Hot take: Understanding Tariffs (Its Impact, and How Businesses Can Adapt)

in Hot Takes, Art of the Deal, CFO, Donald Trump, Tariff in America, All Posts

As a business owner, understanding tariffs is on your mind, as it is on the mind of many. The Art of the Deal by Donald Trump, first published in 1987, provides an insight into President Trump’s philosophies, strategies, and penchant for deal-making. When I read this book, I had no idea that someday Donald Trump would be the President of the United States (twice). But it’ll give you an understanding of his unconventional methods of negotiating favorable deals. Here we are in 2025, and the buzzword for the past few weeks has been “Tariffs.” Trump is now using it strategically as a tool for negotiating with partners Canada, Mexico, and China, on issues extending to immigration, drug control and trade policy.

What are Tariffs?

Tariffs are taxes imposed by one country on goods and services imported from another. They are a tool of trade policy used to achieve various economic and political objectives.

Purpose of Tariffs

- Protect Domestic Industries: Tariffs make imported goods more expensive, giving domestic producers a competitive advantage.

- Generate Revenue: Governments collect revenue from tariffs, which can be used to fund public services or reduce other taxes.

- Regulate Trade: Tariffs can be used to control the flow of goods, protect strategic industries, or address trade imbalances.

- Retaliation or Negotiation: Tariffs can be imposed in response to unfair trade practices by other countries or as leverage in trade negotiations.

Effects of Tariffs

- On Consumers: Tariffs often lead to higher prices for imported goods, reducing consumer purchasing power.

- On Domestic Industries: Reduced competition may benefit protected industries, but it can also lead to inefficiency and a lack of innovation.

- On Trade Partners: Tariffs can strain international relations and lead to retaliatory measures, such as counter-tariffs.

- On the Economy: While tariffs can protect jobs in certain sectors, they may harm other industries that rely on imported materials or face reduced export opportunities

Note that the White House messages that tariffs are a tax on the other country, but these taxes are paid for with higher prices. This will affect your business as a buyer of products from Canada, Mexico and China. If there are retaliatory tariffs aimed to a US, you will be affected the same way as a seller. You will need to pay the tax and either cut costs to make up the difference or raise your prices to pass the tax along. In either scenario, someone is paying more or making less profit. The government takes that difference and pockets the tax, or you end up selling and buying less.

What Tariffs were imposed by President Trump?

Trump initially announced a 25% tariff on all imports from Canada and Mexico, with a 10% tariff on Canadian oil. Also, President Trump announced a 10% tariff on all imports from China. However, the tariffs on imports from Canada and Mexico have been postponed for 30 days as both leaders pledged to enhance border security measures to curb drug and migrant flows into the U.S. Specifically, Mexico agreed to deploy 10,000 National Guard troops to its northern border to combat drug trafficking, focusing on fentanyl. They were scheduled to reconvene, and the tariffs would be introduced if no significant efforts were made on the agreements reached.

Meanwhile, China responded with restrictive trade measures, including tariffs on imports from the United States, antitrust investigations into U.S. companies, export controls on critical minerals, and adding two U.S. companies to its Unreliable Entity List. China’s General Administration of Customs imposed a 15% tariff on imports of U.S. coal and liquefied natural gas and a 10% tariff on crude oil, agricultural machinery, and certain cars and pickup trucks. These heightened tariffs were to be effective February 10, 2025. However, the executive orders stated that if China, Canada, or Mexico retaliated against the U.S. tariffs, the President could increase or expand the duties imposed. So, we await the U.S. response to China’s retaliations while negotiations are ongoing. Do you notice how this brings us back to the “Art of the Deal”.

Tariffs as a Tool for Negotiation

Donald Trump’s approach to tariffs is rooted in his conviction that they are a powerful lever to protect American industries, create jobs, and force trading partners to the negotiating table. During his first presidency (2017–2021), Trump imposed tariffs on billions of dollars worth of goods from China, the European Union, Mexico, and Canada, arguing that these measures were necessary to address unfair trade practices, such as intellectual property theft and subsidies for state-owned enterprises. In 2025, Trump doubled down on this strategy, using tariffs as both a defensive shield for domestic industries and an offensive weapon to extract concessions from trading partners.

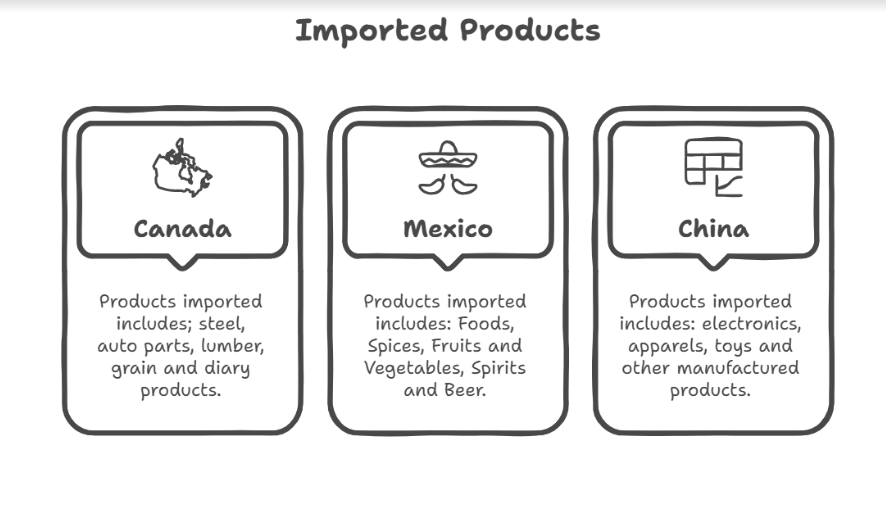

What Products will be affected by the Tariffs?

The products that will be affected are mainly the products that we import from Canada, Mexico, and China. Each country has its comparative advantage (which, in an economic model, is the edge that a country has in producing a particular good or service over another country). For example, the U.S. has a comparative in producing massive tech companies, with the ecosystem built over the years, including knowledge, infrastructure, network, and finance). However, other countries, like China, have a comparative advantage in manufacturing products because of the availability of cheaper labor and factories that have been built over the years.

Impact of Tariffs on Business Owners and Consumers:

When taxes are imposed on imported goods, it can have a significant impact on business owners. These impacts can vary depending on the nature of the business, the industry, and the specific goods involved. For example, a footwear company, that makes comfortable rubber shoes, which are designed in America but mass-produced in China, may have to bear the cost of the increased 10% tariffs of importing goods from China, and most times, that extra cost is usually passed on to customers. And, if the price is too high, customers can start to consider, other locally produced alternatives,

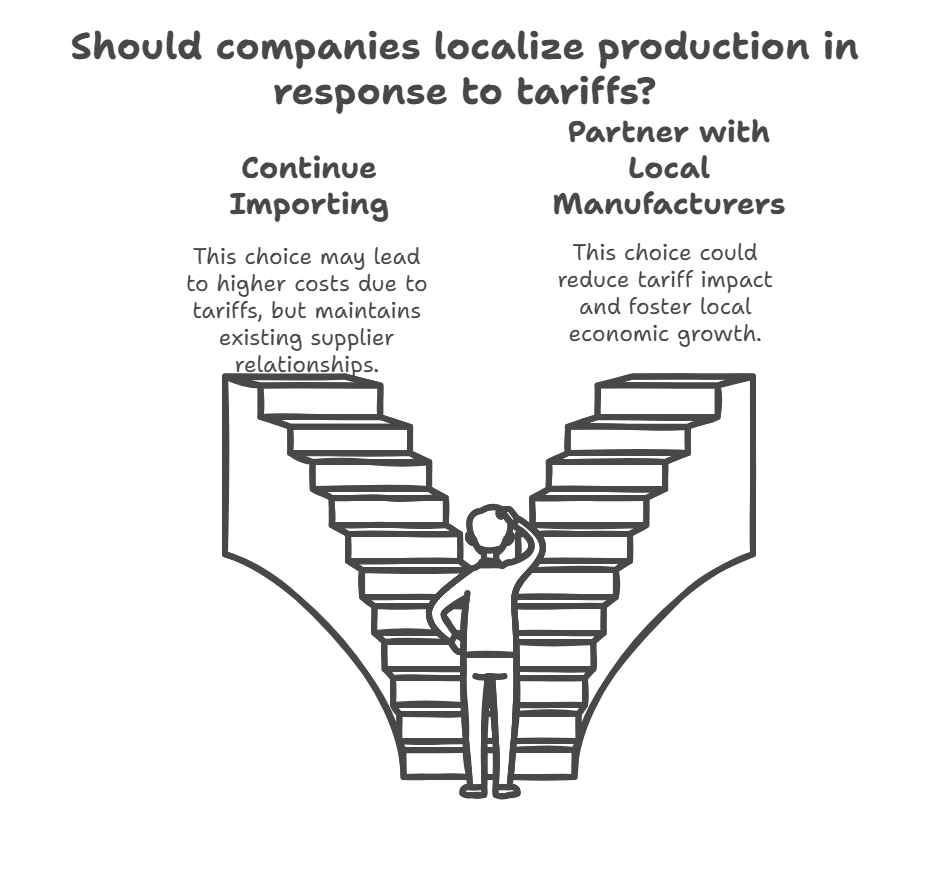

Localizing Production: A Path to Resilience

The era of globalized manufacturing is experiencing a profound shift. Tariffs are creating a compelling economic incentive for businesses to reconsider their production strategies. Take, for example, a small outdoor gear company that previously sourced hiking backpacks from Vietnam. With escalating tariffs making imported goods less competitive, they might discover a golden opportunity to partner with local manufacturers.

Benefits of Localization

- Competitive Edge: By producing domestically, businesses can market their products as “Made in America,” appealing to consumers who prioritize local manufacturing.

- Reduced Supply Chain Complexity: Shorter supply chains mean faster production cycles and greater flexibility.

- Quality Control: Closer proximity to production allows for more rigorous quality management and faster iterations.

Long-Term Strategic Transformations

Reshoring: Bringing Manufacturing Home

Consider the case of TechWear, a small clothing manufacturer that previously relied entirely on Chinese production. The 10% tariff on Chinese imports became a catalyst for reimagining their entire production model. By investing in local textile facilities and advanced manufacturing technologies, they not only avoided tariff costs but also created local jobs and developed a unique selling proposition.

Strategic Supplier Diversification

The risks of depending on a single country for manufacturing have never been clearer. Businesses are now:

- Developing relationships with manufacturers in multiple countries

- Creating backup supply chains

- Negotiating more flexible contracts that account for potential trade disruptions

Exploring New Market Opportunities

Tariffs shouldn’t be viewed merely as barriers but as strategic inflection points. A small electronics accessories company might previously have been content sourcing components exclusively from China. Now, they’re exploring manufacturing hubs in:

- Vietnam

- Mexico

- India

- Eastern European countries

This diversification not only mitigates tariff risks but also exposes businesses to new technological ecosystems and potential innovation partnerships.

Fractional CFO: A Strategic Navigator – Bricks and Co. Case Study

Financial Reconnaissance

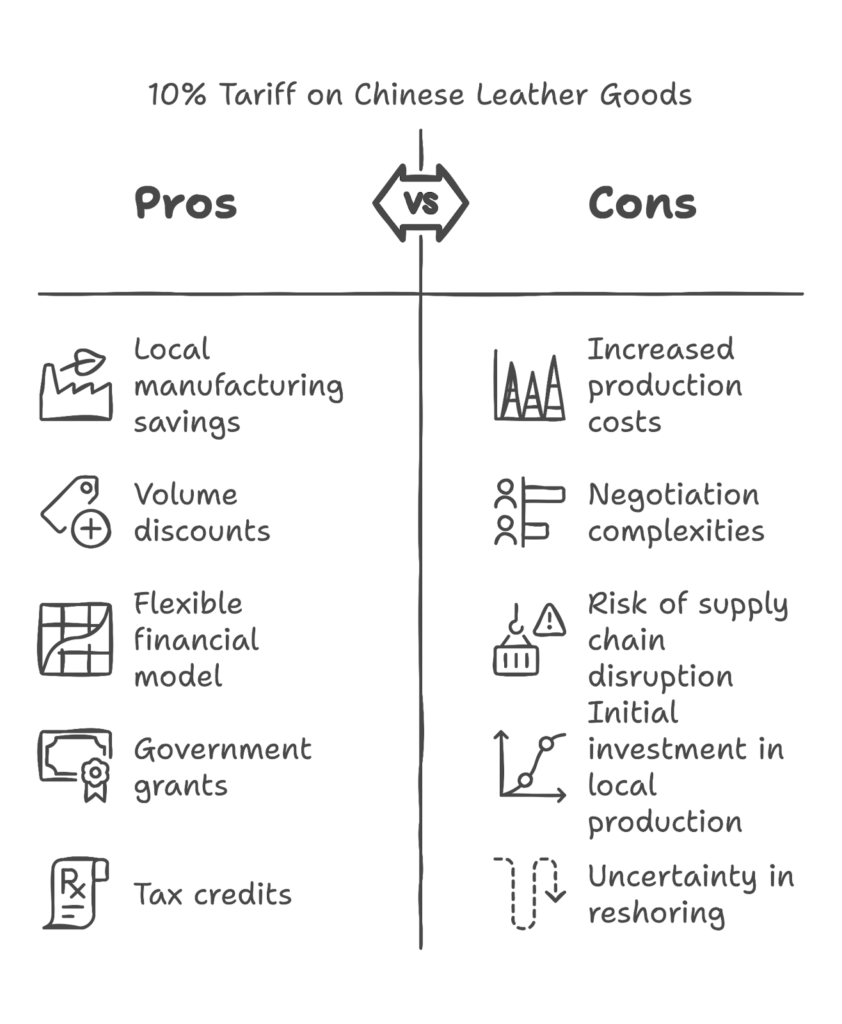

When Bricks and Co. faced the prospect of a 10% tariff on Chinese-manufactured leather goods, their Fractional CFO didn’t just see a problem—they saw a strategic opportunity for transformation.

Financial Modeling Insights:

- Projected a 15% increase in production costs due to tariffs

- Identified potential savings of 8-12% through local manufacturing and efficiency improvements

- Created multiple financial scenarios to stress-test business resilience

Strategic Supplier Negotiations

The CFO didn’t just accept the tariff as a fixed cost. Instead, they:

- Negotiated volume discounts with existing Chinese manufacturers

- Explored partial reshoring of production

- Investigated manufacturing capabilities in Mexico and Vietnam

Risk Mitigation Strategies

- Developed a flexible financial model adaptable to changing tariff landscapes

- Established contingency funds to buffer against sudden cost increases

- Created a dynamic sourcing strategy that could pivot quickly

Innovative Financing Solutions

Beyond traditional financing, the CFO explored:

- Government grants for domestic manufacturing

- Low-interest loans for businesses investing in local production

- Tax credits for job creation and reshoring

Psychological Reframing: From Obstacle to Opportunity

The most successful businesses view tariffs not as insurmountable barriers but as strategic inflection points. They ask:

- How can we innovate?

- Where are our true competitive advantages?

- How can we turn this challenge into a differentiator?

Frequently Asked Questions

Q. How can a Fractional CFO help my business assess the impact of increased tariffs?

A. Fractional CFOs can help assess the impact of tariffs by analyzing financial data, identifying affected areas, and forecasting potential effects on revenue, profitability, and cash flow.

Q. Can a Fractional CFO assist in developing strategies to mitigate the impact of tariffs?

A. Yes, Fractional CFOs can help develop strategies to mitigate the impact of tariffs, such as: Supply chain optimization, cost reduction initiatives, pricing adjustments, hedging strategies and exploring new markets.

Q. How can a Fractional CFO help my business navigate the financial implications of increased tariffs?

A. Fractional CFOs can help you navigate the financial implications of increased tariffs by: Analyzing financial statements to identify tariff-related costs and developing financial models to forecast potential impacts.