Financial Transformation Framework: A Fractional CFO Methodology for Independent Sponsor Success

in Analytics, CFO, Finance, Fractional CFO, Analytics Advantage, CFO Methodology, Creation Strategy, Financial Data Triage, Financial Transformation Framework, Fractional CFO, Role of Fractional CFO Services, All Posts

Overview

Independent sponsors face a unique challenge: creating institutional-grade value in founder-owned businesses that often lack financial sophistication.

What can be done about it?

This briefing lays out the case for how a strategic fractional CFO engagement can rapidly transform these businesses through financial rigor, analytics, and operational excellence. A foundation is created for long-term success under permanent financial leadership.

The Evolution of Value Creation in Founder-Owned Businesses

Traditional approaches to value creation in lower middle-market deals once relied heavily on financial engineering and basic operational improvements. However, the increasing availability of data and advanced analytics tools has introduced new opportunities for sophisticated buyers to identify hidden value. The challenge lies in rapidly implementing these capabilities in founder-owned businesses that lack an appropriately functioning financial infrastructure. A fractional CFO engagement, structured around clear transformation objectives, is the solution for this crucial transition period.

Financial Data Triage: The Foundation of Transformation

Most founder-owned businesses operate with financial systems that evolved organically over time, a process that results in inconsistent practices and insufficient documentation. An experienced fractional CFO, on the other hand, brings both the expertise and objectivity needed to evaluate and transform these systems without disrupting ongoing operations. The opportunity to partner with a financial transformation expert, over an extended period, can offer immense value to an independent sponsor’s new portfolio addition.

Transforming a business begins with a thorough assessment of existing financial practices and implementation of professional-grade accounting systems. These do not need to be massive projects requiring a large IT lift or integration experts. By leveraging experience across multiple similar situations, a fractional CFO can rapidly implement best practices for historical financial restatement, GAAP transformation, establishment of proper financial controls and crucially a forecasting-reporting-KPI flywheel that brings continual insights to management, as described below.

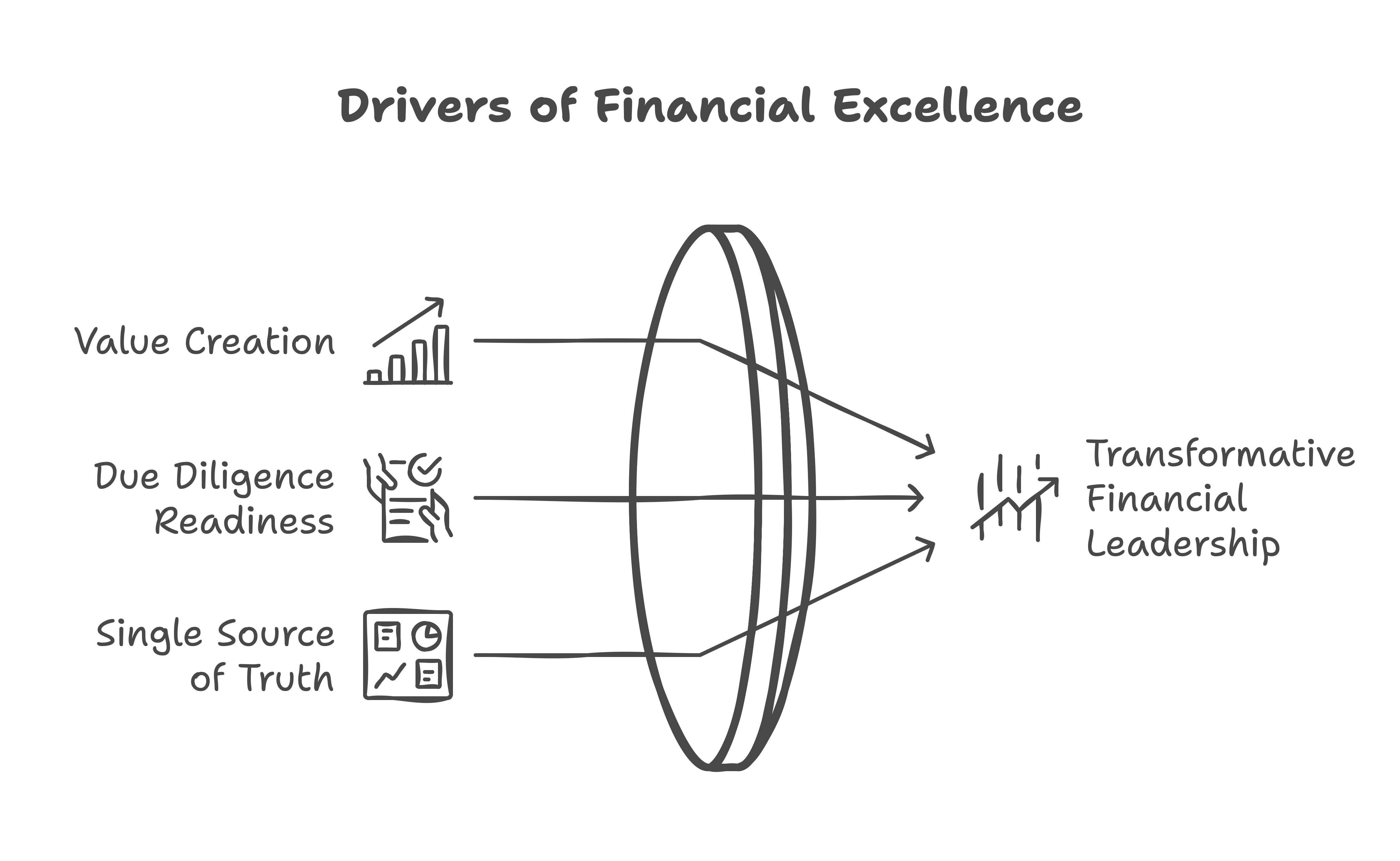

This accelerated transformation creates the foundation needed for a permanent CFO to succeed. Furthermore, it lays the groundwork for CFO Pro+Analytics’ three drivers of financial success: value creation focus, due diligence readiness and single source of truth for data-driven decisions.

As mentioned earlier, a critical component of this transformation is the creation of a financial flywheel – a self-reinforcing cycle of timely monthly closes, standardized reporting, rolling forecasts, KPI reporting and strategic planning updates. Once established, this flywheel can be managed effectively by a permanent financial team, with the processes and controls necessary for sustainable improvement.

The Analytics Advantage in Deal Evaluation

Though there may already be a solid financial foundation in place, modern deal evaluation requires a deeper understanding of operational metrics and their impact on business value. A fractional CFO with both private equity and operational experience bring both valuable perspective on which metrics drive value and knowledge of how to implement systems to track them effectively. For example, machine learning-driven models can reduce customer acquisition costs while maintaining growth rates, directly improving EBITDA margins—to name just one of many examples.

Post-Acquisition Value Creation Strategy

The initial 6–12 months post-acquisition represent a crucial period for establishing financial infrastructure and analytics capabilities. A fractional CFO can rapidly implement comprehensive KPI tracking systems, predictive analytics, and machine learning tools, laying out the foundation for long-term value creation. This initial transformation period focuses on both quick wins that demonstrate value in the short term, and establishing sustainable systems that a permanent CFO can build upon in the long term.

The journey to success involves balancing technical solutions with organizational change management. An experienced fractional CFO brings an array of value-adds: best practices for achieving leadership alignment, clear communication of metrics and goals, and cultural shifts toward data-driven decision-making. Once establishing these foundations, a permanent CFO can take the reins and effectively drive ongoing improvement and optimization.

Building a Modern Value Creation Framework

The transformation framework begins with rapid assessment and implementation of core financial systems, followed by introduction of advanced analytics and value creation initiatives. This phased approach allows for quick wins while building toward comprehensive transformation. Throughout the process, the fractional CFO works to build internal capabilities, ensuring a smooth transition to permanent financial leadership.

The Role of Fractional CFO Services in Independent Sponsor Success

A strategic fractional CFO engagement provides five advantages for independent sponsors:

1. Rapid implementation of best practices from day one

2. Objective evaluation of existing systems and team capabilities

3. Experience-based roadmap for financial transformation

4. Flexible resource scaling during crucial transformation period

5. Smooth transition to permanent financial leadership

Now, the business is well-positioned for a permanent CFO to drive ongoing value creation and growth.

About the Author

Salvatore Tirabassi brings a proven methodology for transforming founder-owned businesses into institutional-grade operations. His approach, refined through 15 years of venture capital and private equity experience combined with first-hand operational expertise as a professional and fractional CFO, leverages three core drivers:

Value Creation: Implementing advanced analytics and operational improvements that drive measurable business performance.

Due Diligence Readiness: Building robust financial infrastructure and controls that prepare companies for successful exits.

Single Source of Truth: Creating integrated data systems that enable confident, rapid decision-making.

The drivers of this methodology have proven successful across multiple industries, aided in raising over $400M in capital, and facilitated a dozen successful exits. By leveraging both financial sophistication and operational excellence, Salvatore creates lasting value for independent sponsors and their portfolio companies.

—

For more information or to schedule a meeting, contact:

stirabassi@cfoproanalytics.com

FAQs

How does a fractional CFO engagement benefit independent sponsors in newly acquired businesses?

A fractional CFO engagement provides rapid implementation of best practices, objective evaluation of existing systems, an experience-based roadmap for financial transformation, flexible resource scaling during the crucial transition period, and a smooth transition to permanent financial leadership. This approach helps create institutional-grade value in founder-owned businesses that often lack financial sophistication.

What is the “financial flywheel” mentioned in the framework, and why is it important?

The financial flywheel is a self-reinforcing cycle of timely monthly closes, standardized reporting, rolling forecasts, KPI reporting, and strategic planning updates. It’s crucial because it establishes a foundation for sustainable improvement, enables data-driven decision-making, and can be effectively managed by a permanent financial team once implemented. This system creates a single source of truth for financial data and supports ongoing value creation.

How does the framework address the challenge of implementing advanced analytics in founder-owned businesses?

The framework takes a phased approach, starting with a thorough assessment and implementation of core financial systems. It then introduces advanced analytics and value creation initiatives. This method allows for quick wins while building toward comprehensive transformation. The fractional CFO also focuses on organizational change management, including leadership alignment, clear communication of metrics and goals, and fostering a culture of data-driven decision-making to ensure successful implementation of these advanced tools.