Strategic Capital Raising: Balancing Runway and Dilution for Maximum Value Creation

in Finance, Fractional CFO, Balancing Runway and Dilution, CFOPro+Analytics, Strategic Fundraising Process, All Posts

After two decades in venture capital and having raised over $400 million throughout my career, I’ve seen firsthand how capital raising strategy can make or break promising companies. Most recently, I helped two clients secure about $5 million each in external funding – each a critical milestone that required precision in both preparation and execution.

Economic uncertainty can significantly impact capital raising strategies, making it essential to prepare for potential financial difficulties and collaborate with legal and financial experts to navigate these challenges.

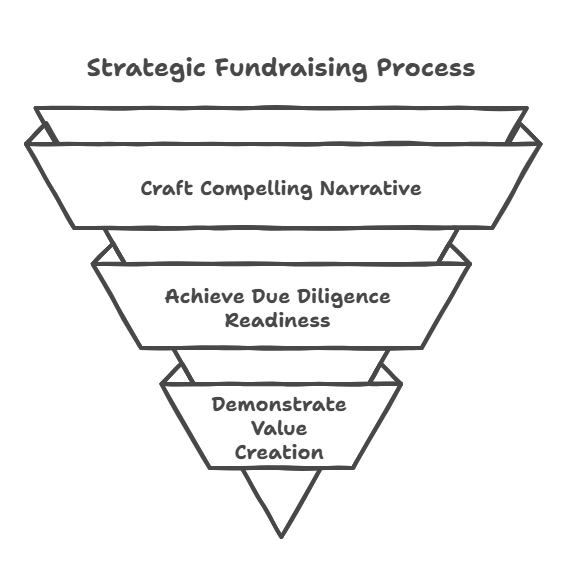

Whether you’re raising your first seed round, a growth-stage Series C or debt, three fundamental principles guide successful fundraising: creating a compelling narrative, achieving due diligence readiness, and demonstrating value creation potential. Let me share how these principles inform a strategic approach to fundraising.

TL;DR

Raising capital isn’t just about securing funds—it’s about doing so strategically to maximize long-term value. Founders should focus on compelling storytelling tied to specific milestones, understand investor expectations at each stage, and prepare meticulously through strong financial modeling, a clean cap table, and due diligence readiness. A smart raise balances dilution and runway—targeting 12–18 months of runway and limiting dilution to 10–20% per round. Stage your funding, leverage tools to model outcomes, and always tie capital to value-creating milestones to preserve equity and investor confidence. And, don’t shy away from raising debt – this is a critical tool for business expansion.

Understanding Capital Raising

Capital raising is a critical process for startups and businesses aiming to secure the necessary funding for growth, expansion, and innovation. It involves seeking investment from various sources, including venture capital firms, angel investors, and institutional investors. Understanding the intricacies of capital raising is essential for entrepreneurs and business leaders to navigate the complex landscape of funding options and make informed decisions about their company’s financial future.

Venture capital firms typically invest in high-growth companies with the potential for significant returns. They provide not only capital but also strategic guidance and industry connections. Angel investors, on the other hand, are often successful entrepreneurs or professionals who invest their own money into early-stage companies. They can offer valuable mentorship and support, in addition to funding. Institutional investors, such as pension funds and insurance companies, usually come into play at later stages, providing substantial capital to fuel further growth and expansion.

Each of these sources has its own set of expectations, investment criteria, and processes. Therefore, understanding the nuances of each can help you tailor your approach and increase your chances of securing the right type of funding for your business.

The Milestone-Based Approach to Venture Capital Raising

Starting with Your Story and Strategic Milestones

During my years at M/C Partners and Dolphin Equity, I reviewed thousands of pitch decks. What separated successful raises wasn’t just numbers – it was the founder’s ability to tell a compelling story that connected capital to specific milestones.

Your story must articulate:

- Why now? – Market timing and momentum

- Why you? – Team capabilities and unique advantages

- Why this amount? – Clear connection between capital and strategic milestones

Effective storytelling creates emotional resonance while providing the logical foundation for your valuation and capital needs. I’ve seen founders with modest traction secure outsized valuations through exceptional narrative construction, while companies with strong metrics falter due to weak storytelling. Additionally, managing investor expectations through clear financial planning and milestone setting can enhance investor confidence.

Early-Stage: TAM Analysis and Revenue Ramp

For early-stage companies, investors scrutinize two critical elements: market opportunity and your path to capturing it.

When developing TAM projections, avoid these common mistakes I regularly saw as a VC:

- Inflated market sizing: Better to segment your market into serviceable addressable market (SAM) and showcase deep understanding

- Undifferentiated capture strategy: Clearly articulate how your approach differs from existing and potential competitors

- Unrealistic revenue velocity: Your revenue ramp should reflect sales cycles, implementation timelines, and resource constraints

When I helped structure a recent $5 million raise, we developed a three-tiered revenue model that demonstrated:

- Conservative base case aligned with historical performance

- Target case matching operational capacity with planned team expansion

- Stretch case identifying specific resources and conditions for accelerated growth

This approach demonstrated both ambition and pragmatism – a powerful combination for investor confidence. Early-stage companies can also consider using SAFEs (Simple Agreements for Future Equity) to secure capital upfront in exchange for future ownership stakes.

Later-Stage: KPIs and Performance Metrics

As companies mature, storytelling remains important but must be reinforced by consistent KPI achievement. Later-stage investors look for:

- Predictable revenue growth: Demonstrated ability to forecast and deliver consistent results

- Improving unit economics: Clear path to profitability at scale

- Customer success metrics: Retention, expansion, and NPS trending positively

- Sales efficiency metrics: CAC payback periods, LTV/CAC ratios improving over time

When I helped scale a company from $38M to $198M, we implemented a recurring-revenue forecasting model that maintained 98% accuracy. This level of predictability dramatically improved our fundraising position and valuation discussions with investors. Additionally, venture debt can serve as a strategic non-dilutive funding option for later-stage companies to bridge gaps between funding rounds.

Preparing for a Capital Raise

Preparing for a capital raise requires meticulous planning, strategic thinking, and a deep understanding of your company’s financial health and growth potential. It involves building a robust financial model, understanding your cap table, and identifying the most suitable funding options for your business.

Building a Solid Financial Model

A solid financial model is the cornerstone of any successful capital raise. It provides a clear and comprehensive picture of your company’s financial performance, growth potential, and funding requirements. A well-constructed financial model should include detailed projections of revenue, expenses, cash flow, and key performance indicators (KPIs). It should also account for various scenarios, including best-case, worst-case, and most likely outcomes.

When building your financial model, ensure that it is both realistic and ambitious. Investors want to see that you have a clear understanding of your business model and the market, as well as a plan for achieving sustainable growth. Your financial model should demonstrate how the capital you raise will be used to drive value creation and achieve key milestones.

Understanding Your Cap Table

A cap table, or capitalization table, is a critical document that outlines the ownership structure of your company. It shows the distribution of equity among founders, investors, and employees, and is essential for understanding your company’s valuation and funding requirements. A well-structured cap table can help you make informed decisions about equity allocation, funding options, and exit strategies.

When preparing your cap table, ensure that it is accurate and up-to-date. This will not only help you understand the current ownership structure but also allow you to model different funding scenarios and their impact on equity dilution. Transparency and clarity in your cap table can build investor confidence and facilitate smoother negotiations during the capital raising process.

By meticulously preparing for a capital raise, you can position your company for success and attract the right investors who can provide not only capital but also strategic value.

The Three Pillars of Successful Fundraising

Single Source of Truth: Building Angel Investors’ Confidence

Investors quickly lose confidence when founders present inconsistent data across meetings or materials. To avoid this trap, establish a single source of truth for all company metrics before beginning your raise.

I recommend implementing:

- Centralized data repository with version control

- Consistent calculation methodologies for all KPIs

- Regular reconciliation between departments

- Clear ownership of metric definitions and reporting

Presenting clear and consistent financial metrics can significantly influence the confidence and decisions of potential investors.

This approach not only builds investor confidence but creates operational advantages. When we implemented this system for a recent client, we discovered significant opportunities to improve sales efficiency that had been masked by inconsistent reporting.

Due Diligence Readiness: Removing Obstacles to Closing

Nothing kills deals faster than surprises during due diligence. From my experience on both sides of transactions, I’ve learned that proactive preparation dramatically improves closing rates.

Before approaching investors, ensure you’re ready for scrutiny on:

- Financial records: Clean books with GAAP-compliant reporting

- Customer relationships: Reference-ready clients with clearly documented contracts

- Intellectual property: Proper ownership documentation and protection

- Team alignment: Clear equity structures and stakeholder alignment

For one client preparing for their first institutional raise, we discovered potential IP issues during our readiness assessment. Addressing these proactively, rather than having investors discover them, preserved millions in valuation.

Value Creation Framework: Optimizing Equity Dilution and Runway

The most strategic aspect of fundraising is balancing dilution and runway to maximize long-term value creation. Based on my experience leading dozens of successful raises, I recommend:

- Target 12-18 months of runway: This timeframe optimizes for milestone achievement while preserving the option to raise at improved valuations

- Limit dilution to 10-20% per round: Protecting founder and early investor equity maintains alignment and motivation

- Focus on milestone-driven valuation increases: Each dollar raised should connect directly to value-creating milestones

Consider this example from a recent client engagement:

The company needed $3M to reach profitability over 24 months. Instead of raising the full amount at a $12M valuation (20% dilution), we raised $1.5M at $10M (13% dilution). Ten months later, after hitting key product and revenue milestones, they raised an additional $1.5M at a $20M valuation (7% dilution). This approach preserved an additional 6% equity for founders and early investors – worth millions in the eventual exit. Raising equity requires careful planning to balance dilution and runway for maximum value creation.

Crafting Your Fundraising Strategy for Institutional Investors

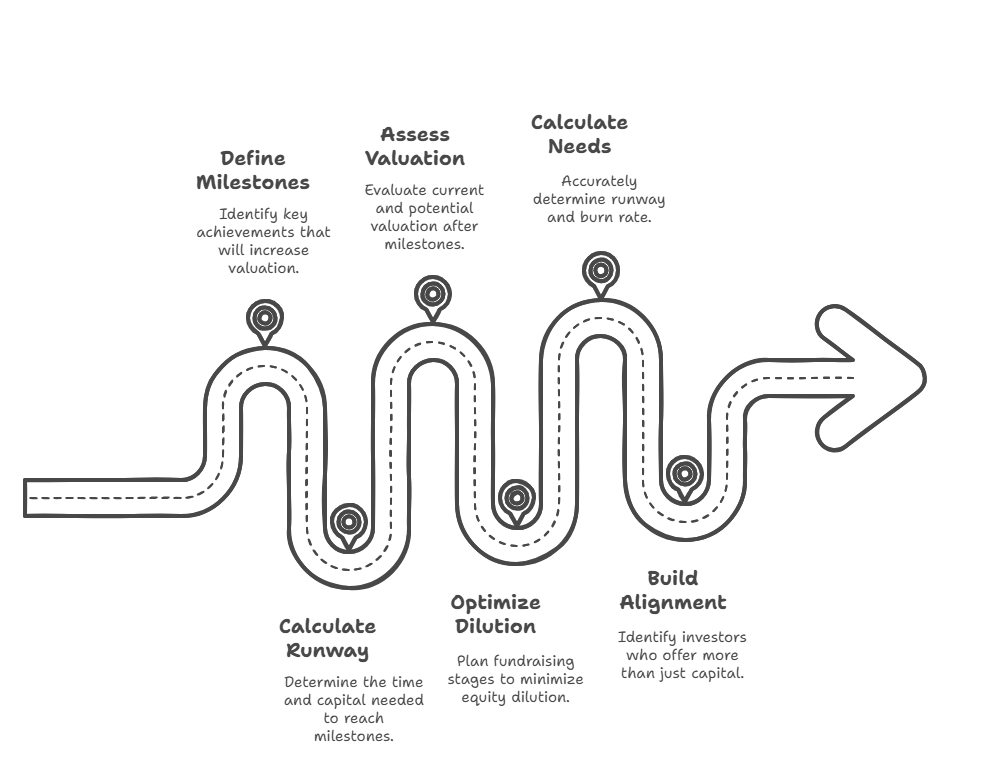

Based on these principles, here’s my recommended framework for determining your capital raise strategy:

- Define value-creating milestones: What specific achievements will significantly increase your valuation?

- Calculate required runway: How much time and capital do you need to reach these milestones?

- Assess market-aligned valuation: What valuation can you realistically achieve now versus after reaching these milestones?

- Optimize for dilution: Can you stage your raise to reduce overall dilution while managing cash risk? (Use our free Equity Cap Table Dilution Calculator on the CFO Pro+Analytics website to model different scenarios)

- Calculate precise runway needs: How much runway do you need, and what’s your true burn rate? (Our Cash Runway/Burn Rate Calculator helps you determine this accurately)

- Build investor alignment: Which investors can provide the most value beyond capital for your current stage? Personal contacts and networking can play a crucial role in raising money for startups.

Non-dilutive capital can be a strategic option for startups looking to raise money without relinquishing ownership stakes.

Final Thoughts

Fundraising is a strategic opportunity, not just a financial transaction. The most successful founders approach it with the same rigor they apply to product development or go-to-market strategy.

My work with dozens of companies has consistently shown that those who master the art of narrative building, establish a single source of truth, achieve due diligence readiness, and implement a value creation framework consistently outperform in both capital efficiency and eventual outcomes. Revenue-based financing can provide operational flexibility and preserve ownership for founders while supporting growth.

To help founders navigate these complex decisions, we’ve developed practical tools available on our website. Our Equity Cap Table Dilution Calculator lets you model different funding scenarios to visualize the impact on ownership, while our Cash Runway/Burn Rate Calculator helps you determine precisely how much capital you need to reach key milestones. These tools have been refined through dozens of successful capital raises and provide a solid foundation for your fundraising strategy.

Whether you’re raising your first round or your fifth, remembering these principles will help you optimize for both short-term capital needs and long-term value creation.

Frequently Asked Questions

How do I know if my company is ready to raise capital?

Company readiness is determined by three factors: provable traction, clear milestone plans, and due diligence preparedness. You should have demonstrable market validation (even if early), a specific plan for how capital will accelerate growth, and your financial house in order. Having raised over $400M across dozens of companies, I’ve found that founders often underestimate the importance of due diligence readiness – clean books, clear contracts, and documented IP are non-negotiable prerequisites for institutional capital. Additionally, managing investor expectations through clear milestone plans and financial projections is crucial to ensure investor confidence and satisfaction.

What’s the biggest mistake founders make when determining how much to raise?

The most common mistake I see is raising for arbitrary timeframes (like “2 years of runway”) rather than specific value-creating milestones. This approach typically leads to either raising too much and diluting unnecessarily or raising too little and falling short of meaningful progress. Instead, work backward from the specific milestones that will significantly increase your valuation, then determine how much capital and time you need to achieve them. Our Cash Runway Calculator can help with these projections.

How should early-stage companies handle valuation discussions with investors?

In early stages, valuation discussions should focus more on alignment and partnership quality than maximizing paper valuation. From my venture capital experience, I’ve seen founders fixate on valuation while overlooking terms that have much greater long-term impact. Prioritize finding investors who understand your market, can add strategic value, and offer fair terms that don’t create challenges for future rounds. That said, come to these discussions prepared with market comparables, a clear articulation of your unique advantages, and a strong narrative about your path to creating outsized returns.

…

Salvatore Tirabassi is the Managing Director at CFOPro+Analytics. He has over 24 years of experience in venture capital, private equity, and executive financial leadership. Throughout his career, he has raised over $400 million in capital and helped dozens of companies optimize their financial strategies for growth and value creation.

Please visit our website to discover our services, calculators and tools, as well as blogs that provide practical financial insights for emerging businesses.