The Power of ESOP: Creating Win-Win Exit Strategies with Employee Stock Ownership Programs

in Accounting, CFO, Finance, #FractionalCFO, CFO, Family-Owned Businesses, Financial Leadership, financial planning, All Posts

A few years ago, I structured the sale of a business to an Employee Stock Ownership Trust under the rules for employee stock ownership plans. These transactions are known in this corner of finance as ESOPs. But these ESOPs are not to be confused with the use of the same acronym in the traditional venture capital world where ESOP refers to Employee Stock Option Program. The ESOP we are talking about here is an unusual process of selling a company to employees and is governed by ERISA and Department of Labor regulations. Interestingly, it is one of the pieces of federal law that is liked on both sides of the aisle because it delivers exceptional equity participation to employees and provides significant tax benefits to founders and the corporations they sell to the employees. In this article, I want to discuss the execution of this kind of a transaction and how to leverage it in founder’s journey to an exit event.

Understanding ESOPs: A Unique Employee Stock Ownership Plan Exit Strategy

An Employee Stock Ownership Program represents a distinctive exit path that many founders overlook. Unlike traditional exits through strategic sales or private equity acquisitions, an ESOP allows owners to sell their business to the employees who helped build it. ESOPs function similarly to profit-sharing plans and are considered a type of employee benefit plan.

The structure works through a trust mechanism: the company establishes an Employee Stock Ownership Trust (ESOT) which then purchases shares from the existing owners. This trust holds these shares on behalf of employees, who receive allocations based on factors like tenure and compensation.

What makes ESOPs particularly compelling are the substantial benefits they offer to all stakeholders:

- For founders: Significant tax advantages, legacy preservation, and gradual transition options

- For employees: Meaningful equity without personal investment, retirement benefits, and enhanced job security

- For the company: Improved performance, tax benefits, and cultural alignment

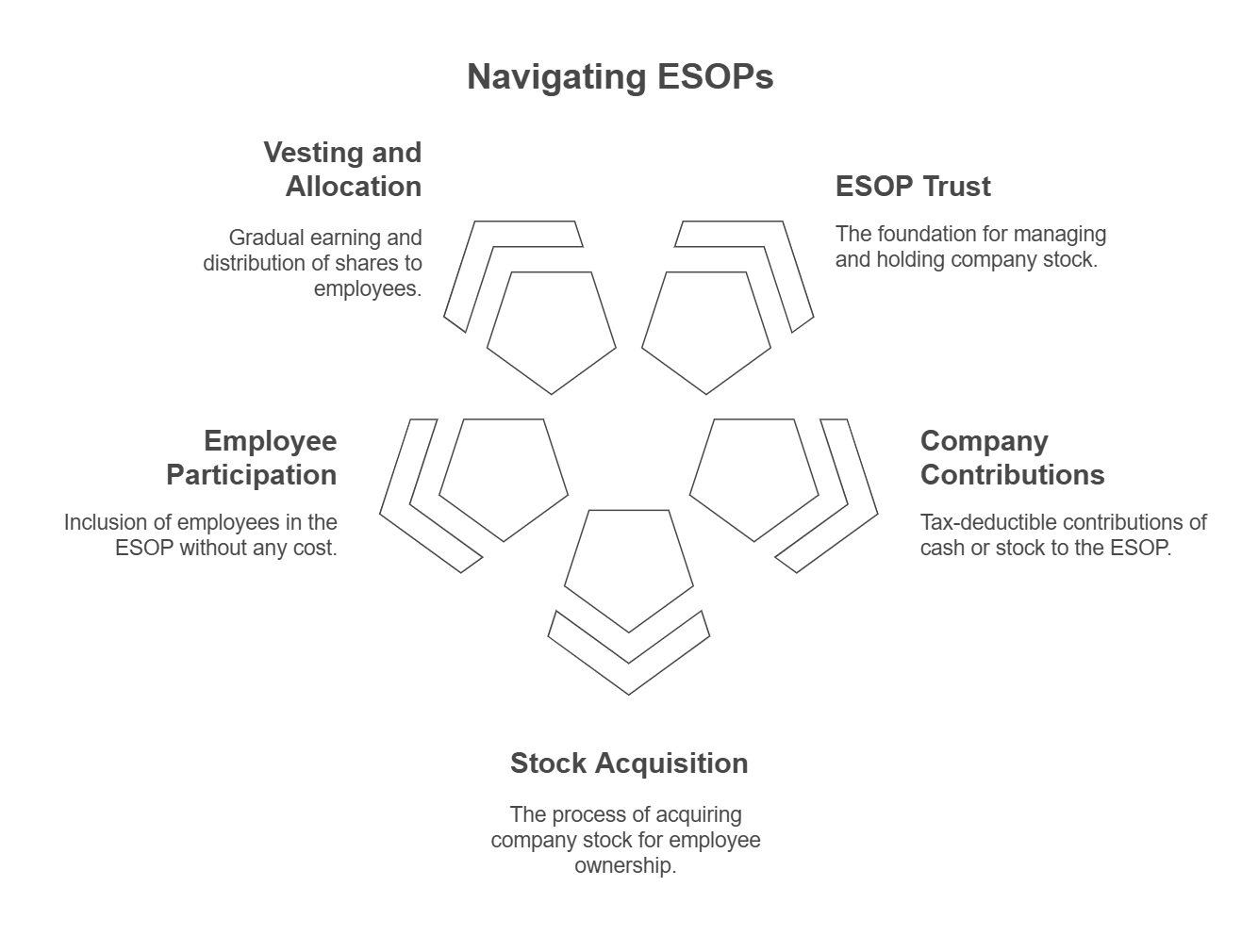

How ESOPs Work

An Employee Stock Ownership Plan (ESOP) is a qualified retirement plan that allows employees to own company stock, providing tax benefits to both the company and its employees. Here’s a step-by-step explanation of how ESOPs work:

- Establishing an ESOP: The first step in creating an ESOP is setting up an ESOP trust fund, which is a separate entity from the company. This trust is responsible for holding and managing the company’s stock on behalf of the employees.

- Company Contributions: The company makes contributions to the ESOP trust, which can be in the form of cash or company stock. These contributions are tax-deductible, offering a significant tax benefit to the company.

- Stock Acquisition: The ESOP trust uses the contributions to acquire company stock. This can be done by purchasing existing shares from current owners or by issuing new shares. This process ensures that the company’s stock is gradually transferred to the employees.

- Employee Participation: Typically, all full-time employees over the age of 21 are eligible to participate in the ESOP. Employees do not need to pay anything to join the plan, making it an attractive employee benefit.

- Vesting: As employees continue to work for the company, they gradually earn the right to the shares allocated to their accounts. This process, known as vesting, usually follows a schedule that can range from three to six years, ensuring long-term employee commitment.

- Stock Allocation: Shares in the ESOP trust are allocated to individual employee accounts based on a formula, which can be related to their salary or a more equal distribution method. This allocation process ensures that employees receive a fair share of the company’s stock.

- Employee Ownership: As employees vest in the ESOP, they become employee owners, sharing in the company’s success and risks. This ownership can lead to increased motivation and productivity, as employees have a direct stake in the company’s performance.

- Tax Benefits: ESOPs offer significant tax benefits, including tax-deductible company contributions, tax-free growth of the ESOP trust, and tax-free distribution of ESOP shares to employees. These benefits make ESOPs an attractive option for both companies and employees.

- Business Valuation: Private companies with an ESOP must undergo an annual outside valuation to determine the fair market value of their shares. This ensures that employees receive a fair price for their shares when they leave the company.

- Employee Departure: When employees leave the company, they receive their vested shares. The company is required to buy back these shares at fair market value, providing employees with a valuable retirement benefit.

By understanding how ESOPs work, companies can leverage this powerful tool to motivate employees, increase productivity, and drive business growth, while providing a valuable employee benefit and tax advantages.

Tax Benefits: The ESOP Difference

One of the most compelling aspects of an ESOP transaction is the extraordinary tax treatment it receives. Companies can borrow money to fund the ESOP, which allows for the tax-favorable purchase of shares. These benefits include:

For Selling Shareholders

If structured properly, selling shareholders can defer capital gains taxes indefinitely under Section 1042 of the Internal Revenue Code. This requires:

- The ESOP must own at least 30% of the company post-transaction

- The seller must reinvest proceeds in qualified replacement property (typically domestic securities)

- The company must be a C-Corporation at the time of sale

This tax deferral represents substantial savings, potentially millions of dollars for successful founders, that would otherwise be paid immediately in a traditional exit.

For the Company

The benefits extend to the company itself:

- C-Corporations: ESOP-owned C-Corps can deduct both principal and interest payments on ESOP loans

- S-Corporations: The portion owned by the ESOP is exempt from federal income tax (and many state taxes)

- All ESOP companies: Contributions to the ESOP are tax-deductible

For a 100% ESOP-owned S-Corporation, this effectively creates a tax-exempt entity, allowing significantly more cash flow for operations, debt service, and growth. Additionally, ESOPs can enhance corporate performance by aligning employees’ interests with company success.

Execution Process: Navigating the ESOP Journey

Successfully executing an ESOP transaction involves several critical steps. ESOPs enable employees to own shares in their company’s stock, providing them with a direct stake in the company’s success.

1. Feasibility Analysis and Business Valuation

Before committing to an ESOP, founders should conduct a thorough analysis considering:

- Company valuation and financial health

- Transaction financing options

- Cultural fit and employee readiness

- Alternative exit strategies

This analysis typically involves specialized ESOP advisors who can model various scenarios and their impacts.

2. Transaction Design

Once feasibility is established, the transaction structure must be developed, addressing:

- Percentage of ownership to be transferred

- Transaction timing (immediate or phased)

- Financing mechanisms (seller notes, bank loans, or hybrid approaches)

- Governance provisions and voting rights

The design phase requires balancing founder objectives, company needs, and regulatory requirements. Restricted stock can be a component of employee ownership alternatives alongside stock options and ESOPs.

3. Implementation

The implementation process involves:

- Establishing the ESOT

- Securing financing

- Completing the stock purchase

- Setting up administrative systems

Throughout this process, clear communication with employees is essential to help them understand their new ownership role.

Case Study: A Successful ESOP Transition

In my experience with ESOP transactions, one particular case stands out. We helped a manufacturing company with $50M in annual revenue transition to 100% employee ownership through a two-stage process: The company became a successful employee-owned business, reflecting the positive impact of employee ownership.

Stage 1: Initial 40% sale to the ESOP, allowing the founder to diversify while maintaining control Stage 2: Three years later, sale of remaining 60%, completing the transition

This approach delivered several key benefits:

- The founder deferred approximately $8M in capital gains taxes through the Section 1042 rollover

- The company’s tax status as an S-Corporation meant no federal income taxes on profits

- Employee retirement accounts grew significantly

- The company experienced 15% annual growth post-transition, outperforming industry averages

This success was built on careful preparation, appropriate valuation, and clear communication throughout the process.

Key Considerations for Founders

While ESOPs offer compelling benefits, they aren’t the right fit for every situation. ESOPs can be a valuable addition to traditional retirement plans, providing employees with enhanced job stability and financial benefits. Founders should consider:

When an ESOP Makes Sense

ESOPs tend to work best when:

- The company has strong, stable cash flow

- There’s a meaningful employee base (typically 20+ employees)

- The founder wants to preserve company culture and legacy

- The business has minimal debt and strong growth potential

- There’s a capable management team that can eventually lead without the founder

Potential Challenges

Common challenges include:

- Transaction complexity and compliance requirements

- Need for ongoing administration and annual valuations

- Potential repurchase obligations as employees retire

- Limitations on strategic flexibility post-transaction

- Perception concerns from employees and customers

ESOP vs. Traditional Exit Options

When comparing to other exit strategies, consider:

- Strategic sale: Typically higher immediate payout but greater disruption

- Private equity: Often involves significant changes to operations and culture

- Family succession: Maintains legacy but may lack capital or management capability

- ESOP: Balances financial outcomes with legacy preservation

Stock ownership plans, including ESOPs, stock options, and restricted stock, offer various ways for employees to acquire shares in the company.

The Future of ESOPs

As business owners increasingly seek meaningful exit strategies that balance financial outcomes with legacy considerations, ESOPs are gaining prominence. Several trends suggest continued growth:

- Increasing awareness among advisors and business owners

- Enhanced financing options from specialized lenders

- Growing emphasis on employee ownership in public policy

- Successful examples driving interest across industries

For founders contemplating their exit journey, ESOPs represent a compelling option that creates lasting value for all stakeholders while delivering significant financial benefits. Employees pay taxes on ESOP contributions only when they receive the stock upon leaving or retiring, highlighting the tax deferral benefits.

Conclusion

Employee Stock Ownership Programs offer a uniquely advantageous exit strategy for business owners who value their legacy, care about their employees, and want to optimize their financial outcomes. Through careful planning and execution, an ESOP can transform a traditional business exit into a powerful succession solution that benefits founders, employees, and the company itself.

If you’re considering your exit options, an ESOP deserves serious consideration alongside more traditional paths. The tax benefits, cultural preservation, and multi-stakeholder advantages make it a compelling alternative for the right situations.

Would you like to learn more about how an ESOP might fit your exit strategy? Feel free to contact me to discuss your specific situation and explore whether this approach aligns with your business and personal goals.

Frequently Asked Questions

What size company is suitable for an ESOP transaction? While there’s no absolute minimum, ESOPs typically work best for companies with at least $5 million in annual revenue and 20+ employees, as the transaction costs and administrative requirements can be proportionately high for smaller businesses.

How long does a typical ESOP transaction take to complete? From initial consideration to closing, most ESOP transactions take 6-9 months, including feasibility analysis, transaction design, financing arrangements, and legal documentation.

Can founders maintain control after selling to an ESOP? Yes, many ESOP transactions are structured to allow founders to maintain significant control through board representation, management positions, or voting agreements, especially in partial ESOP transactions where the founder retains ownership.