughly analyzing the company’s financial situation.

Implementation of Strategies

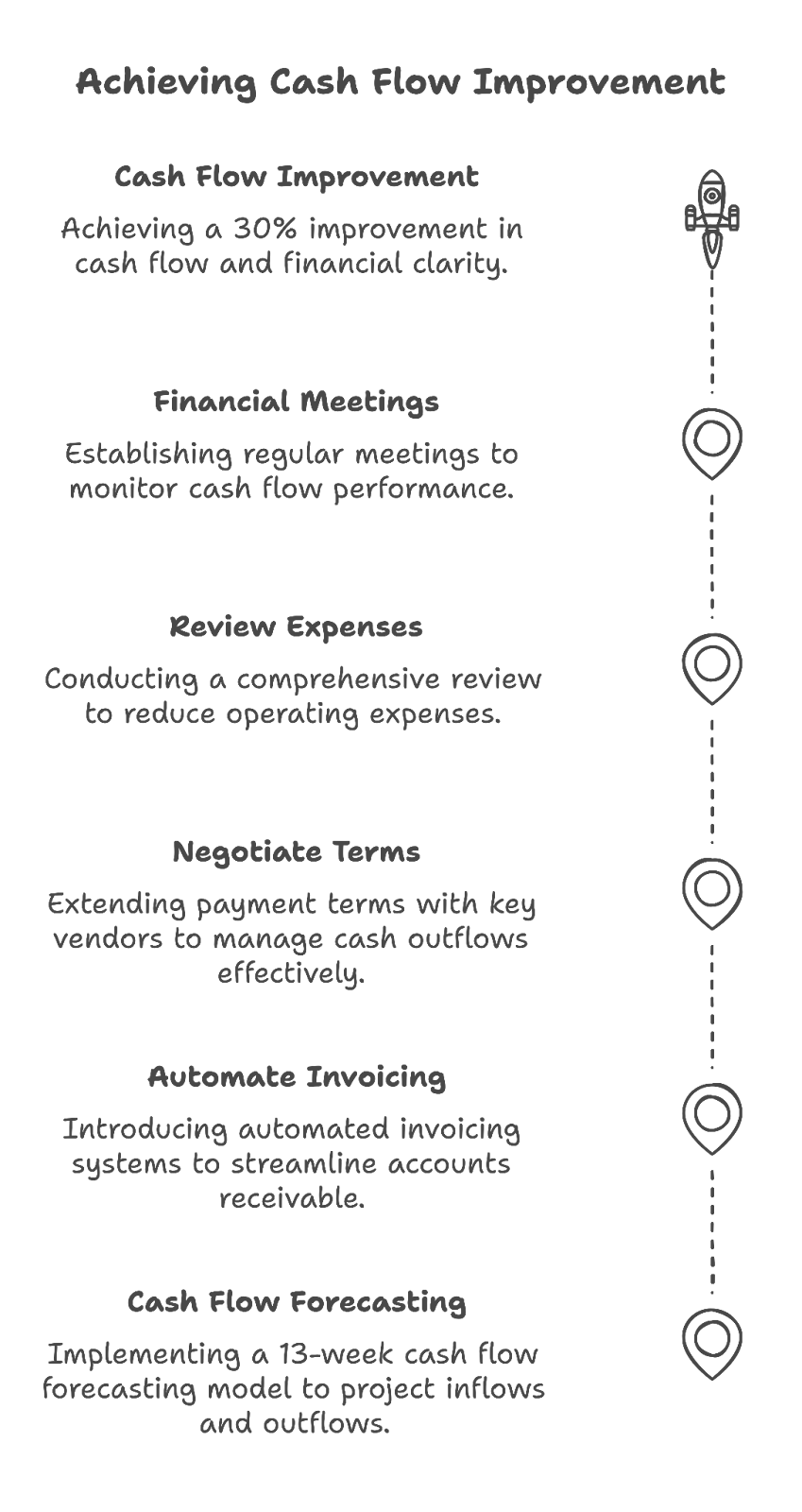

- The Fractional CFO implemented a 13-week cash flow forecasting model that projected inflows and outflows. This model provided visibility into potential cash shortfalls and helped the team make informed decisions about spending and investments.

- The CFO revamped the accounts receivable process by introducing automated invoicing systems and establishing clear payment terms. The startup significantly improved its collection rates by offering early payment discounts and tightening credit terms for clients.

- The Fractional CFO negotiated extended payment terms with key vendors, allowing the startup more time to manage its cash outflows effectively. This strategy enabled the company to retain more cash on hand while still meeting its obligations.

- A comprehensive review of operating expenses was conducted, identifying areas where costs could be reduced without impacting service quality. This included renegotiating contracts with service providers and eliminating non-essential expenditures.

- The CFO established regular financial review meetings with the leadership team to monitor cash flow performance against forecasts. These meetings facilitated ongoing discussions about financial health and allowed for timely adjustments to strategies as needed.

Results Achieved

Within just a few months of engaging the Fractional CFO, the tech startup experienced remarkable improvements in its cash flow situation:

- 30% Improvement in Cash Flow: The implementation of effective cash flow forecasting and streamlined accounts receivable processes led to a significant increase in available cash.

- Enhanced Financial Clarity: Leadership gained better visibility into their financial performance, enabling them to make informed decisions about future investments and growth initiatives.

- Sustained Growth: With improved cash flow management, the startup was able to fund new projects without relying on external financing or compromising operational stability.

Frequently Asked Questions

- What specific strategies does a Fractional CFO use to improve cash flow?

Fractional CFO employs various strategies tailored to a company’s unique financial situation. Key strategies include Cash flow forecasting, optimizing working capital, and expense management.

- How does a Fractional CFO help with accounts receivable management?

Fractional CFOs are crucial in improving accounts receivable management by streamlining invoicing processes, establishing clear payment terms, and monitoring collections.

- What are the benefits of hiring a Fractional CFO compared to a full-time CFO?

Hiring a Fractional CFO offers several advantages over hiring a full-time CFO, especially for small to medium-sized enterprises. These include cost-effectiveness, flexibility, and access to diverse expertise.