Financial Calculators: An Essential Financial Tool for Business Owners

in CFO, Finance, Fractional CFO, #FractionalCFO, financial planning, Financial Planning and Analysis, Financial Strategy, All Posts

Informed decisions are key to sustainable growth and profitability. Financial calculators that once required specialized knowledge or expensive software are now accessible through targeted calculators that provide immediate insights. Whether you’re a startup founder, a seasoned entrepreneur, or a business owner looking to optimize operations, having the right financial tools can mean the difference between intuitive guessing and strategic planning. Additionally, we offer free resources such as downloadable templates and articles to assist with financial forecasting and decision-making.

The following collection of financial calculators addresses the most critical financial metrics and decisions business owners face. From evaluating customer acquisition costs to planning funding rounds, these tools transform complex financial concepts into actionable insights.

- Asset Backed Loan Calculator – For analyzing and comparing loans using receivables and inventory as asset backed collateral

- Business Valuation Calculator – Using weighted multiples of revenue and EBITDA

- Cash Burn Rate Calculator – With sensitivity matrix for runway projections

- Customer Acquisition Cost Calculator – For determining customer acquisition efficiency

- Equity Startup Funding & Cap Table Dilution – For modeling cap tables through funding rounds

- Lifetime Value Calculator – For calculating customer value throughout their relationship

- Loan Amortization Calculator – With 3-way comparison for different loan options

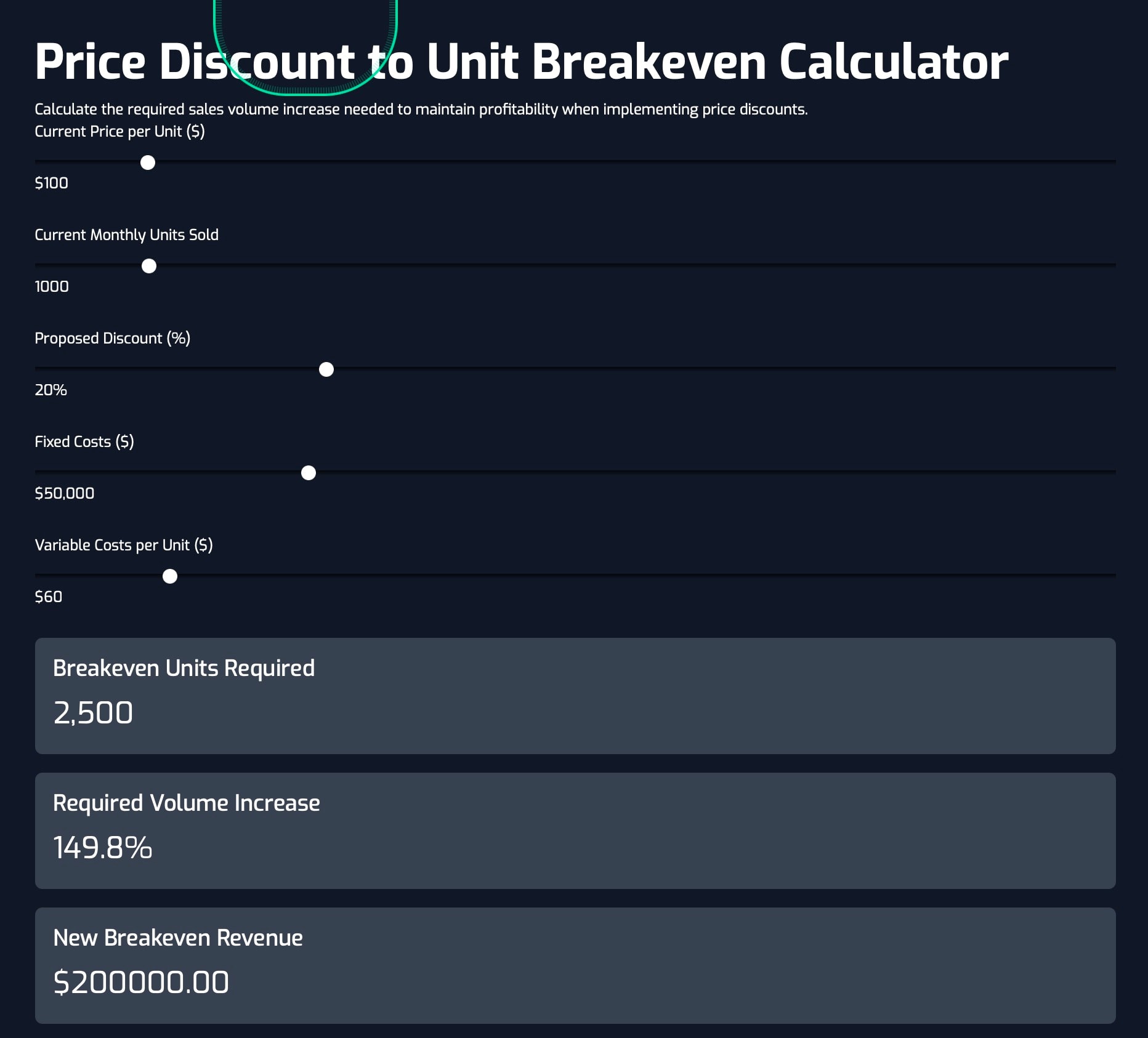

- Price Discount to Unit Breakeven Calculator – For evaluating pricing strategy impacts

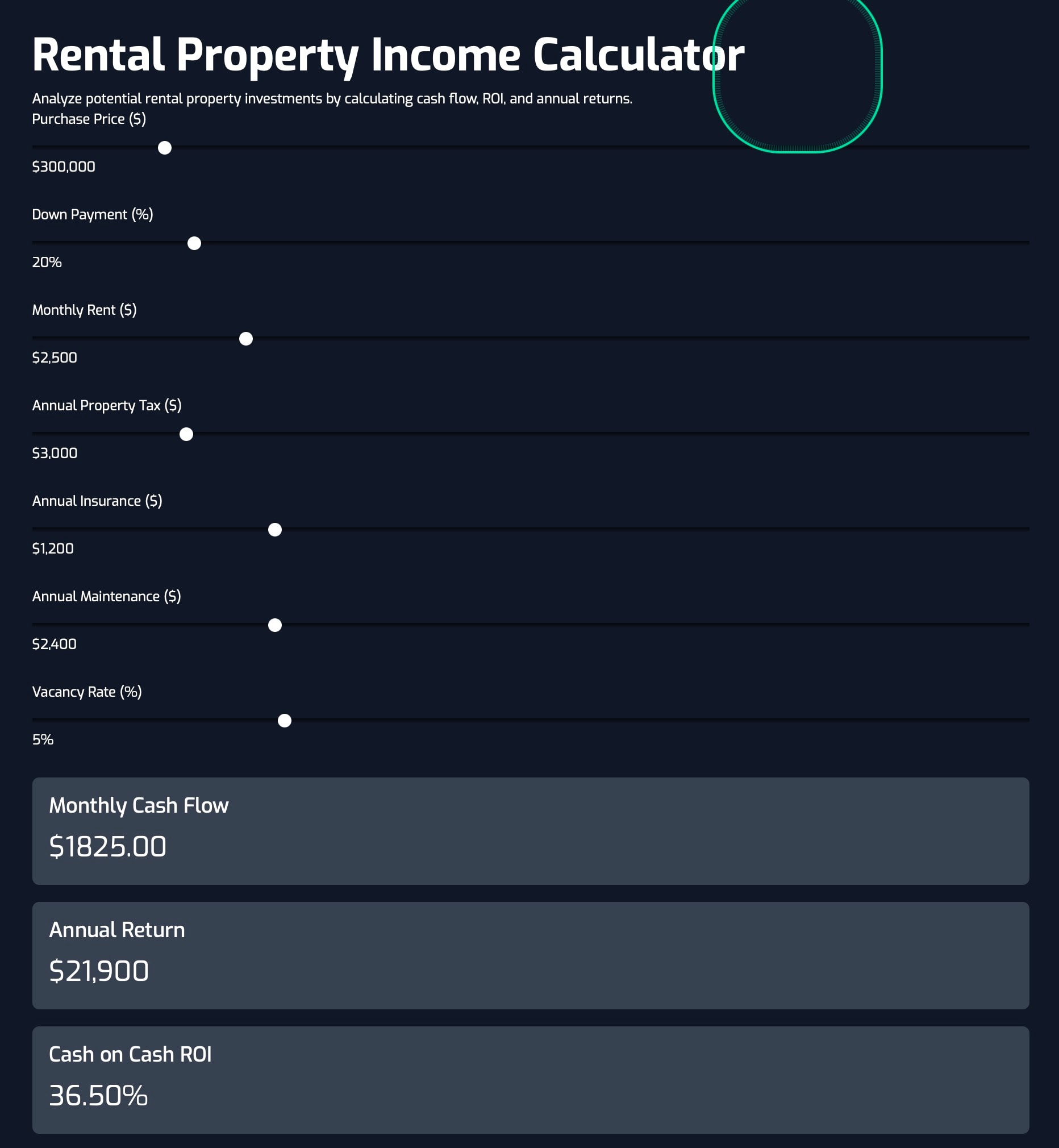

- Rental Property Calculator – For analyzing potential real estate investments

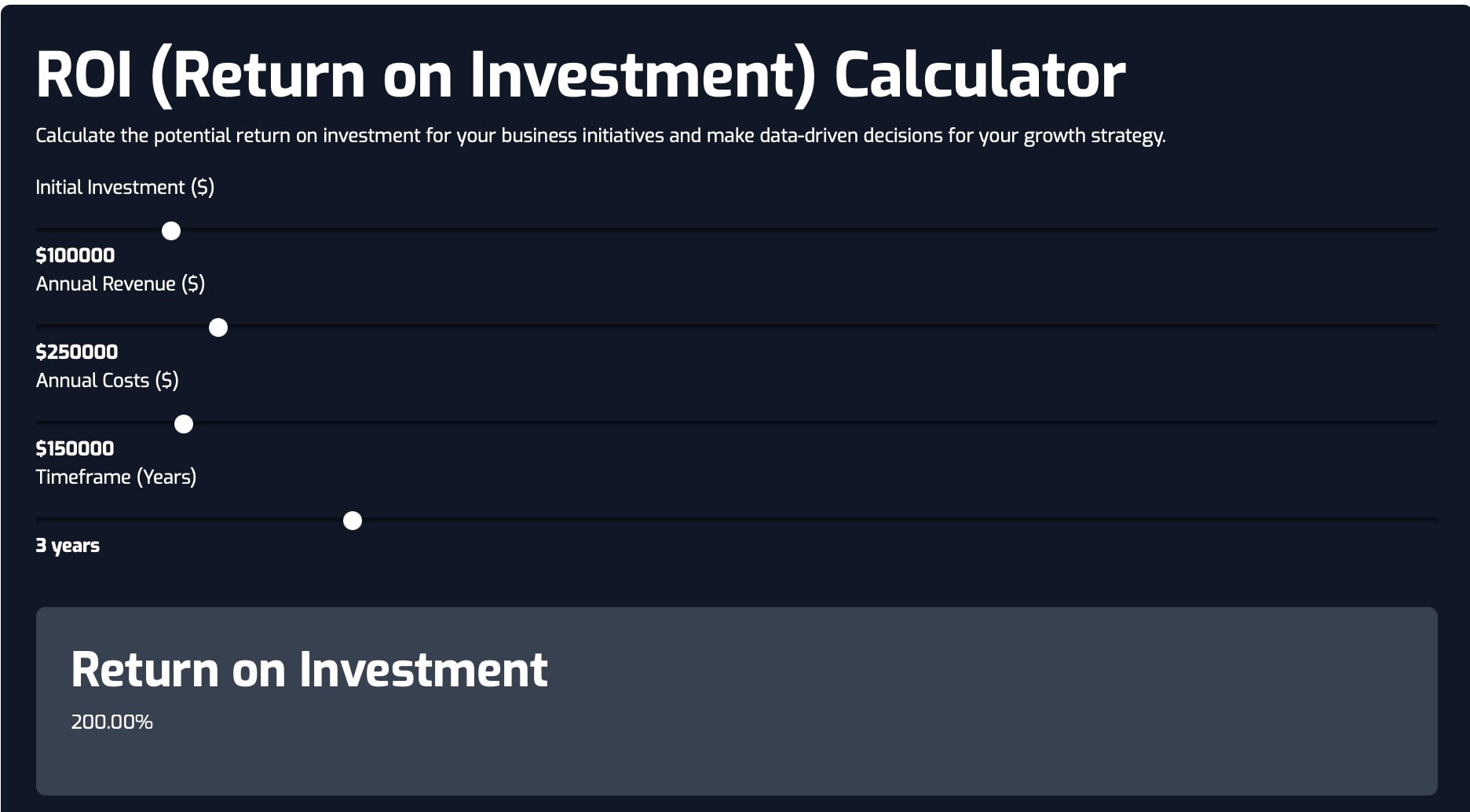

- ROI Calculator – For calculating potential returns on business investments

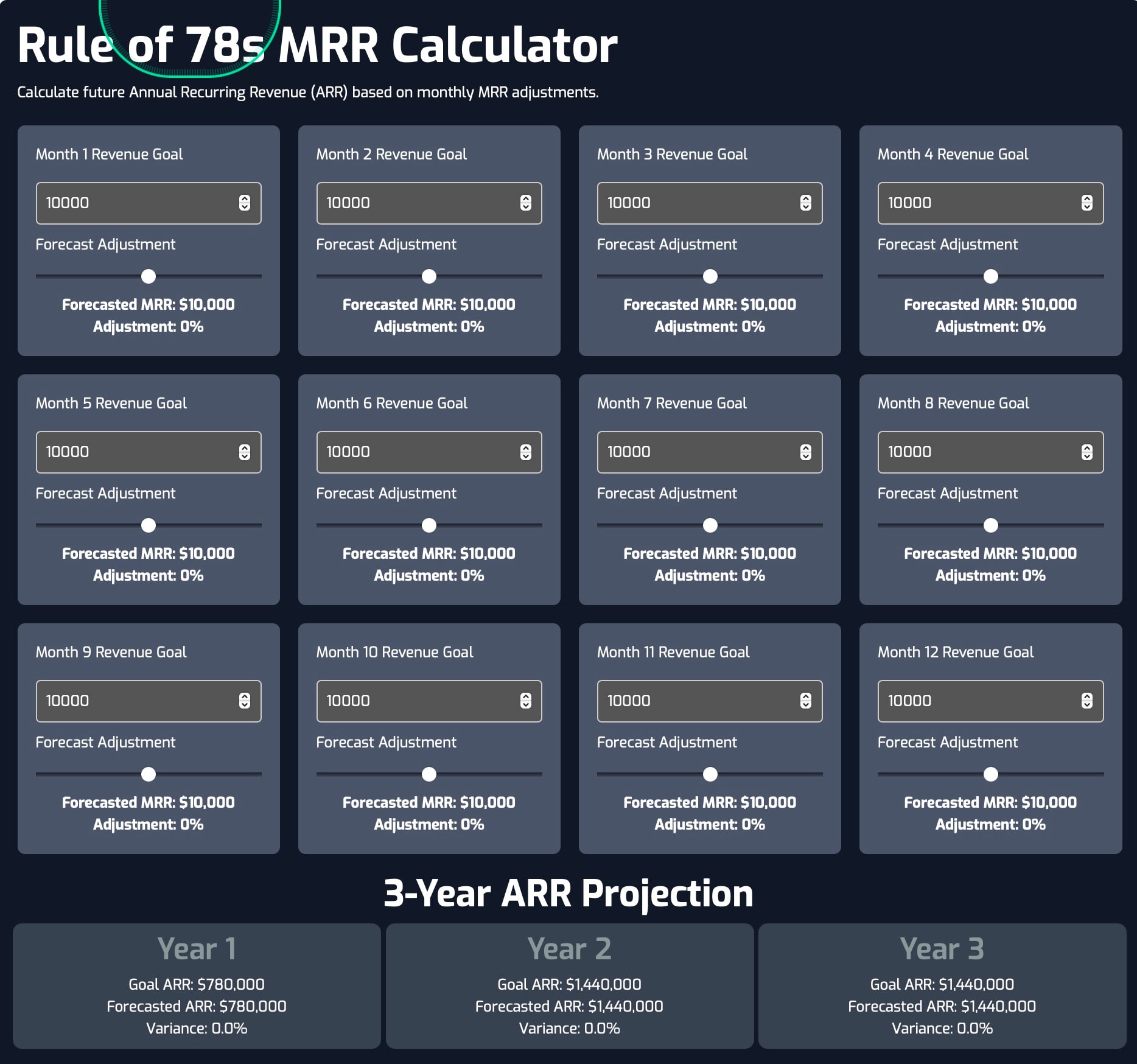

- Rule of 78s Revenue Calculator – For revenue planning with monthly adjustment factors

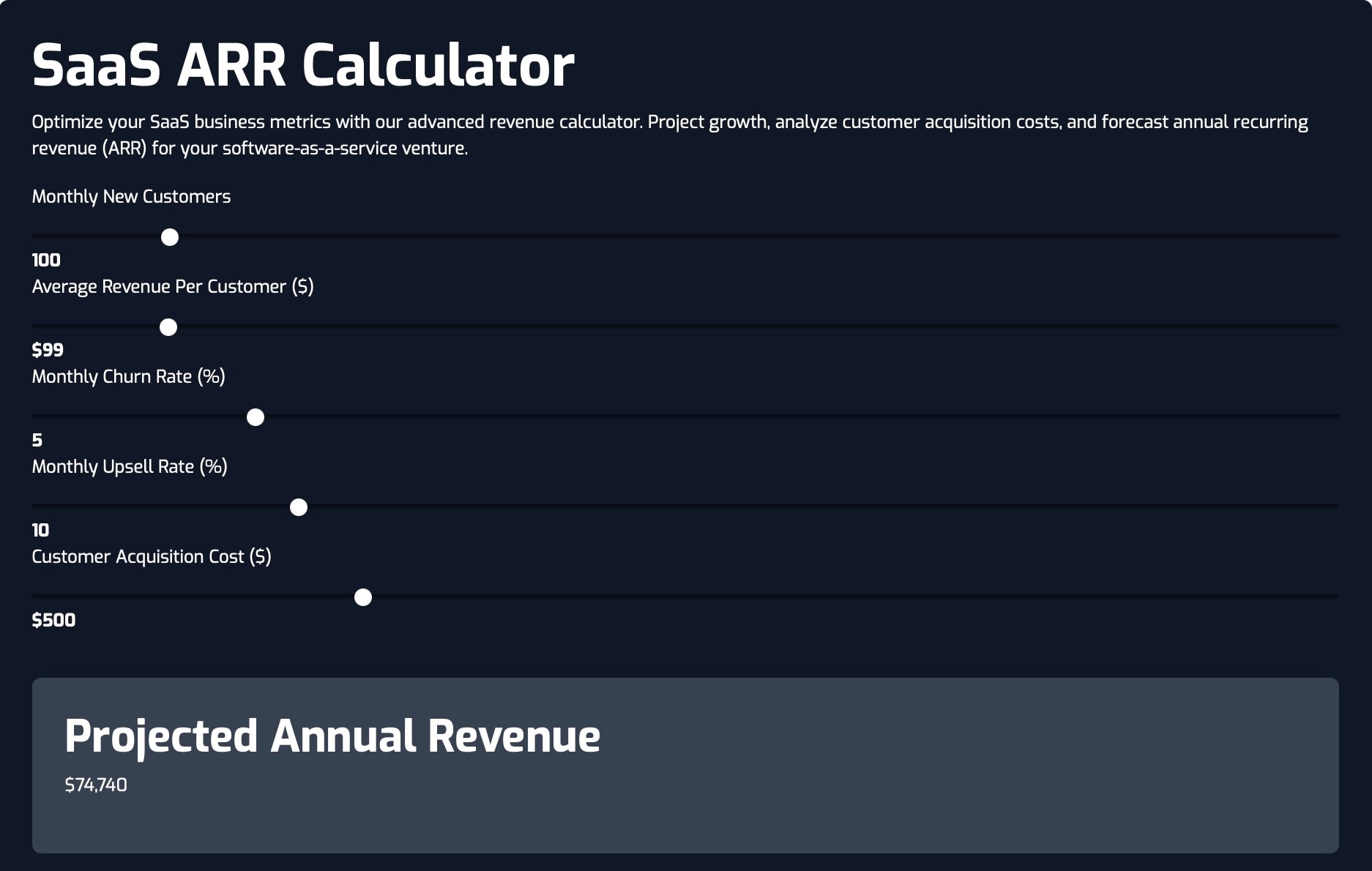

- SaaS Revenue Calculator – For forecasting SaaS business performance using metrics like MRR, churn, and upsell rates

Understanding Key Financial Metrics

Understanding key financial metrics is crucial for businesses to make informed decisions and drive growth. Metrics such as customer acquisition cost, annual revenue, and total revenue provide valuable insights into a company’s performance and help identify areas for improvement. By tracking these metrics, businesses can optimize their customer acquisition strategies, refine their pricing models, and increase their revenue. Additionally, these financial metrics can help measure the effectiveness of marketing campaigns, identify opportunities to reduce costs, and enhance overall efficiency. Regularly monitoring these metrics ensures that businesses stay on track to meet their financial goals and maintain a competitive edge in the market.

Benefits of Using Financial Calculators

Financial calculators are essential tools for businesses to calculate and analyze key financial metrics efficiently. By using financial calculators, businesses can quickly and accurately determine metrics such as customer acquisition cost, annual revenue, and total revenue. These calculators also assist in forecasting future revenue and expenses, identifying trends and patterns, and making data-driven decisions. Furthermore, financial calculators help save time and reduce errors, allowing business owners to focus on high-level strategy and decision-making. By leveraging these tools, businesses can streamline their financial analysis, improve accuracy, and drive growth and profitability.

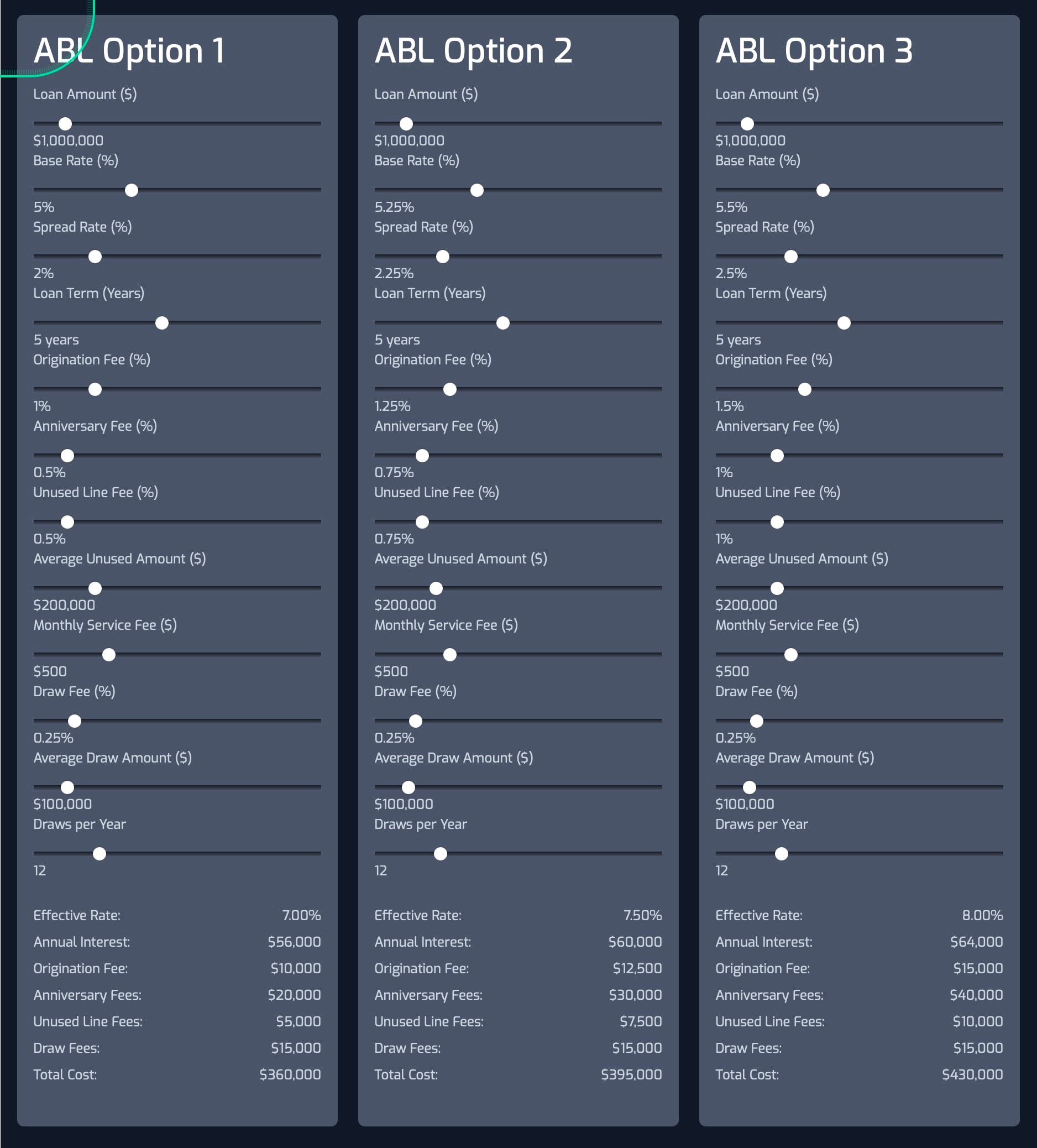

Asset Backed Loan Calculator: Optimizing Your Business Financing Strategy

For businesses with significant assets seeking liquidity without sacrificing ownership, asset-backed loans (ABLs) offer valuable financing flexibility. The Asset Backed Loan Calculator provides comprehensive analysis of different ABL options with their complex fee structures and terms, enabling informed decisions about this specialized financing approach by highlighting how much money is generated from customers and the expenses involved in acquiring them.

This sophisticated calculator breaks down the true cost of asset-backed financing by incorporating all the variables that affect your bottom line: base rates, spread rates, loan terms, origination fees, anniversary fees, unused line fees, monthly service fees, and draw fees. By comparing multiple scenarios side-by-side, business owners can see beyond headline interest rates to understand the complete cost picture.

Asset-backed loans often involve complex fee structures that can obscure the actual financing cost. This calculator brings transparency to the process, revealing how seemingly minor differences in fee structures can significantly impact total financing costs over the life of the loan. For business owners navigating working capital lines, inventory financing, or equipment-backed loans, this clarity prevents expensive financing mistakes.

The calculator proves particularly valuable when comparing offers from different lenders, as it standardizes diverse fee structures into comparable total costs. By quantifying the impact of each fee component, it also gives business owners leverage in negotiations – allowing them to target specific fees that disproportionately affect their financing costs based on their expected utilization patterns.

For seasonal businesses or those with uneven cash flow, the ability to model different draw patterns provides critical insight into how facility utilization affects overall costs. The calculator helps optimize draw strategies to minimize fees while maintaining necessary operational liquidity. This optimization can potentially save thousands in unnecessary fees for businesses that carefully plan their facility usage.

Whether you’re considering your first asset-backed facility or evaluating refinancing options, this calculator transforms complex lending terms into straightforward financial comparisons. By providing total cost projections along with detailed breakdowns of each fee component, it empowers business owners to make financing decisions with complete understanding of their long-term implications.

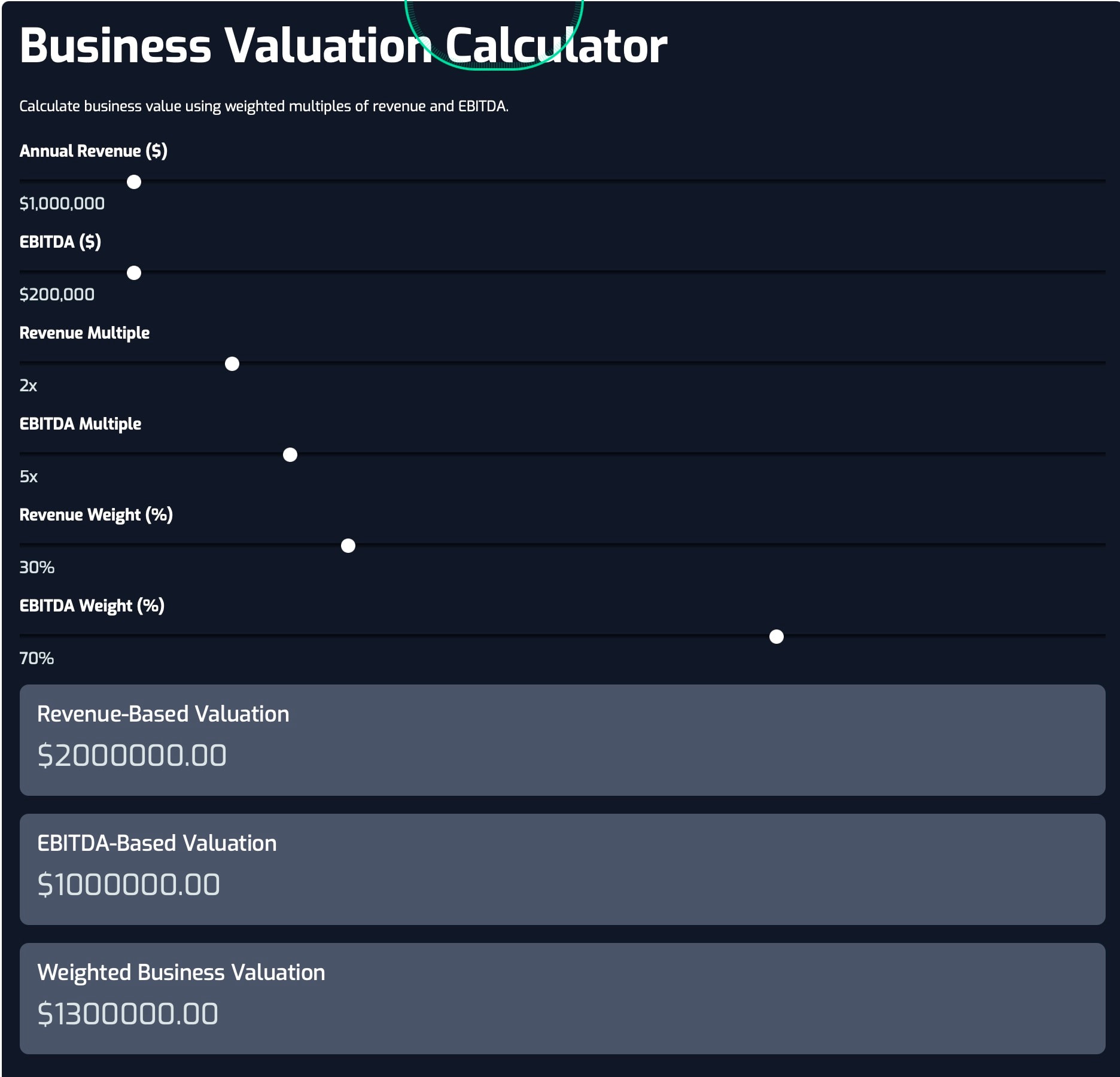

Business Valuation Calculator: Understanding Your Company’s Worth

The Business Valuation Calculator uses weighted multiples of revenue and EBITDA to provide a preliminary valuation range for your business. By allowing customization of multiple factors and weighting between methods, this calculator produces valuations tailored to your specific industry and business characteristics.

For business owners contemplating exit strategies, seeking investment, or simply wanting to track progress, understanding valuation drivers creates focus and alignment. This calculator helps identify which operational metrics most directly impact business value, guiding strategic priorities and investment decisions.

While professional valuations involve additional factors, this calculator provides a reasonable starting point for valuation discussions and helps entrepreneurs understand how industry-standard multiples apply to their specific situation. This knowledge proves invaluable in preliminary discussions with potential investors or acquirers.

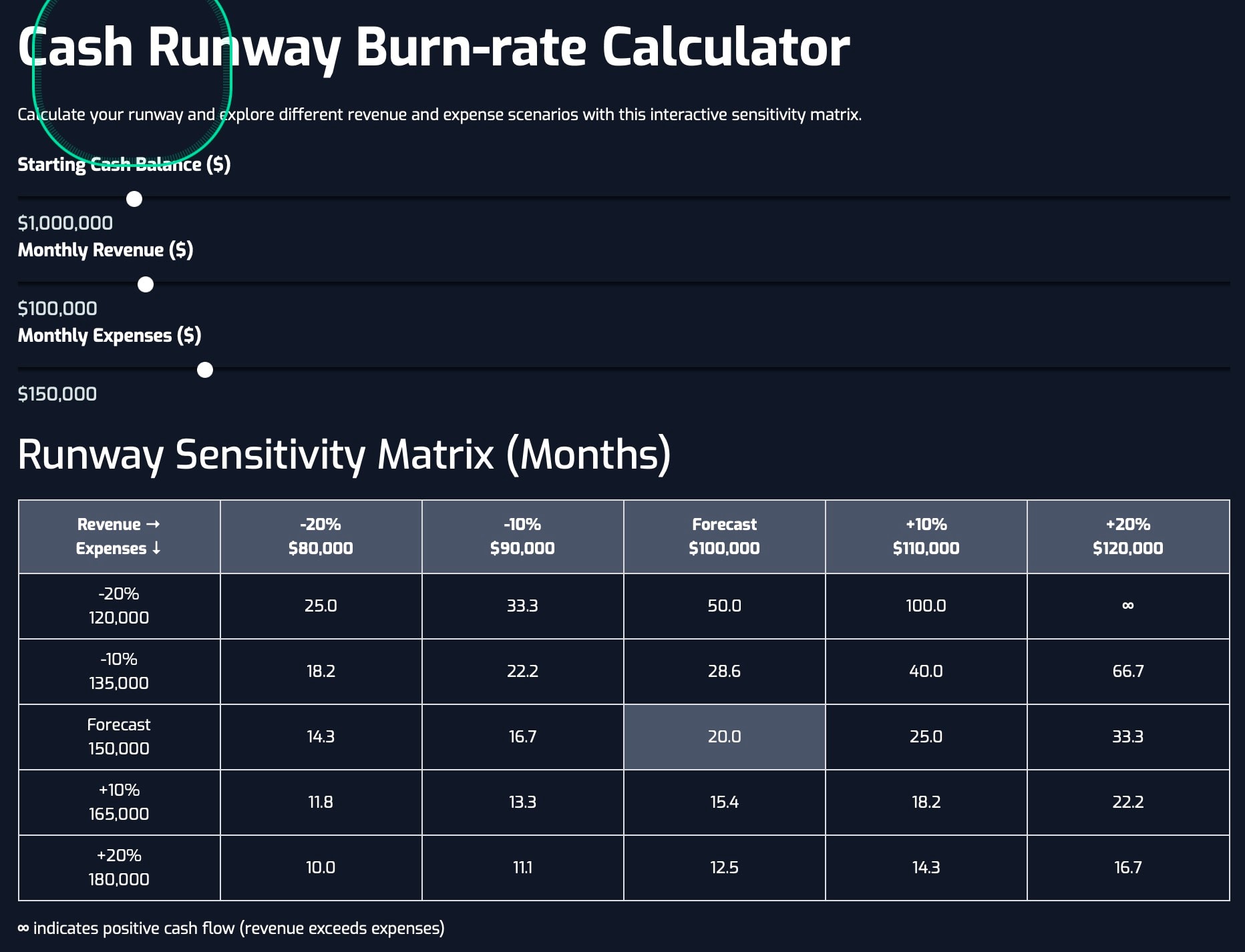

Cash Burn Rate Calculator: Managing Runway and Sustainability

Cash remains the lifeblood of business, particularly for growing companies or those navigating challenging circumstances. The Cash Burn Rate Calculator with sensitivity matrix provides visibility into how long current cash reserves will last under various revenue and expense scenarios.

By inputting starting cash balance, monthly revenue, and monthly expenses, the calculator produces a matrix showing runway under different combinations of revenue and expense variations. This scenario planning capability helps businesses identify the most effective levers for extending runway during challenging periods.

For startups between funding rounds or established businesses managing through economic uncertainty, this calculator provides early warning of potential cash constraints. It also helps quantify the impact of cost-cutting or revenue acceleration initiatives on overall financial sustainability.

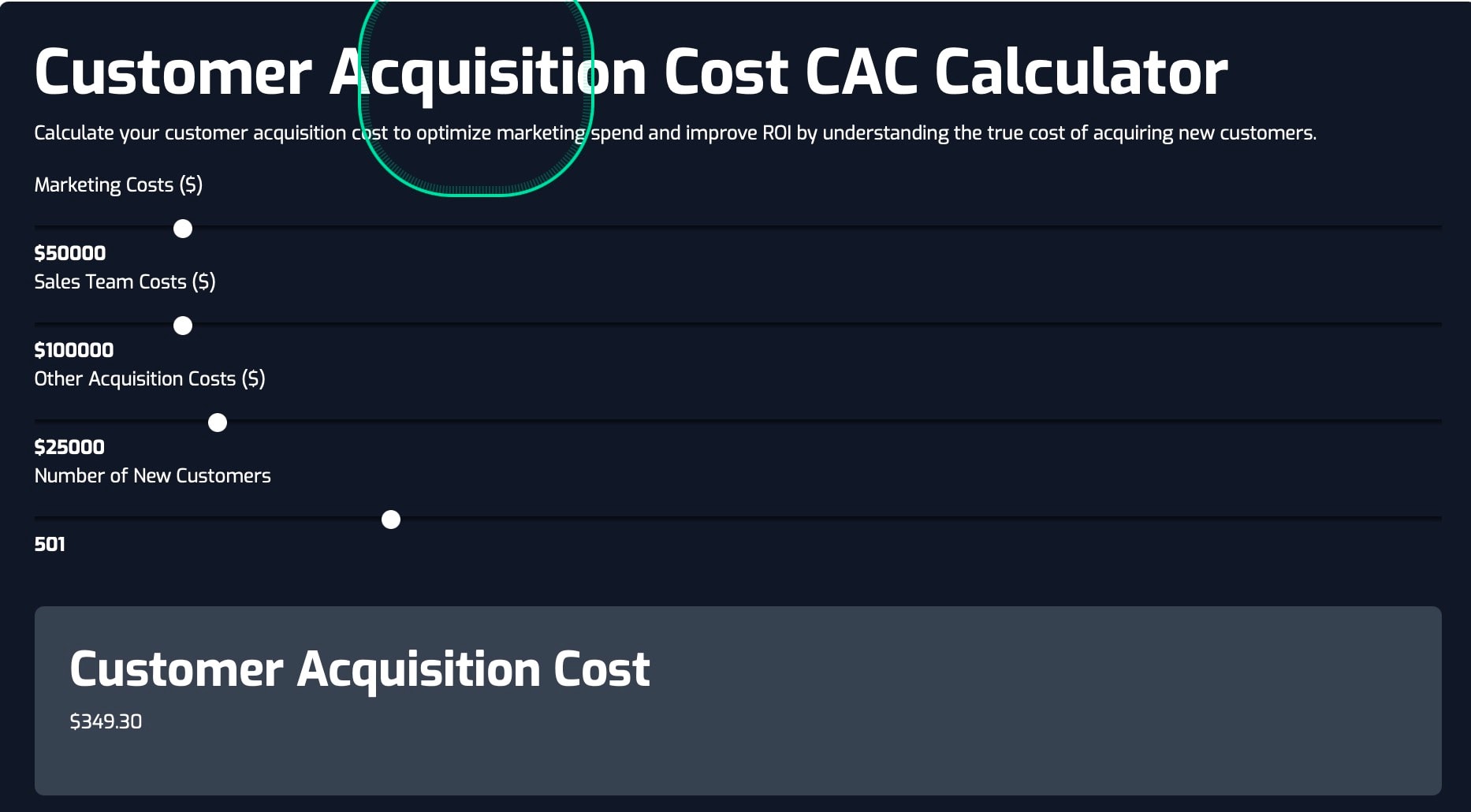

CAC Calculator: Optimizing Customer Acquisition Efficiency

As acquisition costs rise across industries, understanding exactly how much you’re spending to acquire each customer becomes increasingly critical. The Customer Acquisition Cost Calculator helps businesses break down marketing and sales expenses to calculate the true cost of adding each new customer, considering how customers pay through various payment structures like monthly and annual subscriptions.

By separating costs into marketing expenses, sales team costs, and other acquisition expenses, the calculator creates transparency around acquisition efficiency. When compared against customer lifetime value (LTV), this metric forms one of the most important indicators of business health and sustainability.

Entrepreneurs can use this calculator to identify inefficient channels, optimize marketing spend, and ensure that growth initiatives remain economically viable. In competitive markets where margins are thin, understanding and managing CAC can represent the difference between profitable growth and unsustainable expansion.

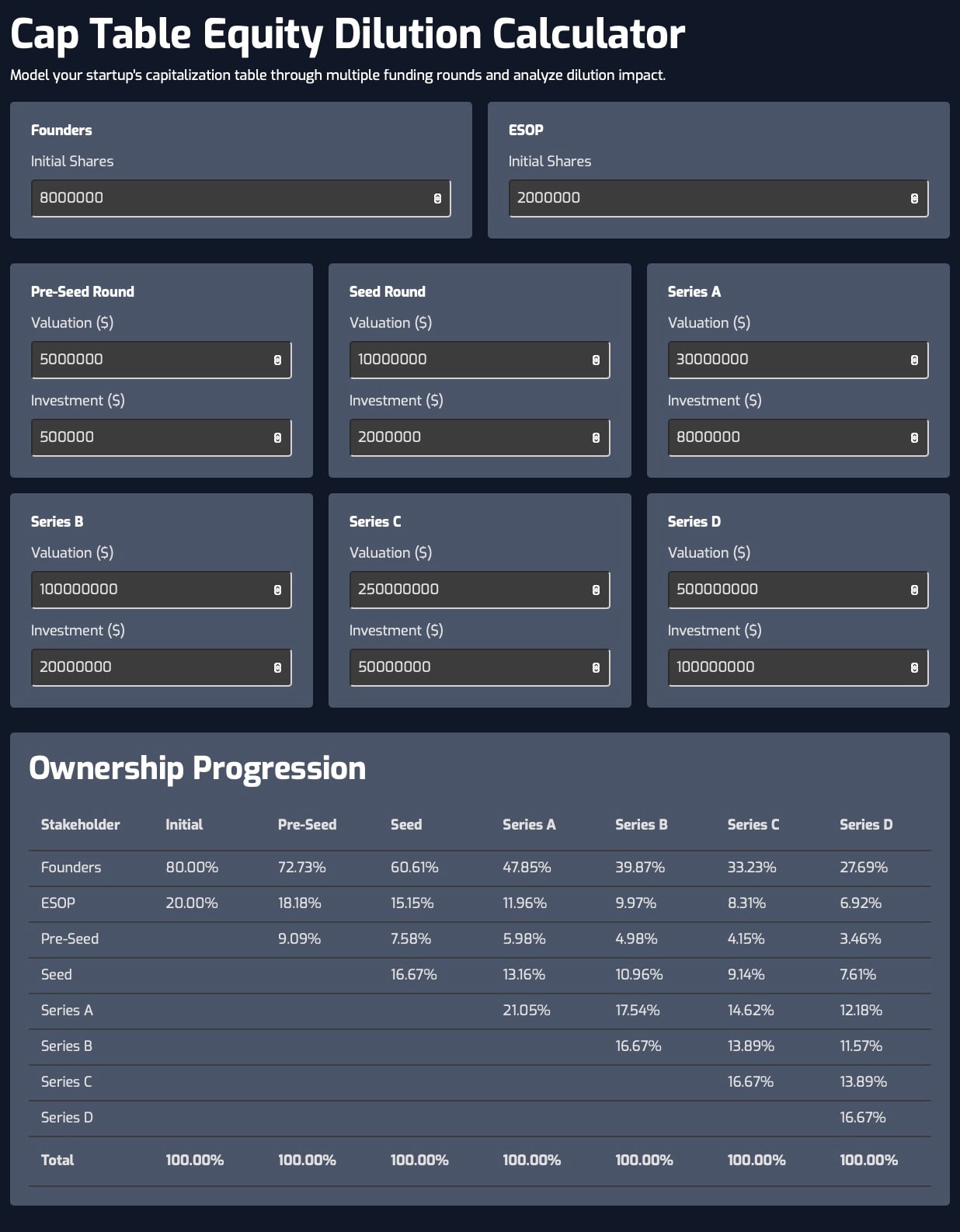

Equity Funding & Cap Table Dilution Calculator: Navigating Investment Rounds

For founders navigating the funding landscape, the Startup Funding & Cap Table Dilution Calculator provides clarity around ownership stakes through multiple rounds of investment. By modeling founder shares, employee stock options, and investor stakes from pre-seed through Series D, this calculator helps entrepreneurs understand the dilution impact of fundraising decisions.

The progressive visualization of ownership percentages helps founders make strategic decisions about raise amounts, valuation targets, and option pool sizing. This calculator proves particularly valuable when evaluating term sheets or planning future funding needs, as it reveals the long-term ownership implications of current financing decisions.

For founders balancing growth capital needs against ownership retention, this calculator provides the analytical foundation for one of entrepreneurship’s most consequential trade-offs. It also helps align founding team expectations with financial realities, preventing misunderstandings about equity as the company evolves.

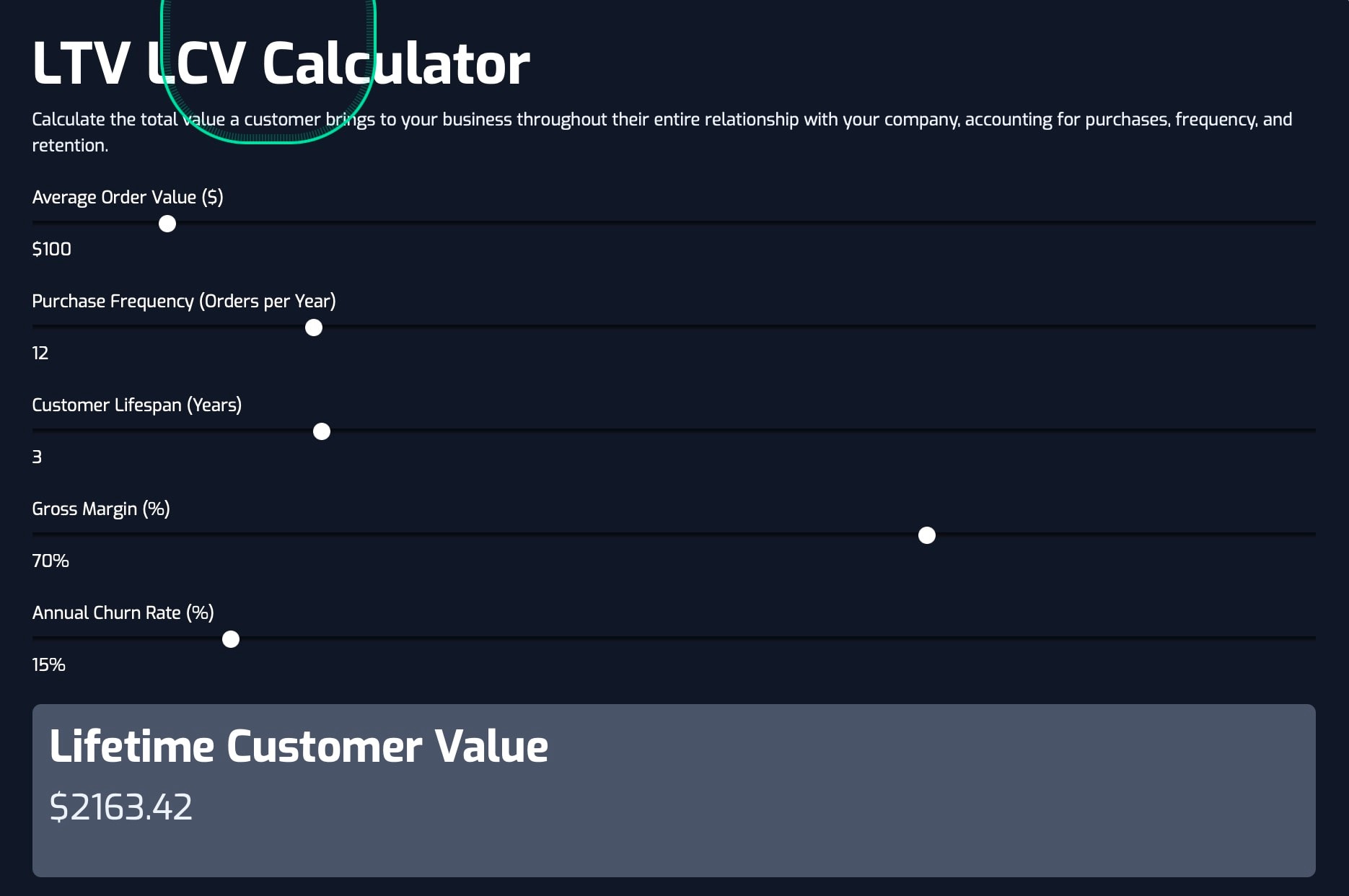

Lifetime Customer Value Calculator – LCV / CLV

The Lifetime Value Calculator provides critical insight into the total value of revenue a customer generates throughout their entire relationship with your business. By factoring in average order value, purchase frequency, customer lifespan, gross margin, and churn rate, this calculator shows the complete economic picture of your customer relationships by determining key financial metrics that are carefully calculated.

This metric serves as the counterbalance to customer acquisition costs, helping businesses determine how much they can affordably spend to acquire each new customer. More importantly, it highlights the financial impact of retention efforts – often revealing that a small improvement in retention can be worth more than significant expansion in acquisition.

For service businesses or subscription models, this calculator helps prioritize customer success initiatives by quantifying their financial impact. It also identifies your most valuable customer segments, guiding strategic decisions about where to focus retention and expansion efforts.

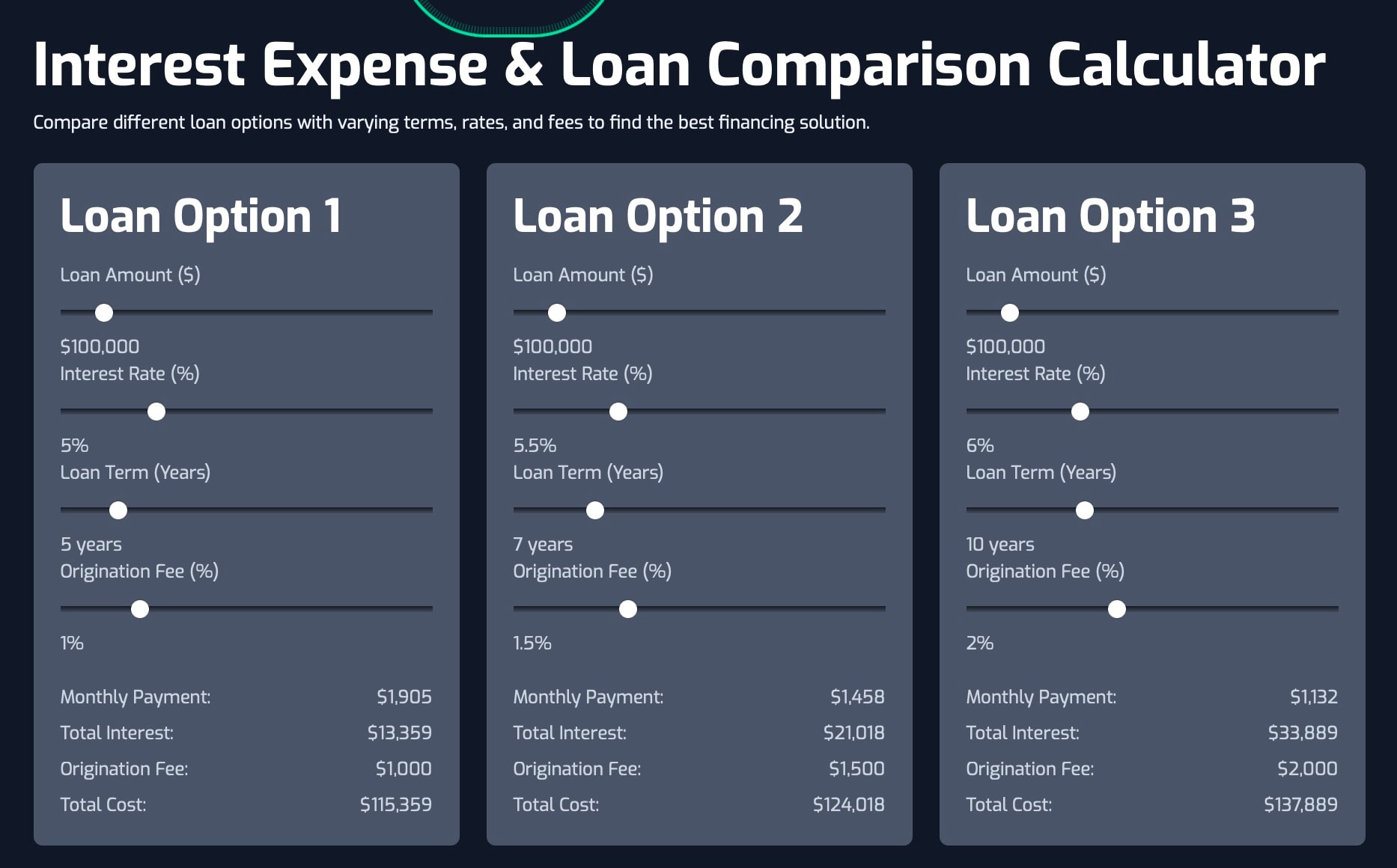

Loan Comparison Calculator: Optimizing Financing Decisions

The Loan Amortization Calculator with three-way comparison functionality allows business owners to evaluate different financing options side by side. By accounting for varying loan amounts, interest rates, terms, and fees, this calculator reveals the true cost of financing beyond the headline interest rate.

Particularly useful when comparing different types of business loans, this calculator helps identify the most cost-effective option for your specific situation. The inclusion of origination fees and ability to visualize monthly payments alongside total interest paid provides complete transparency around financing costs.

For business owners navigating equipment financing, expansion loans, or refinancing options, this calculator cuts through complicated fee structures to reveal which option truly costs less over the life of the loan. This clarity can potentially save thousands in unnecessary financing costs.

Price Discount Breakeven Calculator: Mastering Pricing Strategy

Price discounting represents one of the most common yet potentially dangerous business strategies. The Price Discount to Unit Breakeven Calculator shows exactly how many additional units must be sold to maintain profitability when implementing price reductions.

By inputting current price, current sales volume, proposed discount percentage, fixed costs, and variable costs, businesses can see the precise sales increase required to break even after a price reduction. This calculator often reveals surprisingly high volume requirements, helping prevent discounting decisions that seem intuitively sound but would actually harm profitability.

For retailers, e-commerce businesses, or service providers contemplating promotional pricing, this calculator provides the analytical framework to ensure discounting strategies drive profit rather than just revenue. It also helps structure limited-time offers to maximize effectiveness while managing financial risk.

Rental Property Calculator: Evaluating Real Estate Investments

For entrepreneurs considering real estate as part of their business strategy, the Rental Property Calculator provides comprehensive analysis of potential investment properties. By incorporating purchase price, down payment, monthly rent, property taxes, insurance, maintenance, and vacancy rate, this calculator delivers key metrics like cash flow, annual return, and cash-on-cash ROI.

This calculator proves particularly valuable for businesses considering property ownership versus leasing, or for entrepreneurs diversifying into real estate investments. The detailed breakdown of expenses and returns helps identify properties with the strongest investment characteristics and highlights potential pitfalls before commitments are made.

By providing monthly cash flow projections alongside longer-term return metrics, this calculator helps balance immediate financial needs against long-term wealth building through property appreciation and equity accumulation.

ROI Calculator: Validating Investment Decisions

Return on investment represents one of the most fundamental business calculations. The ROI Calculator simplifies the process of evaluating potential investments by comparing initial costs against projected returns over a defined timeframe.

Business owners can input initial investment amount, anticipated annual revenue, expected costs, and timeframe to see both percentage ROI and actual dollar returns. This calculator proves invaluable when evaluating equipment purchases, marketing campaigns, or facility expansions, enabling comparison of different opportunities on equal footing.

The real power lies in its ability to test different scenarios – adjusting timeframes, costs, or revenue projections to understand the sensitivity of returns to various factors. This scenario planning capability helps business owners identify the variables most critical to investment success and focus their management attention accordingly.

Rule of 78s Revenue Calculator: Planning Recurring Revenue Growth

The Rule of 78s Revenue Calculator helps businesses with recurring revenue models forecast annual revenue based on monthly customer additions. By allowing adjustment of each month’s target revenue and applying sensitivity factors, this calculator projects annual recurring revenue under various growth scenarios.

Named for the mathematical relationship between periodic additions to recurring revenue, this calculator shows how early growth disproportionately impacts annual results. For subscription businesses, service firms with retainers, or any company with recurring revenue components, this calculator helps set realistic targets and understand the compounding effect of consistent monthly growth.

The side-by-side comparison of baseline projections versus sensitized forecasts helps businesses understand both the opportunities and risks inherent in their growth plans. This perspective proves invaluable when setting sales targets, planning resource allocation, or communicating with stakeholders about revenue expectations.

SaaS Revenue Calculator: Mapping Your Subscription Business Growth

For SaaS entrepreneurs, understanding the interplay between monthly recurring revenue, churn, and customer acquisition is fundamental to building a sustainable business model. The SaaS Revenue Calculator provides a comprehensive view of how various metrics, including the acquisition of new customers and upsell opportunities from existing customers, influence your bottom line and future growth trajectory.

By inputting monthly customers, average revenue per customer, churn rate, upsell rate, and acquisition costs, you can visualize projected annual revenue while accounting for both customer losses and expansion opportunities. This calculator is particularly valuable when planning investment rounds or setting growth targets, as it helps you understand how small improvements in retention can dramatically impact overall revenue. Additionally, offering more features in premium plans can improve upsell rates and overall revenue.

Understanding the total value generated from contracts, whether monthly or annual, is crucial for accurate revenue forecasting and strategic planning.

SaaS businesses live and die by their metrics, and this calculator transforms abstract percentages into concrete revenue projections. For founders negotiating with investors or CFOs planning resource allocation, having accurate revenue forecasts backed by actual performance metrics creates credibility and strategic clarity.

Choosing the Right Financial Calculator

With so many financial calculators available, choosing the right one can be overwhelming. Businesses should consider factors such as the type of metrics they need to calculate, the level of complexity they require, and the cost of the calculator. Additionally, businesses should look for calculators that are user-friendly, customizable, and provide clear and concise results. By selecting the right financial calculator, businesses can streamline their financial analysis, make more informed decisions, and drive growth and profitability. Whether you need to calculate customer acquisition cost, forecast annual revenue, or analyze total revenue, the right tool can make all the difference in achieving your financial goals.

Decision-Making and Strategy: Aligning Financial Tools with Business Goals

Decision-making and strategy are critical components of financial planning for businesses. By aligning financial tools with business goals, businesses can make informed decisions, allocate resources effectively, and drive growth and profitability. To align financial tools with business goals, consider the following factors:

- Business Objectives: Clearly define what you aim to achieve.

- Financial Metrics: Use key metrics to measure progress and performance.

- Market Trends: Stay updated on market conditions to inform strategic decisions.

- Industry Benchmarks: Compare your performance against industry standards.

- Customer Feedback: Incorporate customer insights to refine strategies.

By using financial tools, such as a customer acquisition cost calculator, businesses can make data-driven decisions, optimize their marketing efforts, and improve overall financial performance. These tools provide the clarity needed to align day-to-day operations with long-term strategic goals, ensuring sustainable growth and profitability.

FAQ

Q: Which calculators are most essential for early-stage businesses? A: Early-stage businesses should prioritize the Cash Burn Rate Calculator to manage runway, the CAC Calculator to ensure efficient customer acquisition, and the SaaS Revenue Calculator (for subscription businesses) or Profit Margin Calculator (for traditional businesses) to understand fundamental economics. These tools address the most pressing financial challenges new businesses face while establishing operational viability.

Q: How accurate are these calculators for making business decisions? A: These calculators provide directionally accurate insights based on your input data, making them valuable for scenario planning, sensitivity analysis, and understanding key relationships between business variables. While they shouldn’t replace comprehensive financial modeling for major decisions, they offer immediate clarity on financial relationships that guide better day-to-day decision-making and highlight areas warranting deeper analysis.

Q: How should I integrate these calculators into my financial planning process? A: Use these calculators iteratively throughout your planning process – first with rough estimates to understand general relationships, then with increasingly precise inputs as data becomes available. The most value comes from comparing different scenarios and understanding sensitivity to key variables, rather than producing a single output number, as this approach builds intuition about financial relationships specific to your business model and circumstances.