Tariff Impact: Beyond Headlines to the P&L Reality for Emerging Businesses

in Analytics, Finance, business analytics solutions, strategic financial planning, Tariff Impact, All Posts

Overview

The ping-ponging news on tariffs & tariff impact has been very confusing for emerging businesses and clients that I service through my CFO services and analytics practice. The international trade commission has found that while steel and aluminum producers may benefit from tariffs imposed by President Trump, the overall economic repercussions could be detrimental, particularly for downstream industries. In a recent podcast interview, I discussed tariffs and how the fundamental economics of tariff impositions are not covered in the more general media. By this, I mean that the tariffs themselves as headline numbers and the roiling of the stock market supercede a more in-depth discussion of how tariffs affect emerging businesses in their P&L. In this post, I want to provide some insights into the actual P&L impact and management decisions that go into maneuvering these uncertainties and increased costs.

Some Background Facts on the Trade War

In order to make this a concrete discussion, let’s focus on Chinese import tariffs, and I want to talk a bit first about the kinds of privately-held businesses impacted by the tariffs and the quantum of the economic value in this category of businesses that is impacted by the expense of tariffs. My reasons for focusing on this category is to demonstrate the kitchen-table discussion that these tariffs are currently causing in the homes of these business owners.

Privately-held businesses form the backbone of the American economy and are particularly vulnerable to tariff increases. Small and medium-sized enterprises (SMEs) with fewer than 500 employees account for 99.9% of all U.S. businesses and employ 47.1% of the private workforce—approximately 60.6 million Americans. Within this group, businesses involved in importing consumer goods from China are especially exposed to the recent tariffs.

The U.S. Census Bureau reports that approximately 263,000 small businesses engage in international trade, with a significant portion conducting business with China. These companies contribute over $500 billion annually to the U.S. economy and support roughly 6 million jobs directly and indirectly. Many operate on relatively thin margins of 10-15%, making them particularly sensitive to cost increases that cannot be easily absorbed.

Understanding the specific tariff exposure of these SMEs is crucial, as it directly affects their cost structures and pricing strategies. Identifying materials affected by tariffs and calculating potential cost increases are essential steps for these businesses to maintain profitability amid changing tariff conditions.

In the consumer goods sector alone—which includes home furnishings, electronics, apparel, and household items—small and medium-sized importers account for about 40% of the $463 billion in annual imports from China. These businesses typically lack the scale, resources, and negotiating power of their larger counterparts to easily mitigate tariff impacts, making them disproportionately affected by sudden trade policy changes.

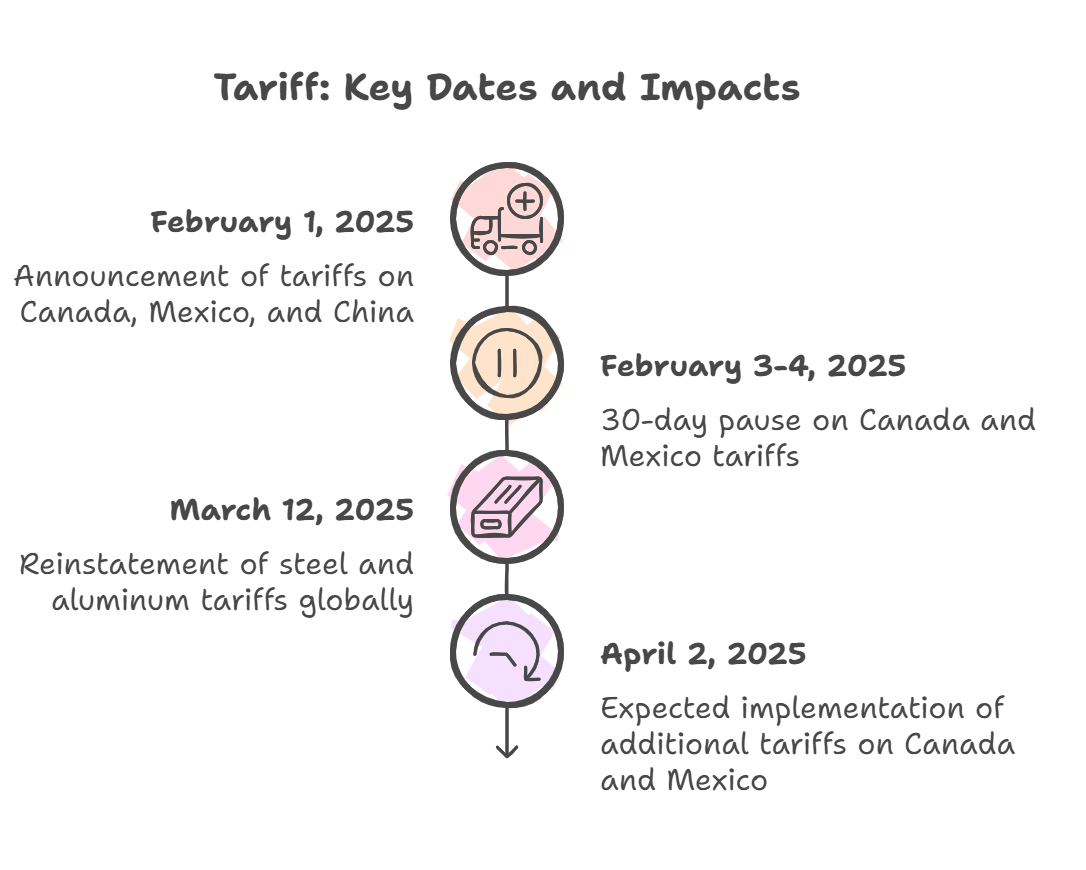

Quick Timeline Review

The rapid evolution of tariff policy has created a challenging environment for business planning. On February 1, 2025, the Trump administration announced plans to impose 25% tariffs on imports from Canada and Mexico, and a 10% tariff on goods from China. By February 3-4, following diplomatic negotiations, the administration agreed to a 30-day pause on the Mexico and Canada tariffs, while implementing the 10% tariffs on Chinese imports.

During this period, targeted tariffs were used as a strategic measure to escalate trade pressures, particularly affecting industries such as automotive and electronics.

On March 12, in a significant escalation, the administration reinstated 25% tariffs on all steel imports and increased tariffs on all aluminum imports to 25%, applying these measures globally without country exemptions. Looking ahead, additional tariffs on Canadian and Mexican imports are expected to take effect on April 2, following the expiration of the temporary reprieve. These have been described as potentially including both sectoral and reciprocal measures, further complicating the planning horizon for businesses.

Understanding Tariffs and It’s Impact

Tariffs are taxes imposed by the federal government on imported goods, and they can have a significant impact on businesses and consumers alike. In the current global trade environment, we are witnessing a “tariffs everywhere, all at once” scenario, where multiple countries are imposing tariffs simultaneously. This creates a complex and unpredictable trade environment, making it challenging for businesses to adapt.

The impact of tariffs extends far beyond the companies that directly import goods. Suppliers, customers, and the broader economy all feel the ripple effects. For businesses, tariffs often lead to rising costs as import taxes increase the price of goods. These increased costs can reduce consumer spending, as higher prices may deter purchases. Additionally, tariffs can disrupt trade flows, leading to delays and inefficiencies in the supply chain.

In some cases, tariffs can trigger retaliatory tariffs from other countries, escalating into a full-blown trade war. This tit-for-tat approach can further complicate the trade landscape, creating additional barriers for businesses to navigate. Companies that invest in strategic financial planning can better prepare for such economic uncertainties, ensuring they have contingency plans in place. While domestic producers might benefit from reduced competition from foreign imports, they too can face challenges. Higher prices for raw materials and components can squeeze margins, and companies may struggle to find alternative suppliers, leading to potential shortages.

Ultimately, companies respond to these increased costs by raising prices, which can lead to decreased demand and lower sales volumes. The broader economic impact includes potential job losses and reduced economic growth, as businesses and consumers alike adjust to the new cost structures imposed by tariffs.

A Profit and Loss Example

Let’s examine how these tariffs concretely impact both a U.S. retailer and a branded manufacturer using designer lighting as our example.

Pre-Tariff Economics:

Branded Manufacturer:

- Manufacturing cost in China: $85 per unit

- Wholesale price to retailer: $150 per unit

- Gross margin: $65 (43.3%)

Retailer:

- Wholesale purchase price: $150 per unit

- Retail selling price: $299 per unit

- Gross margin: $149 (49.8%)

Post-33% Tariff (Phase 1 – Manufacturer Absorbs Cost):

Branded Manufacturer:

- Manufacturing cost: $85 per unit

- Tariff cost (33%): $28.05 per unit

- Total landed cost: $113.05 per unit

- Wholesale price (unchanged): $150 per unit

- Gross margin: $36.95 (24.6%)

- Gross margin reduction: 43.2%

Retailer:

- Wholesale purchase price: $150 per unit

- Retail selling price: $299 per unit

- Gross margin: $149 (49.8%) – Unchanged

The branded manufacturer’s margin has collapsed from 43.3% to 24.6%, a reduction that is likely unsustainable for most businesses in this category. This leads us to Phase 2.

Post-Tariff (Phase 2 – Price Increase):

Branded Manufacturer:

- Total landed cost: $113.05 per unit

- Target margin restoration: 40%

- New wholesale price: $188.42 per unit

- Gross margin: $75.37 (40%)

Retailer:

- New wholesale purchase price: $188.42 per unit

- Adjusted retail price to maintain ~50% margin: $376.84

- Issue: This breaks the $300 price band, which is a conceptual ceiling that retailers determine is the most a consumer will pay for a product or the level at which they are not going to shop for a different deal.

Due to price banding concerns, the retailer and manufacturer might agree to a compromise:

- New retail price: $349.99 (keeping below the $350 psychological threshold)

- Retailer’s new margin: $161.57 (46.2%)

- Slight compression from original 49.8%

This represents a 17% increase in the final consumer price, which will inevitably affect demand.

Consumer Price Elasticity – Lower Demand for Products Due to Retaliatory Tariffs

The price elasticity of demand for designer lighting products typically ranges from -1.2 to -1.8, meaning that for every 1% increase in price, demand decreases by 1.2% to 1.8%. With our 17% price increase, we can expect demand to decrease by approximately 20-30%.

This price sensitivity is magnified by current consumer financial conditions. U.S. household credit card debt reached a record $1.13 trillion in Q4 2024, with average credit card balances exceeding $6,000 per cardholder. Revolving credit utilization rates are approaching 35%, indicating diminished capacity for discretionary spending.

The pressure on consumer spending is further evidenced by the debt-to-income ratio for U.S. households, which has climbed to 102% – meaning households owe more than they earn in a year. This overleveraged position makes discretionary purchases particularly vulnerable to price increases.

For our lighting product example, industry data suggests that when consumer lighting products cross certain price thresholds, particularly from sub-$300 to $350+, conversion rates drop by approximately 28%. This means that for every 100 customers who would purchase at the $299 price point, only 72 would purchase at $349.99.

Tariff Impact on the Businesses and Supply Chain

Let’s quantify this impact on our example businesses, assuming they previously sold 5,000 units annually:

Pre-Tariff Financial Performance:

Branded Manufacturer:

- Annual units: 5,000

- Gross margin per unit: $65

- Total gross margin: $325,000

- Operating expenses (60% of gross margin): $195,000

- Net profit: $130,000

- Effective tax rate: 21%

- After-tax profit: $102,700

Retailer:

- Annual units: 5,000

- Gross margin per unit: $149

- Total gross margin: $745,000

- Operating expenses (70% of gross margin): $521,500

- Net profit: $223,500

- After-tax profit: $176,565

Post-Tariff Financial Performance (with 25% unit volume reduction):

Branded Manufacturer:

- Annual units: 3,750 (25% reduction)

- Gross margin per unit: $75.37

- Total gross margin: $282,638 (13% decrease)

- Operating expenses (unchanged): $195,000

- Net profit: $87,638 (33% decrease)

- After-tax profit: $69,234

Retailer:

- Annual units: 3,750

- Gross margin per unit: $161.57

- Total gross margin: $605,888 (19% decrease)

- Operating expenses (unchanged): $521,500

- Net profit: $84,388 (62% decrease)

- After-tax profit: $66,666

To maintain their original profit levels, both businesses would need to cut costs significantly:

Branded Manufacturer:

- Required cost reduction: $42,362

- If labor represents 40% of operating expenses, this equates to potential layoffs affecting approximately 4-5 employees (based on average annual compensation of $65,000 for workers in this sector).

Retailer:

- Required cost reduction: $139,112

- With retail labor typically representing 65% of operating expenses, this could translate to 10-12 employee positions at risk (based on average retail compensation of $45,000).

The combined effect across these two businesses alone could impact 14-17 jobs. Multiplied across thousands of similar operations nationwide, the employment impact becomes substantial.

Managing Supply Chain Disruptions

Supply chain disruptions are a common consequence of tariffs, as companies scramble to adapt to the new trade environment. These disruptions can lead to delays, increased costs, and reduced efficiency, all of which can significantly impact a business’s bottom line. To manage these disruptions effectively, companies can take several proactive steps:

- Diversify Suppliers: Reducing reliance on a single supplier is crucial. By diversifying their supply chain, companies can mitigate the impact of tariffs and reduce the risk of disruptions. Sourcing from multiple suppliers in different regions can provide a buffer against trade policy changes.

- Invest in Supply Chain Visibility: Implementing supply chain visibility tools can help companies better understand their supply chain dynamics and identify potential disruptions early. These tools can provide real-time data and analytics, enabling businesses to make informed decisions and respond swiftly to changes.

- Develop Contingency Plans: Having a robust contingency plan is essential. Companies should identify alternative suppliers and routes to ensure continuity of supply. This might involve pre-negotiating contracts with backup suppliers or exploring different logistics options to circumvent trade barriers.

- Communicate with Suppliers and Customers: Open communication with suppliers and customers is vital. Keeping all stakeholders informed about potential impacts of tariffs and supply chain disruptions can help manage expectations and foster collaboration in finding solutions.

By taking these steps, companies can better navigate the challenges posed by tariffs and maintain a more resilient supply chain.

Navigating New Trade Policy

The current trade policy landscape is rapidly evolving, with multiple countries imposing tariffs and trade barriers. For businesses, staying ahead of these changes is crucial to maintaining competitiveness and minimizing risks. Here are some strategies to navigate this new trade policy environment:

- Stay Informed: Keeping abreast of changes in trade policy and tariffs is essential. Companies should monitor government announcements, trade publications, and industry reports to stay updated on the latest developments. This information can help businesses anticipate changes and adjust their strategies accordingly.

- Assess the Impact: Understanding the specific impact of tariffs and trade barriers on the business is critical. Companies should conduct thorough assessments to evaluate how changes in trade policy affect their sales, costs, and supply chains. This analysis can inform decision-making and strategic planning.

- Develop a Trade Strategy: A well-defined trade strategy can help businesses respond effectively to new trade policies. This strategy should identify opportunities and risks, outline steps to mitigate negative impacts, and leverage potential advantages. For example, companies might explore new markets or adjust their product offerings to align with changing trade dynamics.

- Engage with Government: Active engagement with government officials can provide businesses with a voice in trade policy discussions. Companies can advocate for their interests, provide input on policy decisions, and seek support for navigating trade barriers. Building relationships with policymakers can also help businesses stay informed about upcoming changes and potential impacts.

By understanding tariffs and their impact, managing supply chain disruptions, and navigating new trade policy, companies can better adapt to the changing trade environment and minimize the risks associated with tariffs and trade barriers. Leveraging business analytics solutions can further help businesses analyze trade patterns, optimize strategies, and make data-driven decisions. This proactive approach will enable businesses to maintain resilience and competitiveness in an increasingly complex global trade landscape.

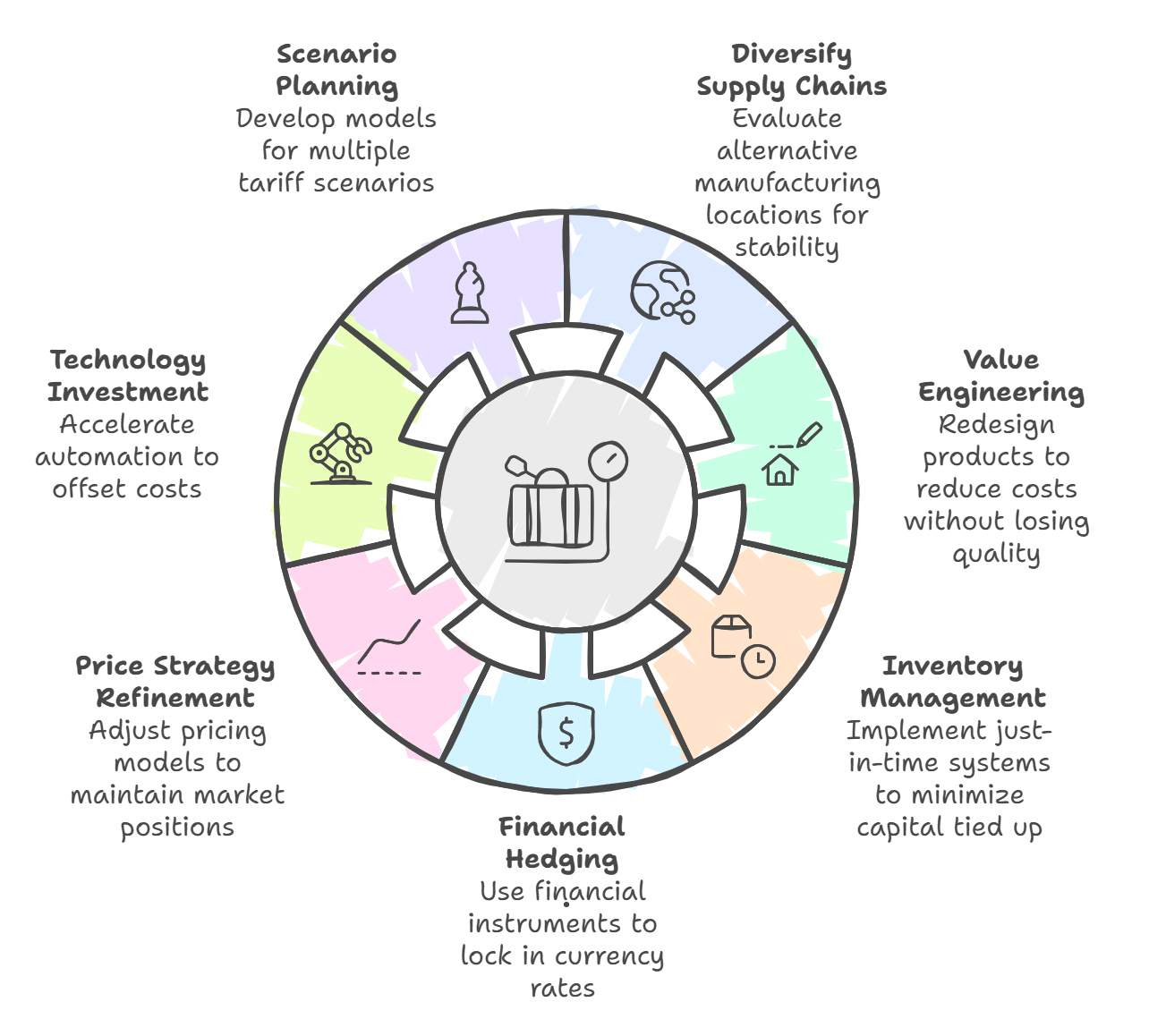

Strategic Recommendations for Financial Leaders

Navigating these tariff challenges requires a multifaceted approach:

- Diversify Supply Chains: Evaluate manufacturing in alternative locations like Vietnam, Malaysia, or Mexico. While relocation costs are significant (typically 20-30% of annual production value), they may prove worthwhile for long-term stability.

- Value Engineering: Revisit product design to reduce costs without compromising quality. Often, 5-10% cost savings can be achieved through material substitution or design optimization.

- Inventory Management: Implement just-in-time inventory systems to minimize capital tied up in higher-cost inventory. Consider alternate ordering patterns that might qualify for reduced tariff rates.

- Financial Hedging: Use forward contracts and other financial instruments to lock in currency exchange rates, potentially mitigating some tariff impacts.

- Price Strategy Refinement: Rather than across-the-board increases, implement tiered pricing models that maintain entry-level price points while adjusting premium offerings.

- Technology Investment: Accelerate automation and efficiency initiatives to offset higher input costs, though this should be balanced against employment considerations.

- Scenario Planning: Develop robust financial models for multiple tariff scenarios, including potential retaliatory measures from trading partners.

Looking ahead, businesses should prepare for a period of trade policy volatility lasting at least through the next 24 months. Those that adapt most effectively will not only survive but may find competitive advantages as less agile competitors struggle with the new cost structure.

The most successful approaches will balance short-term profitability protection with long-term strategic positioning, recognizing that the global trade landscape is undergoing a fundamental realignment that will extend well beyond current tariff actions.

Frequently Asked Questions

Q1: Can tariff costs be claimed as a tax deduction by importing businesses?

Yes, tariffs are considered a cost of doing business and can be included in the “Cost of Goods Sold” (COGS) on your tax returns. However, this only mitigates the impact rather than eliminating it. For example, with a corporate tax rate of 21%, a $100,000 tariff expense would still result in a net cost of $79,000 after tax considerations. Businesses should work with their tax advisors to ensure proper classification and maximize allowable deductions.

Q2: How long does it typically take to relocate manufacturing operations from China to alternative countries?

Relocating manufacturing operations typically requires 9-18 months to fully implement, depending on complexity. The process involves identifying new suppliers or manufacturing partners, negotiating contracts, conducting quality assurance testing, establishing logistics channels, and potentially modifying product specifications. Companies may need to operate dual supply chains during transition, which creates additional overhead. For businesses with complex products or specialized manufacturing requirements, this timeline may extend to 24 months or longer.

Q3: What financial metrics should businesses monitor most closely during periods of tariff volatility?

During tariff volatility, businesses should closely monitor several key metrics:

- Contribution margin by product/SKU: This helps identify which products are most vulnerable to tariff impacts and may need pricing adjustments or redesign.

- Cash conversion cycle: As costs increase, businesses need to optimize the time between paying suppliers and collecting from customers to avoid liquidity issues.

- Inventory turnover ratio: With higher landed costs, efficient inventory management becomes critical to avoid tying up capital in higher-valued inventory.

- Demand elasticity by market segment: Tracking how different customer segments respond to price changes helps optimize pricing strategy.

- Vendor concentration risk: Measuring dependency on suppliers from tariff-affected regions helps identify supply chain vulnerabilities.

Regular scenario analysis incorporating these metrics will help businesses respond more nimbly to further tariff changes.

Salvatore Tirabassi is the Managing Director at CFO Pro+Analytics, with over 24 years of experience in venture capital, private equity, and executive financial leadership. He has raised over $400 million in capital throughout his career and helped dozens of companies optimize their financial strategy for growth and value creation.

For a FREE 20-minute consultancy session CLICK HERE!