Implementing Predictive Analytics in Financial Forecasting: An AI-Driven Approach

in Analytics, Cash Flow Management, Fractional CFO, #FractionalCFO, Financial Forecasting, Predictive Analytics, All Posts

Although traditional financial forecasting methods, such as Excel-based models and historical trend analysis, have made notable progress, these approaches often rely on manual inputs, are susceptible to human error, and fail to account for external variables that significantly influence performance. Moreover, they tend to focus on short-term horizons, making it difficult for businesses to anticipate and respond to evolving market trends, thus demonstrating the benefits of predictive analytics . Predictive analytics can address some of these shortcomings by leveraging large datasets, advanced statistical models, and machine learning algorithms.

TL:DR

Predictive analytics is transforming financial forecasting from a static, error-prone process into a dynamic, data-driven discipline. In this article, I explore how organizations can leverage predictive models, real-time data, and machine learning to enhance forecast accuracy, manage risk, and support smarter strategic decisions, leading to more data driven decisions . Also, I’ll share a practical roadmap for integrating predictive analytics into your financial planning process, backed by real-world insights and a case study from a SaaS client who improved forecast accuracy by 25 percent.

What is Predictive Analytics?

Predictive analytics involves using data, statistical techniques, and machine learning, along with predictive analytics tools and capabilities, to effectively predict future outcomes. In finance, it can be applied to:

- Revenue trends

- Customer acquisition

- Inventory planning

- Other areas where you want to increase predictability of outcomes

Predictive analysis leverages statistical algorithms to enhance forecasting accuracy, enabling organizations to make more informed decisions and manage risks more effectively.

Unlike traditional forecasting, which often relies on historical averages and linear assumptions, predictive analytics integrates a broader range of variables —both internal and external —for more dynamic and reliable forecasts. Predictive analytics allows you to make decisions about your execution plan that is grounded in quantitative analysis, which can lead to effective risk mitigation strategies . You can then incorporate these predicted outcomes into your financial forecasting and have higher confidence in what the future holds for your business.

How Predictive Analytics Transforms Financial Forecasting?

Incorporating Real-Time Data

Forecasts update based on live data from sources such as sales pipelines, market conditions, and macroeconomic indicators. This does not need to be real-time or through a permanent integration. You can implement these in an monthly process.

Identifying Hidden Patterns

Machine learning algorithms detect complex relationships, such as seasonality or customer churn signals, that humans may miss. Usually, I find good operators know these things intuitively but predictive analytics gives the operator nuance, drivers of outcomes and greater confidence in their gut feeling.

Running Scenario Simulations

Finance leaders can model various “what-if” scenarios to plan for different outcomes, such as cost increases or shifts in demand. Having a good driver based financial forecast is a prerequisite to having the ability to do this, but if you have that in place you can leverage predicted inputs into your projections to produce forecasts that allow for scenario planning.

Improving Accuracy

Studies show that leveraging predictive analytics can reduce forecast errors by 20 to 30 percent compared to traditional approaches, supporting more informed financial decisions and enabling organizations to generate more reliable financial outcomes. This is an interactive process. Don’t assume that you starting doing this and it works out of the gate. Give yourself a runway for improvements and create a process of continual improvement.

Automating Routine Tasks

AI-powered tools handle data aggregation, cleansing, and reporting, allowing finance teams to focus on strategic insights. Agentic AI can provide a path to automating some of these aspects of data management.

Core Components of Predictive Financial Analytics

To implement predictive forecasting effectively, several key components must come together, with financial predictive analytics and data analytics serving as foundational elements for modern forecasting. These components are especially critical in corporate finance, where advanced analytics drive better risk management, fraud prevention, and market trend forecasting.

Data Infrastructure and Quality

Reliable forecasting begins with high-quality, centralized data and accurate information. This includes internal financial metrics, customer behavior data, operational KPIs, and external economic indicators, as well as financial data and financial data analytics. In my experience, poor data quality is the single biggest obstacle to success. Many companies struggle with inconsistent data collection, siloed systems, and insufficient historical granularity.

This can seem daunting to operators who are not data geeks or have limited resources.

Here are a few things to keep in mind:

- A key thing to keep in mind is to not let perfection be the enemy of the good.

- Don’t front run this effort with a large data cleaning and repository creation exercise

To do this, follow these suggestions:

- Run sprints for improvement and plan out a process for improving your data. Get started using it and don’t let a formal repository be a bottleneck.

- Use tools like Zapier, Make and N8N to create connections between disparate data souces

- Leverage off-the-shelf data management capabilities in Looker, PowerBI and Excel.

Statistical and Machine Learning Models

Predictive models rely on advanced statistical algorithms to deliver accurate forecasts. Depending on the objective, different modeling techniques are used.

For instance:

- Time series models, such as ARIMA, are ideal for identifying trends and seasonality.

- Machine learning algorithms and machine learning techniques, such as random forests or neural networks, can model complex, non-linear relationships.

- Regression analysis is a standard statistical algorithm used for building predictive models by identifying relationships between variables and predicting numerical outcomes.

- Cohort analysis is highly effective for predicting customer churn and lifetime value in subscription-based businesses.

In these instances you might need different resources on your team. Here you should focus on the forecasting aspects that have the most volatility and the highest profit impact. Don’t waste your time implementing these techniques on elements of your forecasting that don’t move the business. Remember, you want to have high impact and value and that comes from aspects of your business that are hard to predict and consume or produce a volume of cash that matters.

Real-Time Processing Capabilities

Modern businesses require forecasts that can be adjusted in real time, made possible by advanced predictive capabilities and data analytics. Whether due to shifting customer behavior or market volatility, continuous data integration ensures forecasts remain accurate and relevant.

Implementation Roadmap

Step 1: Define Forecasting Objectives

Start with high-impact use cases. Remember think about high volatility and high cash impact within categoreis such as:

- Revenue forecasting

- Expense management

- Cash flow modeling

- Customer lifetime value

- Churn risk analysis

Step 2: Assess and Clean Your Data

Remember, don’t go for perfection. Go for usability and start using the data. Ensure that:

- Historical data is accurate and complete.

- Accurate data is maintained, including detailed records of customer’s payment history, to support evaluating customer creditworthiness.

- Key metrics such as bookings or ARPU are clearly defined.

- Relevant external data is integrated.

Step 3: Choose the Right Tools

Numerous platforms now offer accessible predictive analytics tools for financial companies and other industries, even for teams without in-house data scientists. Notable options that are inexpensive and readily available include:

- PowerBI with PowerQuery

- Excel with PowerQuery

- Looker

- Python or R – Ideal for custom modeling with the right technical talent

Step 4: Build and Train the Models

Most tools offer pre-built templates. The process generally involves:

- Ingesting and analyzing historical data to establish a foundation for accurate forecasting

- Identifying patterns in customer behavior, seasonality, and other factors

- Applying predictive models, such as machine learning or statistical models, to forecast cash flows and other key financial metrics

- Generating and validating predictions

Step 5: Align with Stakeholders

Educate your executive team about how models work and what assumptions they include. Share data-driven insights from predictive analytics to help inform decision-making. Make sure key stakeholders who are more challenging to bring along see some of the work along the way. Always be prepared to discuss output results that conflict with conventional wisdom.

Step 6: Monitor, Iterate, and Improve

Regularly compare predictions to actuals, analyze variances, and recalibrate models. Establish a quarterly review cycle to maintain reliable financial forecasts. If you are doing monthly reforecasting for financial models, make sure you have the process and resources to update all of your input predictions. You can also set up your refresh cadence to be something different, just be as consistent as you can be.

Technology Stack and Tool Selection

The best predictive analytics stack depends on your size, goals, and in-house expertise, especially since predictive analytics plays a critical role in financial risk management when selecting a technology stack.

Cloud-Based Analytics Platforms

Platforms such as AWS, Google Cloud, and Microsoft Azure provide scalable machine learning services, allowing financial institutions to leverage cloud-based platforms for advanced predictive analytics, including real-time data processing and model deployment. Any one of these provides great capabilities, I would choose one that is closest to the overall company tech stack, if not identical.

Specialized Financial Tools

Solutions like Anaplan, Workday Adaptive Planning, and Board combine traditional budgeting features with predictive modeling capabilities and advanced risk mitigation tools. These are ideal for finance teams that need out-of-the-box functionality.

Open-Source Options

Python, R, and platforms like H2O.ai offer maximum flexibility, making them popular choices for financial companies using open-source solutions for custom predictive analytics. These are best suited for organizations with technical resources seeking customizable solutions and control.

Key Applications of Predictive Analytics in Finance

Predictive analytics has become an essential tool for financial institutions, providing a wide range of applications that enable smarter, data-driven decision-making, including the ability to forecast market trends . By analyzing historical data and identifying patterns, predictive analytics models allow finance teams to forecast future outcomes and respond proactively to changing market conditions.

One of the most impactful uses of predictive analytics in finance is credit risk management, where financial institutions assess the likelihood of customer default and make informed lending decisions. Cash flow forecasting is another critical application, allowing organizations to predict future cash inflows and outflows, optimize liquidity, and ensure financial stability. Additionally, predictive analytics supports portfolio optimization by analyzing market data and customer behavior to maximize returns and minimize risk.

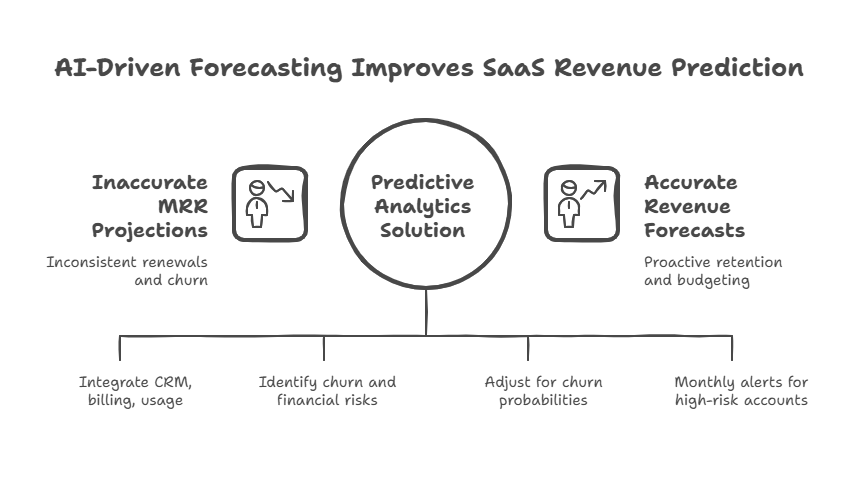

Case Study: Predicting SaaS Revenue with AI-Driven Forecasting

One of my SaaS clients struggled with revenue forecasting due to inconsistent renewal cycles and unpredictable churn. Although topline growth was strong, the finance team lacked confidence in MRR projections, which impacted sales strategy and hiring plans. By implementing a predictive analytics solution, they were able to forecast cash flows more accurately and model multiple financial scenarios, leading to valuable insights and improved revenue projections.

Challenges Identified:

- Irregular renewal patterns, particularly in mid-market and smb segments

- Difficulty predicting churn, especially with usage-based billing

- Overreliance on static spreadsheets and lagging indicators

Solution Implemented:

We designed a predictive analytics solution tailored to their data environment.

- Consolidated CRM, billing, and product usage data from HubSpot, Stripe, and Segment

- Applied machine learning to identify churn risk based on engagement, support tickets, billing anomalies, and feature usage, as well as to assess future financial risks using the analyzed data

- We developed a 13-Week cashflow projection for weekly cash planning

Results:

- Forecast accuracy improved by 25 percent.

- Early visibility into revenue risk enabled proactive retention strategies.

- Leadership made better-informed budgeting and hiring decisions.

This initiative not only improved forecasting. It elevated the company’s revenue operations from a reactive to a proactive approach.

Conclusion

Predictive analytics offers a powerful path to more accurate and responsive financial forecasting. To ensure future economic success, it is essential to leverage predictive analytics and understand how predictive analytics can be made core strategies. By adopting these approaches, organizations can improve decision-making, mitigate risks, and gain a competitive edge.

Frequently Asked Questions

1. Do I need a data science team to implement predictive analytics?

Not necessarily. Many FP&A platforms feature built-in predictive capabilities, and various predictive analytics tools and financial data analytics platforms are available to organizations of all sizes. However, for custom use cases, having access to analytics talent can be valuable.

2. How accurate are predictive forecasts compared to traditional models?

Predictive forecasts typically offer higher accuracy by incorporating more variables and adapting to new data. That said, accuracy depends on the quality of the data and proper model calibration.

3. Can small or mid-sized businesses use predictive analytics?

Absolutely. Cloud-based platforms and user-friendly tools are making predictive analytics increasingly accessible to small and medium-sized businesses (SMBs). The key is starting with a focused use case, such as churn or cash flow forecasting.

…

As a fractional CFO with expertise in technology and AI, I help financial organizations implement predictive forecasting strategies that are practical, scalable, and aligned with their business goals.

Salvatore Tirabassi is the Managing Director at CFOPro+Analytics. With over 24 years of experience in venture capital, private equity, and executive financial leadership, he has raised more than $400 million in capital and guided dozens of companies in optimizing their financial strategies to drive growth and create long-term value.