How Mergers and Acquisitions Can Propel Your Business Growth Strategy?

in Analytics, Finance, Finance, Mergers and Acquisitions, strategy of business growth, All Posts

TL;DR:

This article breaks down the core concepts of M&A, including strategic alignment, financials, and highlights examples of successful and failed deals. It also explains the benefits of M&A, such as market expansion, access to tech and talent, and cost savings. Finally, it introduces CFO Pro+Analytics role in facilitating M&A for businesses, emphasizing due diligence, valuation, risk management, synergy analysis, and post-merger integration.

Overview

An Elon Musk-led team of investors attempted to acquire OpenAI for $97.4 billion, but this was turned down by OpenAI’s Chief Executive, Sam Altman. In the media, Elon’s attempt to own a majority stake in OpenAI was portrayed as a takeover attempt. It will be interesting to see how this situation unfolds in the future. Right now, it appears to be a personal battle between Musk and Altman.

When an acquisition is successful, the news headlines are much more favorable. Here is one example: the Lynda.com story. Lynda Weimann, a graphic designer and web designer who worked as a teacher, figured she could record her graphic design tutorials and have the video mailed to her students for a fee. She built a successful business off direct mail and then moved to digital, where her students could subscribe and access her online tutorials. The courses on her website kept expanding, forming the foundation of Lynda.com, an online learning platform that made professional skills training more accessible.

In April 2015, LinkedIn acquired Lynda.com for $1.5 billion (one of the largest edtech acquisitions). Lynda.com was integrated into LinkedIn Learning, which launched in 2016, making its courses available directly through LinkedIn’s platform.

Her story highlights a successful M&A transaction and how both the seller and buyer benefit from the financial transaction, which leads to more growth and success.

Understanding Mergers and Acquisitions

Mergers and acquisitions (M&A) are strategic transactions that involve consolidating two or more companies to create a new entity. The primary goal of M&A is to drive growth, increase market share, and improve competitiveness. There are of two types: mergers and acquisitions.

A merger occurs when two companies combine to form a new entity, while an acquisition happens when one company purchases another.

The core concepts of M&A include:

- Strategic Alignment: Ensuring the goals and objectives of the acquiring company align with those of the target company. This alignment is crucial for achieving long-term success and realizing the full potential of the merger or acquisition.

- Financial Considerations: Evaluating the financial implications of the M&A transaction, including the purchase price, financing options, and potential synergies. This involves a thorough analysis of the target company’s financial health and the expected return on investment.

- Cultural Integration: Integrating the cultures of the two companies, including their values, mission, and vision. Successful cultural integration can prevent conflicts and ensure a smooth transition.

- Operational Synergies: Identifying potential cost savings and efficiency gains resulting from the consolidation of the two companies. This can include streamlining operations, reducing redundancies, and leveraging economies of scale.

By understanding these core concepts, businesses can better navigate the complexities of M&A and position themselves for success.

Examples of Successful Mergers:

1. Disney and Pixar (2006)

- Deal Value: $7.4 billion

- Why it Worked: Pixar brought cutting-edge animation technology and storytelling expertise, revitalizing Disney’s animation division. The partnership resulted in blockbuster films like Toy Story 3, Frozen, and Inside Out. The merger also created significant revenue synergies, with combined products and services leading to increased sales and enhanced operational efficiency.

2. Facebook and Instagram (2012)

- Deal Value: $1 billion

- Why it Worked: Instagram, a fast-growing photo-sharing app, complemented Facebook’s social network, allowing it to dominate the mobile and visual content space. This strategic merger significantly enhanced Facebook’s market position within the social media industry.

3. Google and YouTube (2006)

- Deal Value: $1.65 billion

- Why it Worked: Google capitalized on YouTube’s massive user base and advertising potential, turning it into the world’s leading video platform. The merger also allowed Google to enter a new market, expanding its reach and diversifying its product offerings.

4. Microsoft and LinkedIn (2016)

- Deal Value: $26.2 billion

- Why it Worked: Microsoft integrated LinkedIn’s professional networking platform with its cloud services, enhancing productivity tools like Microsoft Office and Dynamics 365. The acquired company, LinkedIn, provided Microsoft with an established customer base and operational efficiencies, strengthening its market positioning and business integration processes.

5. Amazon and Whole Foods (2017)

- Deal Value: $13.7 billion

- Why it Worked: Amazon gained a physical retail presence and access to Whole Foods’ customer base, integrating it with its e-commerce and delivery capabilities. The merger allowed Whole Foods, as the target firm, to maintain its brand presence while benefiting from Amazon’s extensive resources.

Example of Failed Mergers

Although mergers can accelerate business growth, there are notable examples of failed M&A events.

1. AOL and Time Warner (2000) – $165 Billion

One of the biggest failures in corporate history, this merger was supposed to combine AOL’s internet dominance with Time Warner’s media assets. The Key Issues were the dot-com bubble burst, which caused AOL’s stock to plummet, and declining business revenue as AOL’s dial-up business became obsolete.

Outcome

The companies officially split in 2009 after billions in losses

2. eBay and Skype (2005) – $2.6 Billion

eBay acquired Skype, hoping it would improve communication between buyers and sellers. The key issue was that there was no real integration from both businesses; buyers and sellers preferred email over voice calls.

Outcome:

eBay sold Skype at a loss in 2009, before Microsoft acquired it in 2011.

3. Microsoft and Nokia (2014) – $7.2 Billion

Microsoft bought Nokia’s mobile division to challenge Apple and Android. The key issues were that the Windows Phone OS failed to gain market share and that Nokia’s brand had already lost its dominance over Apple and Samsung.

Outcome

Microsoft wrote off nearly the entire investment by 2015 and exited the smartphone business.

4. HP and Autonomy (2011) – $11.1 Billion

HP acquired UK-based Autonomy, a big data and software company, to expand beyond hardware. The Key issue was that Autonomy allegedly inflated its financials and was overvalued.

Outcome

HP sued Autonomy’s executives and took a significant financial hit.

5. Google and Motorola (2012) – $12.5 Billion

Google acquired Motorola to boost its hardware business and patent portfolio. The key issue was that Google struggled with hardware production and distribution.

Outcome

Google sold Motorola to Lenovo for $2.9 billion in 2014—an $8 billion loss.

Reasons to Consider Mergers and Acquisitions

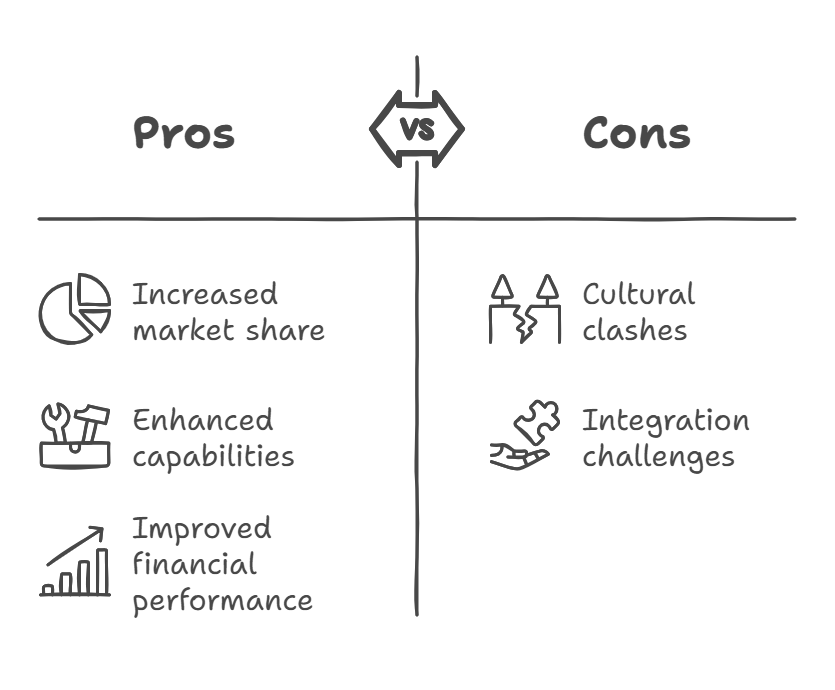

After analyzing the successful mergers and the lessons learned from failures, here are some reasons businesses should consider mergers. Mergers and acquisitions (M&A) represent a powerful growth strategy for both small and medium-sized businesses, providing numerous potential benefits and opportunities.

Market Expansion and Growth

Mergers and acquisitions allow companies to expand their market share, eliminate competition, and gain a stronger foothold in the industry. Also, mergers can accelerate the growth of a business.

Synergy and Efficiency Gains

Mergers and Acquisition can create synergies through cost savings, increased operational efficiency, and economies of scale.

Increased Access to Capital

Some deals are driven by increased access to capital, tax advantages, improved financial performance, or access to other resources.

Acquisition of New Technologies

Companies may acquire other businesses to access new technologies, intellectual property, or specialized expertise, enhancing their innovation capabilities and competitiveness.

Access to New Markets and Geographies

Acquisitions can give companies a foothold in new markets, regions, or countries, expanding their customer base and revenue potential.

Best Practices for Success

M&A can be complex and challenging, and companies must be aware of the common pitfalls that can lead to failure. Some best practices for success include:

- Clearly Defining the M&A Strategy: Companies must clearly define their M&A strategy and goals, including the type of target company they are seeking and the expected outcomes. A well-defined strategy provides direction and helps align the efforts of all stakeholders.

- Conducting Thorough Due Diligence: Companies must conduct thorough due diligence on the target company, including financial, operational, and cultural evaluations. This helps identify potential risks and ensures informed decision-making.

- Integrating the Target Company: Companies must carefully integrate the target company into their operations, including cultural, operational, and financial integration. Effective integration is crucial for realizing the full benefits of the M&A transaction.

- Managing Stakeholder Expectations: Companies must manage stakeholder expectations, including those of employees, customers, and investors. Clear communication and transparency can help build trust and support for the M&A process.

By following these best practices, companies can overcome common pitfalls and succeed in their M&A transactions. This strategic approach can help businesses unlock new opportunities, drive growth, and enhance their competitive advantage.

How CFO Pro+Analytics Can Facilitate the Merger and Acquisition Process

With our knowledge and years of experience in strategic finance, we have overseen mergers and acquisitions. We are poised to facilitate the process of emerging businesses with revenues between $3 and $100 million.

Here’s how CFO Pro+Analytics can facilitate the merger and acquisition process:

1. Pre-Merger and Acquisition Due Diligence Preparation for Target Company

Due diligence is a required process for any sophisticated buyer of your business, and we thoroughly evaluate your financial condition and the presentation of the business in the best possible light. To do this, we streamline the production of professional financial statements, cash flow projections, and other relevant areas of the business needed for a successful sale.

2. Valuation and Deal Structuring

We bring expertise in financial modeling and valuation techniques to value your company accurately. Additionally, we offer detailed financial analysis, including revenue forecasts and growth projections, to establish a fair market value while helping to structure the deal to align with both companies’ financial goals.

3. Risk Management and Compliance

We identify financial, operational, and regulatory risks associated with the transaction, develop strategies to mitigate those risks, and ensure the deal proceeds smoothly. Customer concentration risk is a big issue for prospective buyers. Does one customer account for 50% of your revenues? These types of situations need to be presented intelligently to keep buyers interested. We also ensure the transaction complies with relevant financial regulations and reporting requirements.

4. Synergy Analysis and Cost Savings

Lack of synergy is a major cause of failed mergers and acquisitions, and we aim to justify the acquisition price by identifying and quantifying potential synergies, such as cost savings or revenue enhancements. Above all, we want our client, whether a buyer or seller, to hold onto the synergy value and not negotiate it away to the other party.

5. Post-Merger Integration and Significant Challenges

After a merger or acquisition, we help integrate the two businesses by aligning operations and consolidating financial systems. We also streamline the transition’s financial aspects, including consolidating financial reports, integrating accounting systems, and aligning financial goals. This is a critical step for success and provides the ultimate value capture from a major initiative like M&A.

Frequently Asked Questions About Mergers & Acquisitions

Q1: What makes an M&A transaction successful versus likely to fail?

Successful M&A transactions typically combine strategic fit with proper execution. Key success factors include clear synergy potential (like Disney-Pixar’s complementary capabilities), thorough due diligence, and strong post-merger integration planning. Failed mergers often result from poor strategic fit (like eBay-Skype), inadequate due diligence, or weak integration execution.

Q2: How can a fractional CFO help maximize value in an M&A transaction?

A fractional CFO brings sophisticated transaction experience at a fraction of the cost of a full-time hire. We help prepare comprehensive due diligence materials, identify and quantify synergies, structure deals advantageously, and manage post-merger integration. Our experience with both successful and failed transactions helps clients avoid common pitfalls while maximizing deal value.

Q3: When should a company start preparing for a potential M&A transaction?

Ideally, preparation should begin 12-18 months before any planned transaction. This allows time to clean up financial statements, implement proper systems and controls, document synergy opportunities, and address potential issues before buyer engagement. Early preparation significantly increases the likelihood of a successful transaction and maximizes potential value.

…

Salvatore Tirabassi is the managing director of CFO Pro+Analytics. He has over 24 years of experience in venture capital, private equity, and executive financial leadership. Throughout his career, he has raised over $400 million in capital and helped dozens of companies optimize their financial strategies for growth and value creation.

To schedule a FREE 20-minute consultancy session, CLICK HERE!