Q of E: A Strategic Approach for Maximum Transaction Value in Quality of Earnings

in Finance, Fractional CFO Services, Q of E, Quality of Earnings Analysis, All Posts

Quality of Earnings is a frequent conversation with clients. Many people don’t understand the implications of a good or bad Q of E, and those seeking private equity investment frequently fall into a trap of the big 4 accounting firms where a Q of E cost has so much overhead cost packed into the project budget that it’s almost impossible to justify the value. In its clearest form, the Q of E provides the buyer and seller with a detailed earnings report that helps in understanding the true operational value of the business with all extraneous events and noise taken out of the valuation of earnings. I’d like to shed light on how to make the most of this process if your business is contemplating or needing a Q of E.

Understanding Quality of Earnings: Beyond Standard Financial Statements

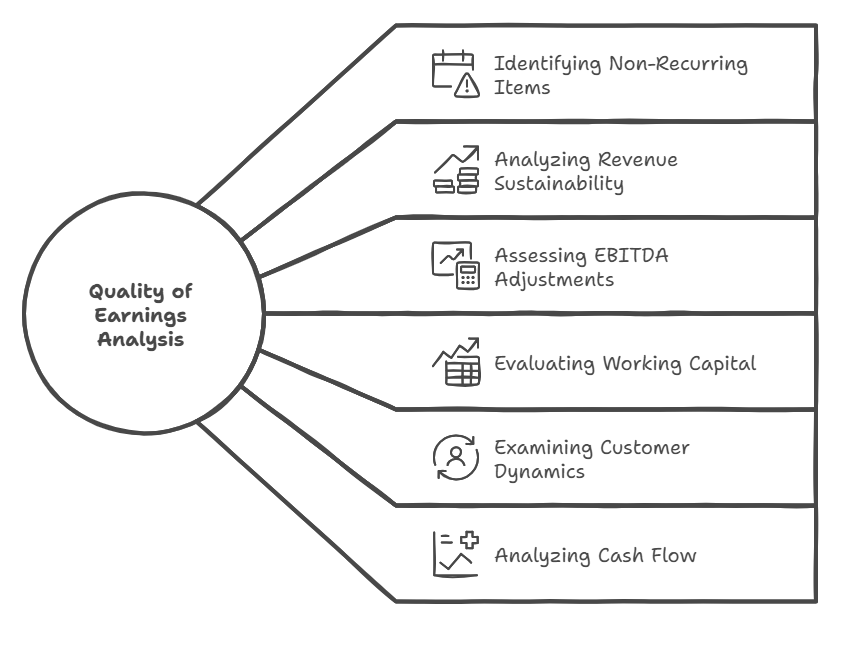

At its core, a Quality of Earnings (Q of E) analysis examines the sustainability and accuracy of a company’s reported earnings. Unlike standard financial statements that follow GAAP guidelines, a Q of E digs deeper to reveal the true economic reality of a business. This includes:

- Identifying non-recurring revenue or expenses

- Analyzing the sustainability of revenue streams

- Assessing the accuracy of reported EBITDA adjustments

- Evaluating working capital requirements

- Examining customer concentration and retention

- Analyzing cash flow to determine the financial health of the business

Through this process, a Q of E provides a clearer picture of normalized earnings—what the business genuinely generates from its core operations on a consistent basis. This normalized figure becomes the foundation for valuation discussions and transaction negotiations.

Mergers and Acquisitions Overview

Mergers and acquisitions (M&A) are strategic transactions that involve the combination of two or more companies to achieve specific business objectives. These transactions can take various forms, including mergers, acquisitions, consolidations, and joint ventures. The goal of M&A is to create a more competitive, efficient, and profitable entity by leveraging the strengths of the companies involved.

In a merger, two companies combine to form a new, separate legal entity, while an acquisition involves one company purchasing another, with the acquired company becoming part of the acquiring company. Consolidations merge multiple companies into a new entity, and joint ventures involve two or more companies collaborating on a specific project while remaining independent.

M&A transactions are driven by various strategic goals, such as expanding market share, acquiring new technologies or intellectual property, achieving economies of scale, or diversifying product lines. The success of these transactions often hinges on thorough due diligence, including a comprehensive Quality of Earnings analysis, to ensure that the financial health and operational realities of the target company are accurately understood.

By understanding the intricacies of M&A and the importance of a robust Q of E analysis, companies can better navigate these complex transactions and achieve their strategic objectives.

The Seller’s Perspective: Why Pre-Transaction Q of E is a Game-Changer for the Target Company

For sellers contemplating a business exit, conducting a Q of E before going to market has emerged as a strategic best practice. A pre-transaction Q of E is a crucial part of the diligence process, helping sellers identify and address potential issues early. Based on my experience guiding companies through successful exits, here’s why this approach delivers substantial value:

1. Taking Control of the Narrative

When sellers wait for buyers to conduct the Q of E, they cede control of the financial narrative. By investing in a pre-transaction Q of E, sellers can:

- Identify and address potential issues before they become deal obstacles

- Develop sound explanations for any anomalies or adjustments

- Present a clean, transparent financial picture from the outset, positively influencing the target company’s stakeholders

- Set realistic valuation expectations based on normalized earnings

This proactive approach allows sellers to frame the conversation rather than reacting defensively to buyer findings.

2. Accelerating the Transaction Timeline

One of the most common reasons deals stall or collapse is unexpected financial discoveries during due diligence. A pre-transaction Q of E can:

- Reduce the time spent in the due diligence process by addressing issues upfront

- Minimize back-and-forth negotiations about financial adjustments

- Create a smoother, more predictable transaction process

- Maintain momentum toward closing

In competitive sale processes, this efficiency can make the difference between closing successfully and losing momentum.

3. Maximizing Business Valuation and Terms

Perhaps most importantly, a pre-transaction Q of E often leads to more favorable deal terms. By understanding exactly what a buyer’s Q of E will likely uncover, sellers can present the acquired firm in the best possible light and:

- Support higher valuation multiples with clean, verified financial data

- Reduce the likelihood of purchase price adjustments

- Minimize escrow amounts and earn-out requirements

- Strengthen negotiating positions on key deal terms

The investment in a pre-transaction Q of E typically represents a tiny fraction of the overall transaction value—often less than 0.5%—yet can influence valuation by 10-30% or more.

The Buyer’s Perspective: Building Confidence and Reducing Risk through the Due Diligence Process

From the buyer’s side, a Q of E serves as a critical risk management tool. Buyers use this analysis to:

- Verify the accuracy of financial information provided by sellers

- Identify potential risks or areas of concern

- Understand working capital needs post-transaction

- Support financing applications with credible financial data

- Develop integration plans based on operational realities

When sellers provide a comprehensive pre-transaction Q of E, sophisticated buyers recognize this as a sign of transparency and preparedness. This often leads to more competitive bidding and simplified due diligence, as buyers gain confidence in the quality of financial information.

The Cost-Benefit Analysis: Why Q of E Investment Makes Financial Sense for Private Equity

Many business owners balk at the cost of a Q of E, particularly when quoted by large accounting firms. However, this perspective fails to consider both the true cost options and the potential return on investment, especially when considering options like debt financing for funding transactions.

Cost Considerations

While Big 4 firms may charge $150,000-$250,000+ for a comprehensive Q of E, specialized firms and experienced fractional CFOs can often deliver comparable quality at a fraction of the cost—typically $50,000-$100,000 depending on complexity.

More importantly, this cost pales in comparison to:

- The potential loss of transaction value from unaddressed financial issues

- The cost of a failed transaction process (often $500,000+ in professional fees)

- The opportunity cost of management distraction during extended due diligence

- The emotional toll of deal fatigue and uncertainty

The Real ROI

Consider a business with $5 million in EBITDA seeking a sale at a 6x multiple. A comprehensive pre-transaction Q of E might identify sustainable earnings improvements or defensible add-backs of $500,000. This single finding could increase the transaction value by $3 million (6 × $500,000)—delivering a 30-60x return on the Q of E investment.

Even more significantly, a pre-transaction Q of E dramatically reduces the risk of deal collapse. With approximately 70% of LOIs failing to result in closed transactions—often due to financial surprises—the Q of E serves as insurance against wasted time and resources.

The Foundation for Success: Leveraging Fractional CFO Expertise

While a Q of E provides tremendous value, businesses can realize even greater benefits by engaging fractional CFO services before contemplating a transaction. A strategic fractional CFO can help identify and integrate innovative business models to enhance the company’s market presence. A strategic fractional CFO can:

1. Build Transaction-Ready Financial Infrastructure

Sophisticated buyers expect more than just accurate financial statements. They seek businesses with robust financial reporting systems, making them attractive target companies. These businesses should have:

- Clear KPI tracking and operational metrics

- Forward-looking financial models

- Documented financial policies and controls

A fractional CFO can implement these systems at a fraction of the cost of a full-time executive, creating the foundation for a successful transaction well before a formal sale process begins.

2. Identify and Implement Value Enhancement Opportunities

Beyond preparing for due diligence, a fractional CFO can help identify and execute strategic improvements that directly impact valuation, such as:

- Working capital optimization

- Customer profitability analysis

- Pricing strategy refinement

- Cost structure improvements

- Revenue diversification initiatives

These operational enhancements often deliver immediate benefits while simultaneously increasing the business’s attractiveness to potential buyers.

3. Provide Transaction Experience and Perspective

Many business owners undertake only one major transaction in their career. In contrast, experienced fractional CFOs bring insights from multiple transactions across various industries. This perspective proves invaluable for:

- Setting realistic valuation expectations

- Preparing for buyer questions and concerns

- Navigating complex transaction structures, including hostile takeovers

- Managing the overall transaction process

By engaging this expertise early, business owners can avoid common pitfalls and position themselves for maximum transaction success.

Conclusion: A Strategic Investment in Transaction Success

A Quality of Earnings analysis represents far more than a compliance exercise—it’s a strategic tool that can significantly impact transaction outcomes. By approaching this process proactively through a pre-transaction Q of E, sellers can take control of their financial narrative, maximize valuation, and dramatically improve the likelihood of transaction success. A comprehensive Q of E benefits both the acquiring firm and the seller by providing a clear financial picture.

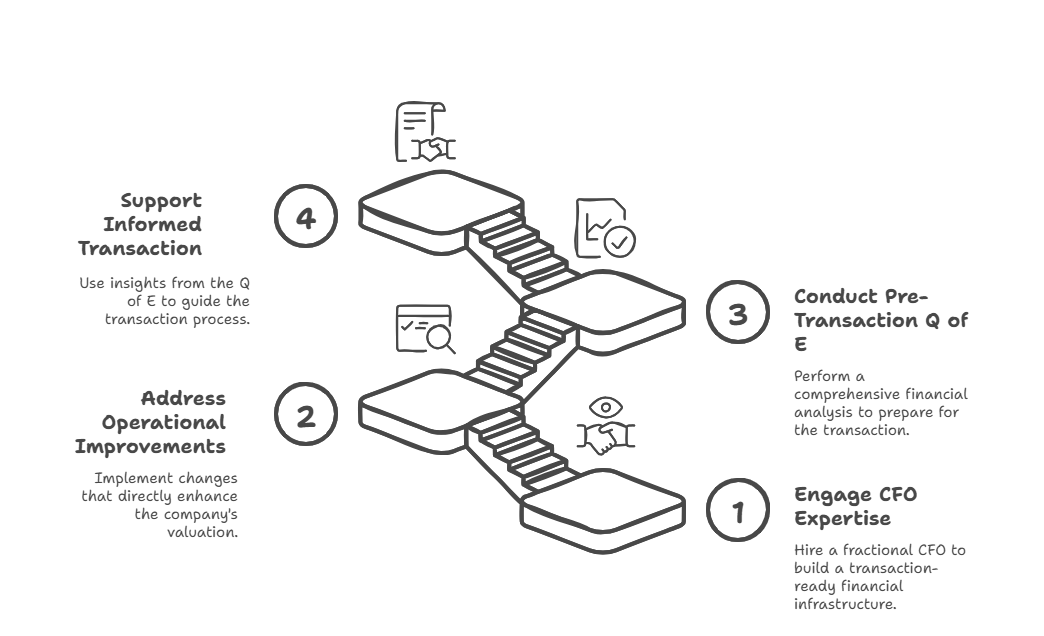

For business owners contemplating a transaction within the next 1-3 years, the path to optimal outcomes is clear:

- Engage fractional CFO expertise to build transaction-ready financial infrastructure

- Address operational improvements that directly impact valuation

- Conduct a comprehensive pre-transaction Q of E before going to market

- Use these insights to support a well-informed transaction process

This strategic approach not only maximizes financial outcomes but also reduces the stress and uncertainty that often accompany major business transitions.

The question isn’t whether you can afford to invest in quality financial leadership and a pre-transaction Q of E—it’s whether you can afford not to.

Frequently Asked Questions

How far in advance of a transaction should we conduct a Q of E?

Ideally, a pre-transaction Q of E should be conducted 3-6 months before going to market, allowing sufficient time to address any identified issues while ensuring the information remains current throughout the transaction process.

Can we use our existing accounting firm for the Q of E?

While your existing firm may have valuable knowledge of your business, most sophisticated buyers prefer an independent analysis to ensure an unbiased evaluation of the target company’s financial health. Additionally, your current firm may lack the specialized transaction expertise needed for a comprehensive Q of E.

What’s the typical scope and timeline for a Q of E engagement?

A comprehensive Q of E typically analyzes 2-3 years of financial data and requires 4-8 weeks to complete, depending on the complexity of the business and the quality of available financial information.

…

Salvatore Tirabassi is the Managing Director at CFO Pro+Analytics, with over 24 years of experience in venture capital, private equity, and executive financial leadership. He has raised over $400 million in capital throughout his career and helped dozens of companies optimize their financial strategy for growth and value creation.

For a FREE 20-minute consultancy session CLICK HERE!