Understanding the Trade-Off Between Debt and Equity Financing

in Cash Flow Management, CFO, Finance, CFO Services, Family-Owned Businesses, financial planning, Fractional CFO, Loan Applications for Small Businesses, Mergers and Acquisitions, All Posts

I work with a lot of family-owned businesses at the point of scaling, and one question that I get asked a lot is: Should we raise funds with equity or Debt? But before giving an answer, which I will at the end of the article, I try to make the owners answer three fundamental questions about finance, which are;

- What do you need to buy?

- How do you get the money?

- How do you manage finances after funding?

Most of the time, businesses focus on how to get the money, often considering traditional bank loans evaluated by banks based on various financial metrics, but the other questions are just as important. So in this article, I’ll explain funding by debt or equity based on those fundamental questions, so let’s get started.

TL;DR

The choice between debt and equity financing depends on what you’re buying, your business stage, and risk tolerance. Debt financing works best for asset-heavy businesses with stable cash flows, offering tax benefits while maintaining control. Equity financing suits high-growth companies needing patient capital without repayment pressure. The optimal approach often combines both, balancing the tax advantages and lower cost of debt against the flexibility and shared risk of equity to minimize your overall cost of capital.

Introduction to Capital Structure

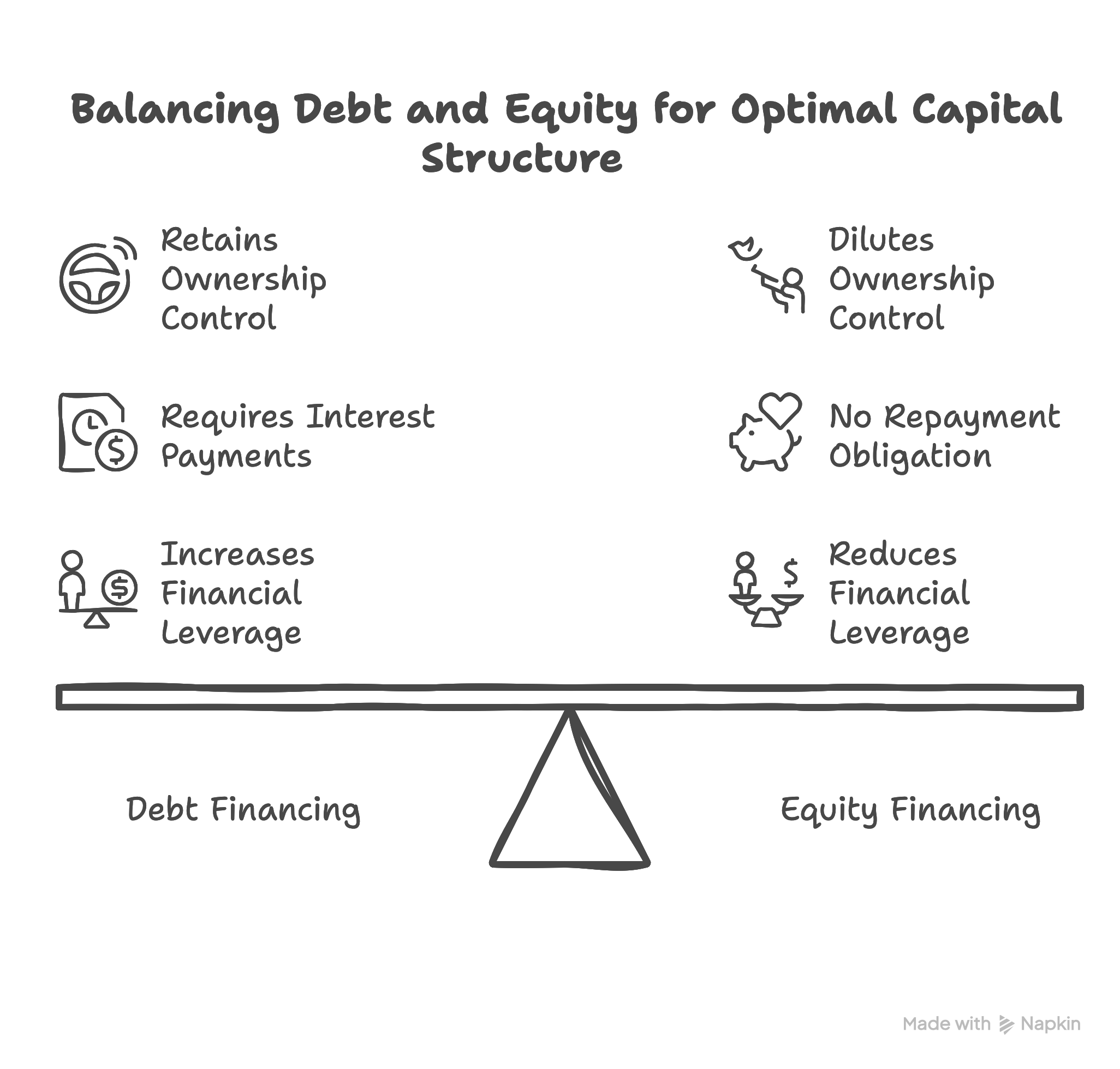

Capital structure refers to the mix of equity and debt financing that a company uses to fund its operations and growth. Finding the optimal capital structure is crucial because it helps minimize the cost of capital and maximize the firm’s value. Essentially, it’s about striking the right balance between borrowing money (debt financing) and selling ownership stakes (equity financing).

Equity and debt financing are the two primary methods companies use to raise capital. Debt financing involves borrowing money from financial institutions or investors, which must be repaid over time with interest. This method allows companies to raise capital without giving up ownership but comes with the obligation of regular interest payments. On the other hand, equity financing involves selling shares of the company to investors, which doesn’t require repayment but does dilute ownership and control.

The choice between debt and equity financing depends on several factors, including the company’s risk profile, financial performance, and tax implications. For instance, companies with stable cash flows might prefer debt financing due to the tax benefits of interest payments being tax-deductible. Debt increases financial leverage, which magnifies both potential gains and losses for the company. Conversely, startups or high-growth companies might lean towards equity financing to avoid the burden of debt obligations and benefit from the expertise and network of equity investors.

In summary, the optimal capital structure is a well-balanced mix of debt and equity that aligns with the company’s financial goals and risk tolerance, ultimately enhancing firm value.

The Role of Financial Markets in Business Financing

Financial markets are the backbone of modern business financing, providing companies with the platforms and mechanisms needed to raise capital efficiently. Whether a business is seeking to expand operations, invest in new projects, or simply strengthen its balance sheet, financial markets offer access to both debt and equity financing options.

For instance, companies can secure debt financing through bank loans or by issuing bonds in the bond market. This allows them to raise capital while retaining full control and ownership, and to benefit from tax advantages such as the tax deductibility of interest payments. On the other hand, equity financing is facilitated through stock exchanges, where companies can issue shares to raise money from a broad pool of investors. While this approach means sharing ownership and control, it can provide substantial funds without the burden of regular interest payments.

The optimal capital structure for any business is heavily influenced by the conditions and opportunities present in financial markets. When interest rates are low and investor confidence is high, companies may find it more attractive to increase debt financing. Conversely, in volatile markets or when the risk of financial distress is elevated, equity financing might be the safer route. The trade off theory states that companies should carefully balance the tax benefits and lower cost of capital associated with debt against the potential risks of financial distress and bankruptcy.

Ultimately, financial markets enable businesses to tailor their capital structure to their unique needs and market conditions, helping them raise capital efficiently while managing risk and maximizing firm value.

Factors that Determine Capital Structures

Several factors play a crucial role in determining a company’s capital structure. These factors determine whether a company chooses debt or equity financing. These include the industry in which the company operates, its business risk, and the prevailing tax environment. Each of these factors can significantly influence whether a company leans more towards debt or equity financing.

- Industry: Different industries have varying capital structure norms. For example, capital-intensive industries like manufacturing might have higher debt levels due to the need for substantial upfront investment in equipment and facilities. In contrast, tech companies might rely more on equity financing to fund research and development.

- Business Risk: Companies with higher business risks, such as those in volatile markets, might prefer equity financing to avoid the pressure of fixed interest payments. Equity investors share the business risk, which can be advantageous during economic downturns.

- Tax Environment: The tax benefits associated with debt financing, such as the tax deductibility of interest payments, can make debt an attractive option. However, changes in tax laws can impact this decision, making it essential for companies to stay informed about the tax implications of their financing choices.

- Growth and Investment Plans: Companies with aggressive growth and investment plans might favor equity financing to ensure they have the necessary capital without the burden of debt repayments. Equity financing can provide the flexibility needed for long-term projects and scaling.

The trade-off theory states that companies balance the benefits and costs of debt and equity financing to determine their optimal capital structure. This involves finding the optimal debt-equity ratio that minimizes the cost of capital and maximizes firm value. By carefully considering these factors, companies can develop a well-balanced capital structure that supports their financial health and growth objectives.

Question 1: What Do You Need To Buy?

This is the first question that business owners need to answer as they need to determine what they have to purchase or what they want to spend on. For example, a traditional business like Gillette and the Giant streaming platform will have two different types of expenses. A Business like Gillette will need to spend mostly on land, equipment, manufacturing plants, and logistics. In contrast, a business like Netflix will invest heavily in software development, funding original movie content, and acquiring licenses (like the $5bn mega deal to stream WWE content).

Generally, banks and corporate financiers will lend money to businesses that own physical assets like land, buildings, and trucks because they can recover these assets when the company fails to make payments or goes bankrupt. In the event of bankruptcy, secured creditors have the first claim on the company’s assets, while unsecured creditors are paid only after the secured creditors have been satisfied. While businesses that invest heavily in structure, infrastructure, and skill will raise funding more easily via equity from angel investors, venture capitalists, and individual investors.

Question 2: How do you get the money?

This is the next phase of fundraising, where businesses consider their options to raise funds, which are usually categorized as follows:

- Debt financing

- Equity financing

- Reinvesting Profits.

When raising capital or raising business capital, it is crucial to select the appropriate financing method to ensure the business capital is structured efficiently and tax advantages are maximized.

Debt financing

Debt financing is when a business borrows money that must be paid back over time, usually with interest. Debt involves borrowing money for a specific period, which must be repaid with interest. This can come from banks, credit unions, or even private lenders. It is similar to taking out a personal loan or using a credit card. You get money upfront to use for your business, but you agree to repay it over a set period. The lender does not own any part of your business, but they expect to be paid back on time regardless of how your business performs. When you use borrowed money, you are obligated to repay the full amount plus interest, which can create financial strain if your business faces challenges.

The benefit of debt financing is that you can keep full control of your business while still getting the cash you need to grow. You might use this money to buy equipment, hire staff, or expand into new markets. Interest expense is a key consideration in debt finance, as it is often tax-deductible and can provide a tax shield. Debt financing offers tax deduction opportunities because the interest expense on the company’s debt is tax-deductible, creating a tax shield and resulting in tax shield benefits that reduce your overall tax liability. However, it is important to be careful because taking on too much debt can hurt your cash flow or even put your business at risk if you cannot make the payments. Increasing a company’s debt through debt finance raises financial leverage, which can magnify both gains and losses and increase the risk of financial distress. Fixed interest rates provide certainty in repayment amounts, while variable interest rates can lead to higher costs if market rates rise, increasing repayment risk. It’s important to note that the law is on the side of lenders, and they have the first right to access your assets in case of bankruptcy or inability to pay. If you breach loan covenants, the lender may require you to repay the entire loan immediately, which can be financially devastating. During an economic downturn, the risks of debt financing are amplified, as financial distress costs can increase and make it harder for businesses to meet their obligations.

Equity Financing

Unlike debt financing, equity financing is when a business raises money by selling a piece of ownership in the company. This usually means bringing in investors who give you cash in exchange for a share of your business. Unlike a loan, you do not have to pay this money back. But since the investors now own part of your company, they may have a say in how things are run and will expect a share of the profits if the business does well.

The good thing about equity financing is that you get the money you need without taking on debt or monthly payments. This can be helpful if your business is new or not yet making steady profits. The trade-off is that you give up some control and ownership. Equity investors can also benefit from capital gains if the value of their shares increases over time. Companies may pay dividends to shareholders as a way to distribute profits, though these dividends are not tax-deductible and have tax implications for both the company and the individual. Securing equity financing can be challenging, as it often involves meeting investor expectations and managing the potential dilution of ownership.

A key tax consideration for companies disposing of significant shareholdings is the substantial shareholdings exemption, which can exempt gains from corporation tax if certain conditions are met.

Reinvesting Profits

With so much focus on raising funds via equity and debt, raising funds the old-fashioned way of reinvesting profits seems like a lost art. Still, it’s noteworthy that Berkshire Hathaway became the investment juggernaut it is today by consistently reinvesting profits. Warren Buffett, undoubtedly the most successful investor of the 20th century, recognized reinvesting as the best way to build wealth and continually grow as a business. Redirecting a portion of profits back into the company can help the establishment to grow and position itself for long-term success. One common way to reinvest is by making business improvements. As a business owner, you likely have a list of areas that could benefit from additional capital. This includes enhancing infrastructure, streamlining manufacturing processes, strengthening customer support, and refining your marketing strategy.

Question 3: How Do You Manage Finances After Funding?

What businesses need to do after funding is just as important as sourcing for funds. Because if a company runs into problems after funding, it’ll cause more damage, such as stress to the founder, loss of jobs, and waste of capital. As in the case of Lehman Brothers in the 2008 financial crisis, the bank was funded by loans and heavily invested in unregulated mortgage-backed securities. And, when the value of those securities plummeted, the bank could not meet its debt and fell into bankruptcy. To know how best to manage finances, businesses should understand the implications of the different means of funding.

Implications of Debt Financing

Debt financing has several implications for businesses. One of the main advantages is that it allows companies to access capital without diluting ownership. Additionally, debt can help reduce agency costs by aligning management and shareholder interests, as management is incentivized to use resources efficiently to meet debt obligations.

Pros:

- Interest payments on debt are tax-deductible, providing a tax benefit to the company.

- These interest payments reduce the company’s tax liability and can result in significant tax savings.

- Debt financing can improve return on equity when used appropriately.

- It allows existing owners to retain control of the business.

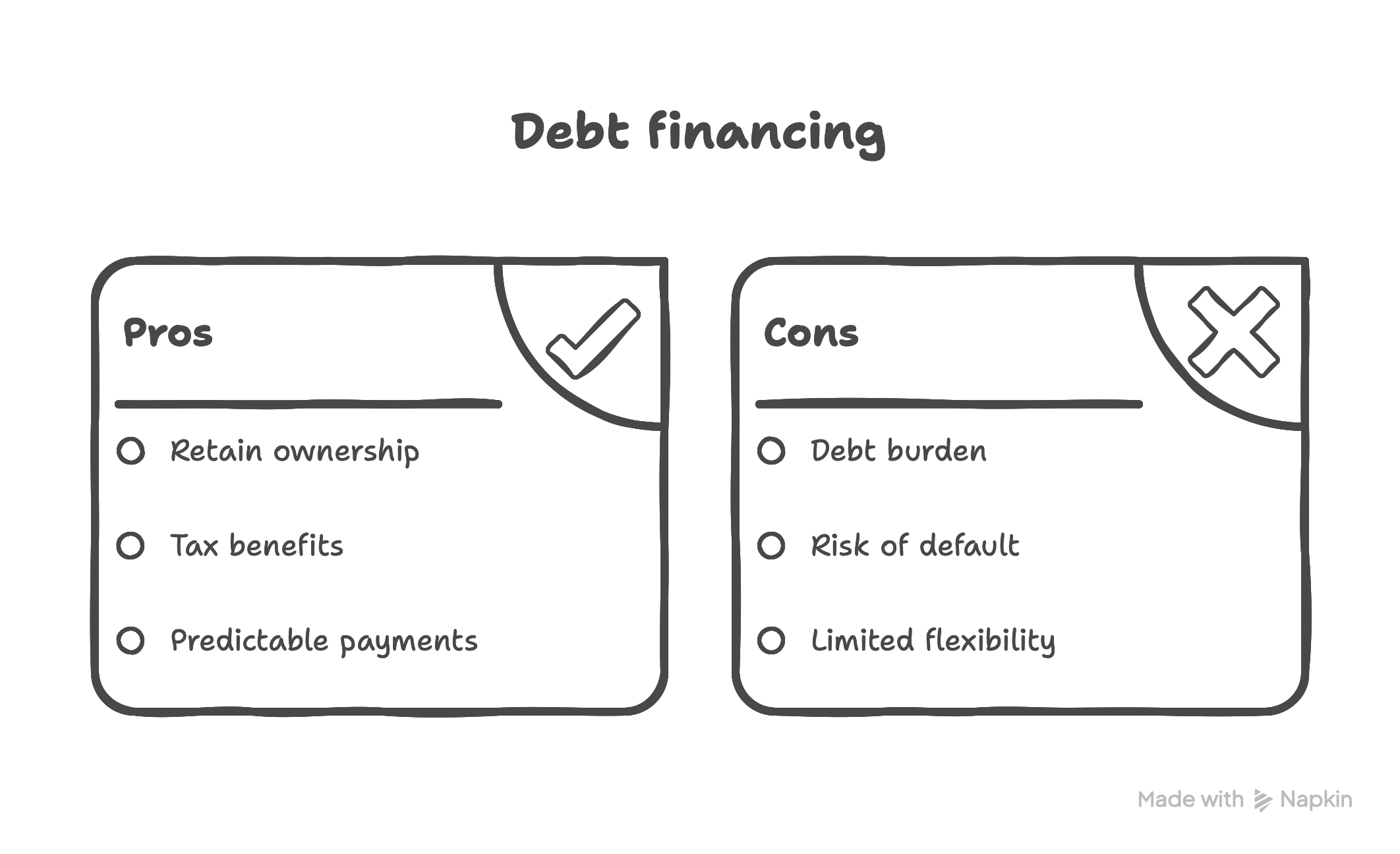

Pros:

- Retain ownership: You don’t have to give up shares of your company.

- Tax benefits: Interest payments on debt can be tax-deductible.

- Predictable payments: You know exactly how much you need to pay each month.

Cons:

- Debt burden: You have to repay the loan with interest, which can strain cash flow.

- Risk of default: If you can’t pay, you risk defaulting on the loan, damaging your credit score.

- Limited flexibility: Debt repayment schedules can limit your financial flexibility.

Debt works best for companies with:

- Steady cash flow

- Predictable revenue models

- Short-term funding needs (e.g., inventory, equipment)

Implications of Equity Financing

Equity financing has several implications for businesses. It not only affects ownership and control but also plays a significant role in shaping the company’s financing structure. By choosing equity over debt, a business influences its overall financing strategies, balancing the benefits and limitations of each option to optimize capital structure and align with long-term financial goals.

Pros:

- No debt burden: You don’t have to repay the investment, and there’s no interest.

- Shared risk: Investors share some of the business risk.

- Expertise and network: Investors can bring valuable experience and connections.

Cons:

- Loss of ownership: You dilute your ownership and control.

- Profit sharing: You’ll need to share profits with investors.

- Potential for conflict: Investors may have different visions for the company.

Equity suits companies that:

- Are pre-revenue or not yet profitable

- Operate in high-growth industries (e.g., SaaS, biotech)

- Need patient capital for R&D or scaling

Using Financial Ratios to Evaluate Capital Structure

Evaluating a company’s capital structure is not just about intuition—it requires a careful analysis of financial ratios to determine the most effective mix of debt and equity financing. These ratios provide valuable insights into a company’s financial health, risk profile, and ability to meet its financial obligations.

One of the most important metrics is the debt-to-equity ratio, which compares the amount of debt financing to equity financing. A higher ratio indicates greater reliance on borrowed funds, which can amplify returns but also increase financial risk. The interest coverage ratio is another key indicator, measuring a company’s ability to cover its interest payments from its operating income. A strong interest coverage ratio suggests that the company can comfortably meet its debt obligations, reducing the risk of financial distress.

Return on equity (ROE) is also crucial, as it shows how effectively a company is using equity capital to generate profits. By monitoring these financial ratios, businesses can assess whether their current capital structure is optimal, or if adjustments are needed to minimize the cost of capital and maximize firm value.

In addition to these ratios, companies must consider the tax implications of their financing choices. Debt financing often provides tax deductions on interest expenses, offering a tax benefit that can lower the company’s taxable income. However, relying too heavily on debt can increase the risk of financial distress, especially if cash flows become unpredictable.

By regularly analyzing financial ratios and understanding the tax benefits and risks associated with debt and equity financing, companies can make informed decisions to achieve an optimal capital structure that supports long-term growth and stability.

The Optimal Capital Structure

This model aims to have a mix of equity and debt in your funding plan, and this can help balance business growth and still have enough cash flow to meet business obligations. The optimal capital structure is one that minimizes the Weighted Average Cost of Capital (WACC) by taking on a mix of debt and equity. The purpose of WACC is to determine the cost of each part of the company’s capital structure based on the proportion of equity, debt and preferred stock it has. The optimal capital structure is achieved when the marginal benefit of additional debt equals its marginal cost, balancing the tax advantages of debt with the risks of financial distress. Such optimal capital structure is reached by weighing the tax benefits of debt against the potential costs of bankruptcy and financial distress. However, the trade-off theory has limitations, as it assumes a single target debt ratio and often overlooks real-world factors like transaction costs, which can make adjusting capital structure more complex. The weighted average cost of capital is an integral part of a DCF valuation model and, thus, it is an important concept to understand for finance professionals, especially for investment banking, equity research, and corporate development roles. But for now, I leave out the technical terms and provide a case study of an effective mix of the use of the optimal financing model.

Case Study for An Optimal financing model

Company: GreenTech, a renewable energy startup

Goal: Raise $1 million for product development and scaling

Current situation: GreenTech has a strong product prototype, a solid business plan, and a growing market

Financing options:

- Debt financing: $500,000 loan at 10% interest, repayable over 3 years

- Equity financing: $500,000 investment in exchange for 10% equity

Optimal financing mix:

- Debt financing: $300,000 (loan at 10% interest, repayable over 3 years) to cover operational costs and some product development

- Equity financing: $700,000 (in exchange for 14% equity) to fund aggressive product development and scaling

Rationale:

- Debt financing provides predictable payments and tax benefits, suitable for operational costs

- Equity financing brings in expertise and network, suitable for high-growth initiatives

Benefits:

- Reduced debt burden (compared to 100% debt financing)

- Shared risk and expertise from equity investors

- Flexibility to allocate funds effectively

Key takeaways:

- A mix of debt and equity financing can optimize financing costs and risks

- Align financing options with business goals and cash flow projections

- Consider the trade-offs between ownership, control, and financial flexibility

Conclusion

So it’s back to the initial question at the start of this article, which method of financing is preferred for for businesses, My answer remains, that it depends on your business goals, tolerance for risk, and need for control. Many companies in the startup stage will pursue equity financing, while those already established and those that have no problem with debt and possess a strong credit score might pursue traditional debt financing types like small business loans. However, I recommend a mix of both as the optimal finance model considering your Weighted Average Cost of Capital, which I will discuss in detail in a subsequent article.

Frequently Asked Questions

Q: What’s the main advantage of debt financing over equity financing for established businesses?

The primary advantage of debt financing is that it allows you to retain full ownership and control of your business while accessing capital. Additionally, interest payments on debt are tax-deductible, creating a “tax shield” that reduces your overall tax liability. This makes debt particularly attractive for profitable businesses with steady cash flows that can comfortably service the debt payments while benefiting from the tax advantages.

Q: When should a startup consider equity financing instead of taking on debt?

Startups should consider equity financing when they lack the predictable cash flows needed to service debt payments, are in high-growth industries requiring patient capital, or need more than just money—such as investor expertise, networks, and strategic guidance. Equity financing is also preferable when the business is pre-revenue or not yet profitable, as equity investors share the business risk and don’t require immediate returns like debt payments do.

Q: How do I determine the right mix of debt and equity for my business?

The optimal mix depends on your industry, business stage, cash flow predictability, and growth plans. Start by assessing what you’re buying (physical assets favor debt, while R&D and scaling favor equity), then evaluate your ability to service debt payments. Many successful businesses use a hybrid approach: debt for operational needs and asset purchases where you can leverage tax benefits, and equity for growth initiatives and strategic expansion. Consider working with a financial advisor to analyze your specific situation and calculate your optimal capital structure based on your Weighted Average Cost of Capital (WACC).