Empowering Businesses in Washington: The Strategic Benefits of Fractional CFOs

in CFO, Fractional CFO, Fractional CFO in Washington, reporting and business intelligence, All Posts

The Evolving Business Landscape in Washington

Washington’s economy is a dynamic mix of innovation and industry, spanning from Seattle’s tech powerhouses to Spokane’s aerospace sector and the Tri-Cities’ clean energy initiatives. This diverse ecosystem offers immense growth potential, but it also brings financial complexities that businesses must navigate. As companies strive to scale efficiently, fractional CFO services have emerged as a strategic asset, offering expert financial leadership without the commitment of a full-time executive.

Navigating Washington’s Competitive Business Environment

The state of Washington is a hub for industries such as cloud computing, biotechnology, e-commerce, and renewable energy. Businesses operating in these high-growth sectors face unique challenges, including regulatory compliance, international trade considerations, and rapid financial scaling. Fractional CFOs bring specialized expertise to help companies optimize cash flow, streamline financial operations, and strategically plan for future expansion.

Case Study: Scaling a Washington-Based Tech Firm

A Seattle-based enterprise software company generating $60 million in annual revenue encountered difficulties while expanding into international markets and preparing for Series C funding. By leveraging a fractional CFO’s expertise, the company was able to implement advanced revenue recognition strategies, enhance reporting and business intelligence, and improve foreign exchange (FX) risk management. Within nine months, the firm successfully secured $80 million in funding, optimized its global operations, and positioned itself for further product development and market expansion.

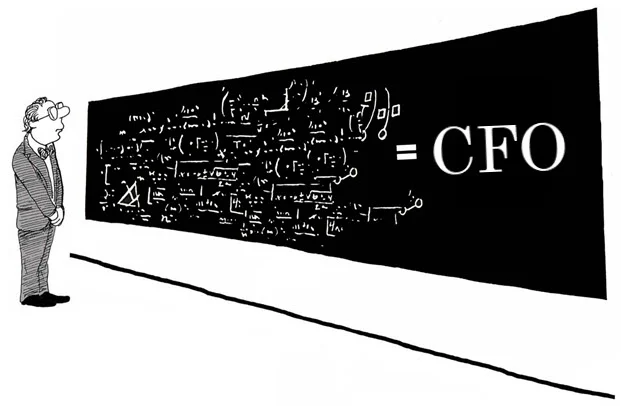

The Strategic Advantages of Hiring a Fractional CFO

For businesses in Washington, financial leadership plays a critical role in navigating challenges such as tax regulations, funding rounds, and global expansion. A fractional CFO provides strategic insights and financial oversight, helping companies:

- Manage Complex Tax Structures: Washington’s Business & Occupation (B&O) tax, R&D incentives, and sales tax requirements can be difficult to navigate. A fractional CFO ensures compliance while maximizing available tax benefits.

- Enhance Cash Flow Management: Effective budgeting and financial forecasting are essential for businesses looking to scale sustainably. A fractional CFO provides detailed financial planning to optimize cash flow and resource allocation.

- Support Fundraising and Investment Strategies: Whether securing venture capital, preparing for mergers, or optimizing investor relations, fractional CFOs help businesses position themselves for successful fundraising and strategic partnerships.

- Facilitate International Growth: With Washington’s strong connections to Pacific Rim markets, businesses often expand internationally. Fractional CFOs provide expertise in global tax compliance, FX risk management, and cross-border financial structuring.

The Growing Demand for Fractional CFO Services in Washington

As Washington continues to lead in technology, aerospace, and clean energy, the demand for sophisticated financial leadership will only increase. Fractional CFOs offer a cost-effective way for businesses to access top-tier financial expertise without the overhead of a full-time CFO. From startups to mid-sized enterprises, companies that leverage fractional CFO services gain a competitive edge by aligning their financial strategies with their long-term growth goals.

Conclusion: A Smart Investment for Sustainable Growth

For businesses operating in Washington’s fast-paced and competitive environment, having access to strategic financial leadership is crucial. Fractional CFOs provide the expertise needed to navigate financial complexities, optimize operations, and position businesses for long-term success. By leveraging fractional CFO services, companies can scale more effectively, maximize profitability, and remain agile in an ever-evolving market.

Frequently Asked Questions

How do technology companies in Washington benefit from fractional CFO services?

Technology companies require financial leadership to manage rapid growth, international expansion, and evolving tax regulations. A fractional CFO helps streamline financial operations, optimize revenue models, and ensure compliance with industry-specific tax laws.

What makes Washington’s business environment ideal for fractional CFOs?

Washington’s unique combination of global tech influence, international trade, and complex tax structures creates an ideal landscape for fractional CFO services. Companies benefit from expert financial guidance to navigate these challenges effectively.

How do fractional CFOs support businesses in Washington’s diverse economy?

Fractional CFOs assist with financial forecasting, tax optimization, funding strategies, and international expansion. Their strategic insights help businesses scale efficiently while remaining compliant with state and federal regulations.