How Fractional CFO’s Can Help Prevent Bankruptcy for Small-Medium Sized Businesses: Teaming Up with Founders to Enhance Liquidity

in Analytics, CFO, Finance, calculators and tools, Cash Flow Management, CFO blogs, Fractional CFO Services, All Posts

The words “Chief Financial Officer (CFO)” and “Founder” are often used in the same sentence when it is too late. Founders sometimes seek out a CFO when they are already drowning in hot water. Due to the high cost of engaging a full-time CFO, business owners can consider a Fractional CFO who can help avoid liquidity problems and the possibility of bankruptcy by providing strategic financial guidance, planning, and execution. By providing high-level financial expertise on a part-time or contract basis, a Fractional CFO helps businesses make strategic decisions without the high cost of a full-time executive.

Understanding the Challenges of Small Business Finance

Small businesses face unique financial challenges that can impact their ability to grow and succeed. One of the most significant challenges is managing cash flow, which is essential for meeting financial obligations, investing in growth opportunities, and maintaining a competitive edge. Effective cash flow management ensures that a business has enough liquidity to cover its expenses, pay its employees, and invest in future growth. Without proper cash flow management, small businesses can quickly find themselves in financial distress, struggling to stay afloat.

Financial Challenges Faced by Small Businesses

Small businesses often struggle with financial management due to limited resources, lack of expertise, and inadequate financial planning. Some common financial challenges faced by small businesses include:

- Poor Cash Flow Management: Small businesses often experience cash flow problems due to delayed payments, slow sales, or unexpected expenses. This can lead to difficulties in meeting financial obligations and maintaining operational stability.

- Limited Access to Capital: Small businesses may struggle to secure funding from traditional lenders, making it difficult to invest in growth opportunities. This lack of capital can hinder their ability to expand, innovate, and compete in the market.

- Inadequate Financial Planning: Small businesses may not have a comprehensive financial strategy, making it challenging to make informed decisions about investments, pricing, and resource allocation. Without proper financial planning, businesses can miss out on opportunities and face unexpected financial challenges.

- Risk Management: Small businesses may not have the resources or expertise to manage risks effectively, leaving them vulnerable to financial shocks. This includes market risks, regulatory changes, and operational challenges that can impact their financial health.

The Impact of Poor Cash Flow on Small Businesses

Poor cash flow management can have a significant impact on small businesses, including:

- Reduced Ability to Invest in Growth Opportunities: Poor cash flow can limit a small business’s ability to invest in new products, services, or marketing initiatives. This can stifle growth and prevent the business from reaching its full potential.

- Increased Risk of Insolvency: Poor cash flow can increase the risk of insolvency, making it challenging for small businesses to meet their financial obligations. This can lead to financial distress and, in severe cases, bankruptcy.

- Reduced Competitiveness: Poor cash flow can reduce a small business’s competitiveness, making it challenging to attract and retain customers. Without sufficient cash flow, businesses may struggle to invest in quality improvements, marketing, and customer service, putting them at a disadvantage in the market.

Hooters Considering Bankruptcy

Recently, the popular chain restaurant Hooters has been in the news for possibly filing for bankruptcy. The restaurant has been struggling post-pandemic. Here are some of the reasons for its recent financial challenges:

Declining Foot Traffic and Sales

Over recent years, Hooters has experienced a decrease in customer visits and sales, impacting its revenue streams.

Significant Debt Obligations

In 2021, the company issued approximately $300 million in asset-backed bonds. The burden of servicing this debt has strained its financial resources.

Closure of Underperforming Locations

In June 2024, Hooters closed around 40 underperforming restaurants across several states, including Florida, Kentucky, Rhode Island, Texas, and Virginia, as part of cost-cutting measures.

Evolving Market Conditions

Changing consumer preferences and increased competition have challenged Hooters’ traditional business model, contributing to its financial difficulties.

It’s important to note that filing for a chapter 11 bankruptcy is not doom and gloom but an opportunity to restructure the business and manage its debt load more effectively. These evolving market conditions can significantly impact a company’s financial health, making it crucial to adapt and implement effective financial strategies.

Types of Bankruptcy

There are several types of bankruptcy, each with its own set of rules and implications:

Chapter 7 Bankruptcy

Also known as liquidation bankruptcy, this involves selling a business’s assets to pay off creditors.

Chapter 11 Bankruptcy

This type allows businesses to restructure their debt and continue operating while paying creditors.

Chapter 13 Bankruptcy

This bankruptcy process is designed for individuals but can also apply to small businesses. It allows them to restructure debt and make payments over time.

Consequences of Bankruptcy to Small-Medium Sized Business.

Bankruptcy can have severe consequences, including:

Damage to Credit Score

Bankruptcy can significantly lower a business’s credit score, making it harder to secure loans or credit in the future.

Loss of Assets

In Chapter 7 bankruptcy, businesses may be forced to sell assets to pay off creditors.

Business Closure

Bankruptcy can ultimately lead to business closure, resulting in job losses and financial devastation.

For a business owner, the closure of their business can be a devastating experience, both financially and emotionally.

Stigma

Bankruptcy can be stigmatized, making it challenging for businesses to regain the trust of customers, suppliers, and investors.

Identifying the Root Causes of Liquidity Issues

Liquidity issues can arise from a variety of sources, including poor cash flow management, inadequate financial planning, and external factors such as economic downturns or changes in market conditions. Understanding the root causes of liquidity issues is crucial for developing effective strategies to address them. Poor cash flow management, for instance, can result from delayed customer payments, inefficient billing processes, or unexpected expenses. Inadequate financial planning can lead to a lack of foresight and preparedness for financial challenges. Additionally, external factors like economic downturns or shifts in consumer behavior can impact a business’s liquidity. By identifying and addressing these root causes, small businesses can improve their financial health and enhance their ability to navigate financial challenges.

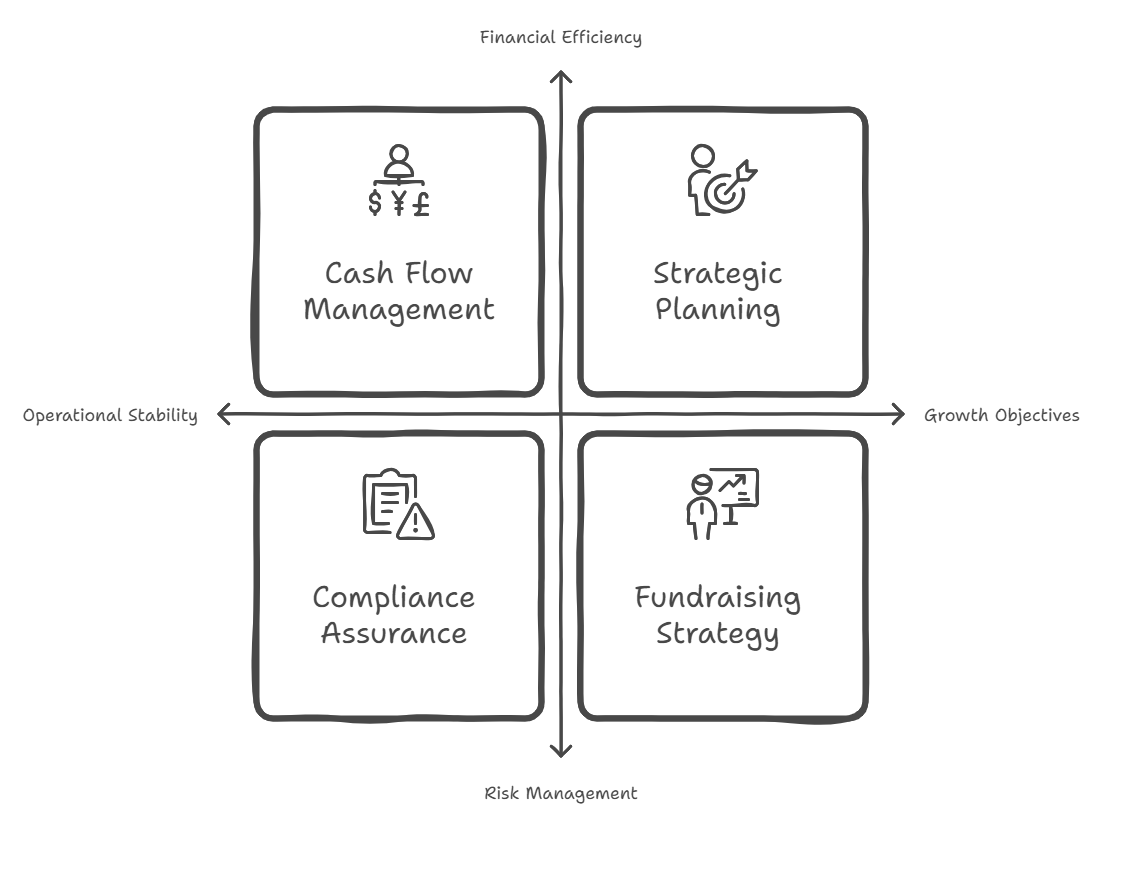

How a Fractional CFO can help a business prevent bankruptcy

Cash Flow Management:

A fractional CFO can assess current cash flow, identify inefficiencies, and implement strategies to improve liquidity. This is crucial for SMBs, as poor cash flow management is a common reason for financial distress. For example, a business facing declining customer traffic and rising operational costs could benefit from a fractional CFO’s expertise in managing cash flow to meet financial obligations and maintain operational stability. By creating detailed cash flow projections, a fractional CFO can help businesses anticipate future cash needs and avoid liquidity issues.

Financial Planning and Analysis

A fractional CFO can help create detailed financial plans and budgets that align with business objectives. This includes forecasting future financial outcomes, which is essential for making informed decisions about investments and expansions. For example, a fractional CFO can assist a business in developing a strategic plan to restructure its operations, potentially focusing on cost reduction and revenue enhancement strategies to improve profitability. Through comprehensive financial analysis, a fractional CFO can identify key areas for improvement and help businesses make data-driven decisions.

Risk Management

A fractional CFO can identify potential financial risks and develop mitigation strategies. This includes managing market risks, regulatory changes, and operational challenges. For example, a business could leverage a fractional CFO’s expertise to assess risks associated with market trends and changes in consumer behavior, implementing strategies to adapt and reduce financial exposure

Financial Reporting and Compliance:

A fractional CFO can ensure accurate and timely financial reporting, which is vital for maintaining stakeholder trust and complying with regulatory requirements. For example, a fractional CFO can help a business ensure its accurate and compliant financial statements, facilitating smoother negotiations with creditors during restructuring efforts.

Fundraising and Capital Structure:

A Fractional CFO assists in securing funding and optimizing the capital structure to support growth objectives. This includes preparing financial statements and investor presentations. For example, a fractional CFO can help prepare compelling financial documents and presentations to attract investors. Effective management of cash flows is crucial for presenting a strong financial position to potential investors and securing the necessary funding.

Case Study: How We Assisted a Business Navigate Bankruptcy.

Following the pandemic in 2021, a mid-sized company we consulted for was facing the following identified challenges.

- Insufficient Cash Flow: The company was struggling to meet its financial obligations, including payroll, supplier payments, and debt servicing.

- High Debt Levels: The company had accumulated significant debt, including a $4.5 million loan from a private lender.

- Declining Sales: The company’s sales had declined by 20% over the past two years, exacerbating its financial difficulties.

Our Solution

To help navigate the company’s financial challenges, we initiated the following strategies:

- Financial Assessment: We conduct a comprehensive financial assessment to identify areas of improvement and develop strategies for growth.

- Debt Restructuring: We negotiating with creditors to restructure debt and reduce financial obligations.

- Cost Restructuring: We guided the company through a closure of its offices which were up for renewal to eliminate expense and allow them to leverage more remote staff to decrease costs.

Fractional CFOs play a critical role in providing these tailored financial solutions, helping businesses navigate complex financial challenges.

The Outcome

- Debt Reduction: The company reduced its debt through negotiations with creditors.

- Cash Flow Improvement: With the successful implementation of our 13-Week Cash flow forecasting strategy, we improved the company’s cash management, ensuring sufficient liquidity to meet financial obligations.

- Successful Bankruptcy Avoidance: The company avoided Chapter 11 bankruptcy with a restructured balance sheet and a solid foundation for future growth.

With our guidance, the company successfully navigated the threat of bankruptcy, and has returned to doubling its pre-covid revenue.

Frequently Asked Questions

1. How do I know if my business needs a Fractional CFO?

Consider engaging a Fractional CFO if you’re experiencing cash flow challenges, struggling with financial planning, preparing for growth, or seeking capital. Warning signs include declining profitability, trouble meeting financial obligations, lack of visibility into financial performance, or spending too much of your time on financial matters rather than business growth.

2. What is the typical cost structure for Fractional CFO services?

Fractional CFO services typically cost between $5,000-$10,000 per month depending on complexity and time requirements, representing 20-30% of the cost of a full-time CFO. This investment provides access to executive-level financial expertise while maintaining flexibility as your business needs change.

3. How quickly can a Fractional CFO help improve our liquidity situation?

Most businesses see initial improvements in cash flow within 30-45 days of engaging a Fractional CFO through implementation of better forecasting, collections processes, and expense management. More significant structural improvements typically emerge within 90-120 days as deeper strategies are implemented and begin taking effect.

…

Salvatore Tirabassi is the Managing Director at CFO Pro+Analytics. He has over 24 years of experience in venture capital, private equity, and executive financial leadership. Throughout his career, he has raised over $400 million in capital and helped dozens of companies optimize their financial strategies for growth and value creation. To schedule a FREE 20-minute consultancy session, CLICK HERE!

Please explore our website for our services, calculators and tools, and CFO blogs, which offer practical finance insights for emerging businesses.