Fractional vs Interim CFO: Understanding the Continuum of Strategic Finance Leadership

in CFO, Finance, Fractional CFO, Uncategorized, #FractionalCFO, Accounting and Finance, CFO, CFO Services, Choose CFO, Financial Leadership, Fractional CFO, Fractional CFO Services, Functions of a CFO, outsourced cfo, Outsourced CFO services, part-time CFO, Roles of a Fractional CFO, All Posts

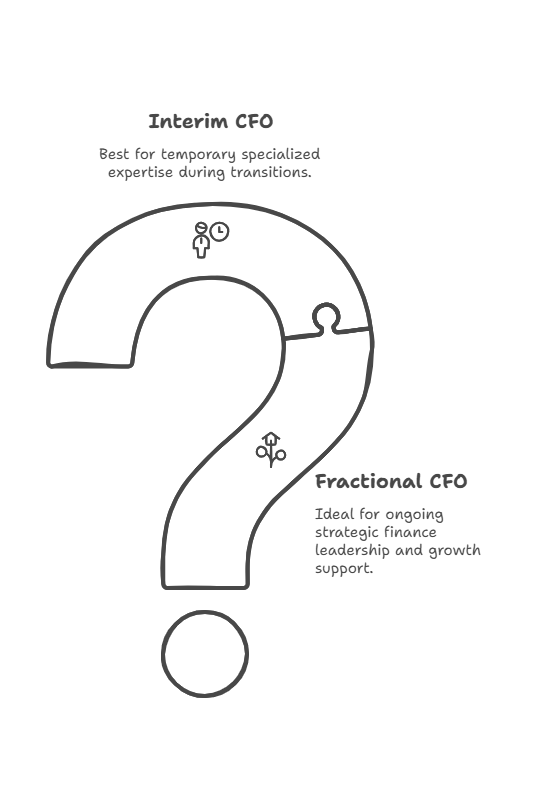

As a provider of strategic CFO services, I am often asked what the difference is between a fractional CFO and an interim CFO. This is a classic “CFO vs” scenario, where understanding the comparison between these financial leadership roles is crucial. Our firm mainly focuses on fractional work, but we have worked on interim projects as well. At a high level, the main difference is that fractional is permanent part-time and interim is temporary part-time. But the use case and the buyer of the service is different and I am going to discuss a continuum of use cases and the key differences where the buyers are;

- Founder/family-owned businesses,

- Venture capital-backed companies,

- Lower middle market companies looking to engage or having engaged an investment bank for a sale process, and

- Lower middle market companies recently acquired by private equity.

The first two are more suited to fractional CFO work and the latter two are more suited to interim CFO work. Let’s dive in.

TL;DR

Fractional CFOs provide ongoing part-time strategic finance leadership as an alternative to full time cfos for founder-led and VC-backed companies seeking permanent growth support, while interim CFOs offer temporary specialized expertise during transition periods for companies in sale processes or post-acquisition integration when a permanent cfo is not in place. The key is matching the type of financial leader to your company’s stage, ownership structure, and specific business objectives.

Understanding the Fundamental Differences

Before exploring the continuum of use cases, it’s essential to understand the core distinctions between fractional and interim CFO services. A fractional CFO becomes an integral part of your executive team, working consistently over months or years to build systems, develop strategy, and guide financial decision-making. They invest time in understanding your business culture, long-term objectives, and the nuances of your industry. While a fractional CFO is involved in the company’s operations, their level of involvement may be more limited compared to a full-time CFO, which can affect their understanding of internal challenges and strategic alignment. This relationship is characterized by continuity and deep institutional knowledge. Fractional CFOs typically support your business on an ongoing basis, ensuring regular oversight and guidance. However, their limited availability compared to a full-time CFO can sometimes restrict their accessibility during urgent or high-demand periods.

An interim CFO, conversely, serves as a specialized problem-solver brought in for specific situations with defined endpoints. They arrive with extensive experience handling similar challenges across multiple organizations and can quickly assess situations, implement solutions, and transfer knowledge before transitioning out. Their value lies in their ability to impact the company’s financial stability and operations by hitting the ground running and delivering results within compressed timeframes.

The Full-Time CFO Alternative: Why Companies Choose Flexible Finance Leadership

In today’s fast-paced business environment, many companies are rethinking the traditional approach of hiring a full time CFO. Instead, they are turning to flexible finance leadership solutions—namely, interim CFOs and fractional CFOs—to access strategic financial guidance without the long-term commitment and overhead of a full time executive. This shift is especially appealing for businesses experiencing rapid change, growth, or periods of transition, where agility and cost effectiveness are paramount.

Interim CFOs and fractional CFOs offer distinct advantages over full time CFOs. They bring high level financial expertise to the table, often gained from working with multiple clients and across various industries. This breadth of experience allows them to quickly identify best practices and implement solutions tailored to a company’s unique needs. For many businesses, the ability to scale financial leadership up or down—engaging a time CFO for a specific project or a fractional CFO for ongoing support—means they can align financial resources with their current stage and objectives.

Cost effectiveness is another major driver. Without the salary, benefits, and long-term commitment required for a full time CFO, companies can invest in the financial expertise they need, when they need it. This flexibility is particularly valuable for startups, growing businesses, and companies navigating complex financial challenges. By choosing interim CFOs or fractional CFOs, organizations gain access to strategic financial guidance and leadership that supports growth, innovation, and long-term success—without the constraints of a permanent, full time hire.

The Fractional CFO Sweet Spot: Founder-Led and Family-Owned Businesses

Founder-led and family-owned businesses represent the ideal client profile for fractional CFO services. These organizations typically operate with lean management structures where the founder or family members wear multiple hats, including financial oversight. As these businesses scale beyond the founder’s ability to manage all aspects personally, they need professional financial leadership but cannot justify the cost of a full-time CFO. Financial clarity is essential for supporting the business’s growth and ensuring long-term stability. A strong foundation in accounting knowledge and understanding of financial terminology are crucial tools for supporting a business’s growth, as they enable better decision-making and long-term development.

The fractional CFO model provides these businesses with access to senior-level financial expertise at a fraction of the cost of a full-time hire. A smaller company, in particular, benefits from this arrangement, as it allows them to gain strategic guidance without the expense of a full-time executive. More importantly, the fractional CFO can grow with the business, scaling their involvement as the company expands. They become intimately familiar with the business model, seasonal patterns, customer base, and competitive landscape – knowledge that proves invaluable when making strategic decisions.

These engagements often start with fundamental financial infrastructure needs: implementing adequate accounting systems, establishing budgeting processes, and creating insightful financial reporting. As time goes on, the fractional CFO’s role expands to encompass strategic planning, cash flow management, banking relationships, and preparing the business for potential investment or acquisition opportunities.

The relationship dynamic is particularly important in founder-led businesses. Founders often have strong emotional connections to their ventures and may resist outside input. A fractional CFO who builds trust over time can become a valued advisor, helping the founder make objective decisions based on financial data rather than intuition alone. Finance experts bring an outside perspective and specialized knowledge, providing clarity and confidence in navigating complex financial matters.

Venture Capital Backed Companies: Scaling with Professional Finance Leadership

Venture capital backed companies present another compelling use case for fractional CFO services, though for different reasons than founder-led businesses. In the early stage, when these companies are just beginning and may not require or afford a full-time CFO, fractional CFO services provide a practical solution. These companies typically have access to capital but face intense pressure to demonstrate growth and achieve specific milestones within defined timeframes. They need sophisticated financial planning, reporting, and analysis capabilities to satisfy investor requirements and support rapid scaling.

VC-backed companies often exist in a state of controlled chaos, with priorities shifting rapidly based on market conditions, investor feedback, and growth opportunities. A fractional CFO provides stability and financial discipline during these dynamic periods. A part time cfo arrangement offers the flexibility for companies to access strategic financial leadership without the commitment of a full-time hire.

The fractional CFO’s role in VC-backed companies extends beyond traditional financial management to include investor relations support, board reporting, fundraising preparation, and strategic financial modeling. They help management teams translate operational metrics into financial projections that resonate with investors and support funding requests.

Additionally, fractional CFOs bring valuable experience from working with multiple VC-backed companies, providing insights into best practices, common pitfalls, and successful scaling strategies. This cross-pollination of knowledge proves invaluable for companies navigating their first or second funding rounds.

The timing flexibility of fractional CFO services aligns well with the episodic nature of VC funding cycles. Companies can choose from different time cfos arrangements, such as fractional or part-time, to match their evolving needs. Companies can increase the fractional CFO’s involvement during fundraising periods or board meetings, then scale back during quieter operational periods, optimizing their investment in financial leadership.

The Investment Banking Continuum: Preparation vs. Execution

Lower middle market companies engaging with investment banks present two distinct scenarios that require different CFO service approaches, depending on their timeline and readiness for a transaction. These businesses are typically founder-led or family-owned enterprises that have achieved significant scale but lack the sophisticated financial infrastructure necessary to maximize valuation in a sale process. During critical changes or growth phases, a company’s specific needs often require tailored financial guidance from a CFO to address challenges such as restructuring, IPOs, or mergers. However, it is important to consider the potential limitations of the fractional CFO model, such as reduced availability and involvement during critical periods due to the part-time nature of the role.

The fractional CFO’s role in this preparation phase focuses on building the financial foundation that will support an eventual transaction. A month to month arrangement offers flexibility, allowing companies to adjust the engagement as their needs evolve without committing to a long-term contract.

This relationship-based advisory role requires continuity and trust that develops over months and years of working together. Fractional CFOs often serve multiple businesses, bringing a breadth of experience and best practices from various industries to each client.

Fractional CFO for Sale Preparation: The Long-Term Strategy

Companies beginning to consider a sale process in the next 18 months to three years represent an excellent fractional CFO opportunity. These businesses are typically founder-led or family-owned enterprises that have achieved significant scale but lack the sophisticated financial infrastructure necessary to maximize valuation in a sale process.

The fractional CFO’s role in this preparation phase focuses on building the financial foundation that will support an eventual transaction. This includes implementing robust financial reporting systems, establishing proper internal controls, creating meaningful KPI dashboards, and developing the historical financial narratives that buyers find compelling. The fractional CFO works systematically to address potential due diligence issues before they become problems, such as cleaning up revenue recognition practices, documenting expense policies, or establishing consistent accounting treatments.

This preparation phase requires deep business understanding and long-term relationship building – hallmarks of the fractional CFO model. The fractional CFO becomes intimately familiar with the business operations, seasonal patterns, customer relationships, and competitive dynamics that will ultimately drive valuation. They help management teams understand which metrics matter most to buyers and work systematically to improve those metrics over time. After the initial setup and onboarding, the ongoing engagement often requires fewer hours to maintain the relationship and continue supporting the client’s needs efficiently.

The fractional CFO also serves as an educator during this phase, helping founders understand the sale process, prepare for the emotional challenges of selling their business, and make strategic decisions that enhance value rather than simply optimize short-term cash flow. This relationship-based advisory role requires continuity and trust that develops over months and years of working together.

Interim CFO for Deal Execution: Getting It Done

Once a company has formally engaged an investment bank and launched a sale process, the needs shift dramatically toward interim CFO services. The deal execution phase creates intense time pressure, requires specialized transactional expertise, and demands someone who can hit the ground running without a learning curve.

During active deal execution, companies face scrutiny from potential buyers conducting thorough financial due diligence. The process requires specialized expertise in areas like quality of earnings analysis, normalized EBITDA calculations, working capital adjustments, and management representation preparation. An interim CFO brings specific transactional experience that most internal finance teams lack, understanding exactly what buyers look for and how to present financial information persuasively.

The interim CFO’s value during deal execution lies in their ability to address due diligence inquiries effectively and efficiently. They’ve seen hundreds of buyer questions across multiple transactions and can anticipate issues before they arise. Their involvement often makes the difference between a successful sale at optimal valuation and a failed process or suboptimal outcome.

The temporary nature of interim CFO services aligns perfectly with the defined timeline of an active sale process. Companies need intensive support for six to twelve months, after which the CFO role either transitions to the acquiring company or requires a different skill set for the new ownership structure. Interim CFOs also provide valuable objectivity during emotionally charged sale processes, presenting financial information without the emotional attachment that long-term employees might have. This external perspective helps reduce internal biases and supports clear, unbiased decision-making during critical moments. Unlike part time engagements, interim CFOs are fully dedicated to the process, ensuring consistent leadership and eliminating the drawbacks of split attention or limited availability.

Accounting Systems and Management: Building a Scalable Finance Backbone

A robust accounting system is the cornerstone of any successful business, serving as the scalable finance backbone that supports both day-to-day operations and long-term strategic planning. Effective accounting systems and management practices enable companies to streamline financial operations, enhance financial reporting, and improve cash flow management—all of which are critical for sustainable growth.

By investing in modern accounting systems, businesses can automate routine processes, reduce errors, and ensure compliance with regulatory requirements. This not only minimizes financial risks but also provides stakeholders with accurate, timely financial information for better decision-making. As companies grow, scalable accounting systems allow them to adapt quickly to new business needs, integrate with other financial tools, and support more complex financial strategy development.

Strong accounting management also lays the groundwork for effective strategic planning. With reliable data and transparent financial reporting, leadership teams can confidently assess performance, allocate resources, and pursue new opportunities. Ultimately, a well-designed accounting system empowers businesses to manage cash flow, optimize financial operations, and build a foundation for long-term success.

Cash Flow Management: Safeguarding Liquidity and Growth

Cash flow management is a critical pillar of financial health for any company, directly influencing both day-to-day operations and long-term growth potential. Effective cash flow management ensures that a business has the liquidity needed to meet its obligations, invest in new opportunities, and weather unexpected challenges.

Interim CFOs and fractional CFOs play a vital role in helping businesses master cash flow management. Drawing on their experience across multiple companies and industries, these finance experts can analyze cash flow patterns, identify bottlenecks, and implement strategies to optimize both inflows and outflows. This might include improving receivables collection, renegotiating payment terms, or streamlining expense management.

By safeguarding liquidity, companies can maintain financial stability and avoid the pitfalls of cash shortages, which can disrupt operations or stall growth initiatives. Proactive cash flow management also positions businesses to seize new opportunities, invest in innovation, and drive long term success. Whether through interim CFO leadership during a transition or ongoing support from a fractional CFO, expert guidance in cash flow management is essential for companies aiming to thrive in today’s competitive landscape.

Financial Planning and Analysis: Driving Strategic Decision-Making

Financial planning and analysis (FP&A) is at the heart of strategic decision-making for modern businesses. This function goes beyond basic budgeting, encompassing the analysis of financial data, identification of trends, and development of forecasts that inform every aspect of business planning.

Interim CFOs and fractional CFOs bring high level financial expertise to the FP&A process, helping companies develop comprehensive financial plans that align with their goals. They work closely with leadership to analyze financial performance, model different scenarios, and identify opportunities for growth and improvement. This strategic approach enables businesses to make informed decisions, allocate resources effectively, and respond proactively to changing market conditions.

By leveraging advanced FP&A, companies can optimize financial performance, mitigate risks, and capitalize on new opportunities. The insights gained from robust financial planning and analysis empower businesses to drive long-term success and sustainability, ensuring that every decision is backed by data and aligned with the company’s overall financial strategy. Whether through interim CFO support during periods of change or ongoing guidance from a fractional CFO, expert FP&A is a key driver of business growth and resilience.

Post-Acquisition Integration: Specialized Interim Leadership

Companies recently acquired by private equity firms face unique challenges that make interim CFO services particularly valuable. These organizations must rapidly implement new reporting systems, integrate with portfolio company standards, and often pursue aggressive growth or operational improvement initiatives. These changes are critical for assessing and improving the company’s financial health, ensuring stability and readiness for future growth. Interim CFOs play a key role in evaluating the company’s financial health during post-acquisition integration, identifying areas for restructuring, cost reduction, and maintaining stability in periods of financial transition.

Private equity buyers typically have specific expectations for financial reporting, management systems, and performance metrics. Many PE firms maintain a network of qualified professionals and set high standards for financial leadership, making it essential to engage interim CFOs who meet these requirements. An interim CFO with PE experience understands these requirements and can quickly implement necessary changes without the learning curve that internal candidates might face. Their strategic leadership is essential for guiding the organization through complex transitions and aligning financial operations with investor goals.

The post-acquisition period often involves significant organizational change, including potential management turnover, system implementations, and operational restructuring. An interim CFO provides stability during this transition while helping identify and develop internal candidates for permanent roles.

Private equity ownership also brings unique opportunities for add-on acquisitions, refinancing, or operational improvements that require specialized financial expertise. Interim CFOs often have experience managing these initiatives across multiple portfolio companies, bringing valuable best practices and execution capabilities. These efforts are designed to drive long term success by building a foundation for sustainable growth and financial stability.

Cost Structure and Pricing: What to Expect and How to Budget

When evaluating whether to bring on a chief financial officer—either as an interim CFO or a fractional CFO—understanding the cost structure and pricing models is essential for effective financial planning. The investment in high-level financial expertise can vary significantly based on your company’s size, the complexity of your financial operations, and the specific challenges you’re facing.

Interim CFOs typically operate on a full-time, short-term basis and command a monthly fee that reflects their deep integration and immediate impact. For most businesses, interim CFOs charge between $20,000 and $50,000 per month, depending on the scope of work and the specialized expertise required. This pricing model is especially common among companies in transition—such as those undergoing mergers, acquisitions, or rapid growth—where full time financial leadership is needed without the long-term commitment of a permanent hire. For private equity firms and their portfolio companies, interim CFOs offer the ability to stabilize financial operations and address complex financial challenges quickly, making them a strategic investment during critical periods.

Fractional CFOs, on the other hand, provide ongoing, part-time strategic financial guidance and typically bill by the hour or on a retainer basis. Hourly rates for fractional CFO services generally range from $100 to $250, depending on the individual’s experience and the level of financial complexity involved. This model is ideal for companies that require high level financial expertise but do not need—or cannot justify—the cost of a full time CFO. Fractional CFOs often work with multiple clients, allowing businesses to access the same services and strategic value as a full time executive, but at a fraction of the cost.

When budgeting for CFO services, companies should take a structured approach:

- Assess Your Needs: Evaluate your company’s financial complexity and determine whether you need full time financial leadership or part time, ongoing support. Consider whether your business is facing a specific transition or requires long-term strategic planning.

- Estimate Engagement Scope: Project the number of hours per month (for fractional CFOs) or the number of months (for interim CFOs) required to achieve your objectives.

- Research Pricing Models: Compare the cost effectiveness of different pricing models—hourly, monthly, or retainer—and consider which aligns best with your company’s operations and budget.

- Account for Additional Expenses: Factor in costs such as travel, accounting systems upgrades, and financial software, which may be necessary to support the CFO’s work.

- Build a Realistic Budget: Combine all anticipated costs to create a comprehensive budget that supports your company’s financial health and growth objectives.

For many businesses, especially small businesses or those in the early stages, fractional CFO services offer distinct advantages in terms of cost structure and flexibility. The part time nature of these engagements allows companies to access specialized expertise and strategic financial guidance without the overhead of a full time hire. For companies experiencing rapid growth, significant change, or preparing for a transaction, interim CFOs provide the full time support and leadership needed to navigate complex financial concepts and stabilize operations.

Private equity firms and their portfolio companies often leverage both interim and fractional CFOs to drive sustainable success, depending on the stage of investment and the specific financial challenges at hand. By understanding the differences between interim and fractional CFO pricing models, companies can make informed decisions that align with their strategic initiatives and long-term goals.

Ultimately, the key to maximizing value is to prioritize the right level of financial leadership for your business’s growth stage and complexity. Whether you choose a fractional CFO for ongoing strategic planning or an interim CFO for a defined transition period, investing in experienced professionals will help ensure your company’s financial systems, reporting, and strategy are built for sustainable success.

The Decision Framework: Choosing Between Fractional and Interim

The choice between fractional and interim CFO services ultimately depends on your company’s specific situation, timeline, and objectives. Unlike a fractional or interim CFO, an in-house CFO is a permanent member of your executive team, providing comprehensive, ongoing financial management. Typically, an in-house CFO is a full-time employee, dedicated solely to your organization’s financial leadership. Companies seeking long-term strategic financial leadership with relationship continuity should consider fractional CFO services. Those facing specific transitional challenges with defined endpoints are better served by interim CFO expertise.

Consider fractional CFO services if you need ongoing financial leadership, want to build institutional knowledge within your organization, face budget constraints that preclude full-time hires, or operate in dynamic environments requiring flexible resource allocation. The fractional model works best when you can benefit from relationship continuity and when the CFO can grow with your business over time.

Choose interim CFO services when facing specific transitional challenges, requiring specialized expertise for defined projects, needing objectivity during organizational change, or operating under time constraints that demand immediate results. The interim model excels when you need proven experience handling similar situations quickly and effectively. This is distinct from a traditional CFO, who serves as a long-term, in-house executive responsible for the company’s overall financial leadership.

Maximizing Value from Your CFO Service Investment

Regardless of which model you choose, success depends on clear communication, defined expectations, and proper integration with your existing team. Establish specific objectives, timelines, and success metrics at the engagement’s outset. Ensure your chosen CFO has relevant industry experience and a track record of success in similar situations.

For fractional CFO engagements, focus on building strong working relationships and establishing clear communication protocols. Invest time in helping your fractional CFO understand your business culture, competitive environment, and long-term objectives. The more they understand your business, the more valuable their contributions become.

For interim CFO engagements, prioritize knowledge transfer and documentation to ensure continuity after the engagement ends. Work with your interim CFO to develop internal capabilities and identify potential permanent candidates who can build on their foundation.

The strategic CFO services market continues evolving as companies recognize the value of flexible financial leadership. Businesses today, regardless of size, now have access to these high-level financial services, making it easier to adapt to changing economic conditions. Whether you choose fractional or interim services, the key is matching your specific needs with the appropriate service model and finding an experienced professional who can deliver results within your timeline and budget constraints.

Frequently Asked Questions

Q: How long do typical fractional and interim CFO engagements last?

Fractional CFO engagements are designed for the long term, typically lasting 1-3 years or more, with the relationship evolving as the company grows. The fractional CFO becomes part of the permanent management team structure. Interim CFO engagements are project-based and usually last 6-18 months, depending on the specific situation – such as completing a sale process, post-acquisition integration, or bridging to a permanent hire.

Q: What are the typical cost differences between fractional and interim CFO services?

Interim CFO services typically command higher hourly or daily rates due to their specialized expertise and the intensive, time-sensitive nature of their work. However, because interim engagements are shorter in duration, the total cost may be lower than a long-term fractional arrangement. Fractional CFO services offer more predictable monthly costs that can scale with your business needs, making them more budget-friendly for ongoing strategic financial leadership.

Q: Can a company transition from fractional to interim CFO services or vice versa?

Yes, companies can transition between service types as their needs evolve. A fractional CFO might transition to an interim role during a specific project like a sale process, then return to fractional status afterward. Alternatively, a company might start with interim CFO services during a transition period, then move to a fractional arrangement for ongoing strategic support. The key is working with a CFO services provider who can adapt their service model to match your changing business requirements.

…

As a fractional CFO with expertise in technology and AI, I help financial organizations implement predictive forecasting strategies that are practical, scalable, and aligned with their business goals.

Salvatore Tirabassi is the Managing Director at CFOPro+Analytics. With over 24 years of experience in venture capital, private equity, and executive financial leadership, he has raised more than $400 million in capital and guided dozens of companies in optimizing their financial strategies to drive growth and create long-term value.