Transform Your Business Today

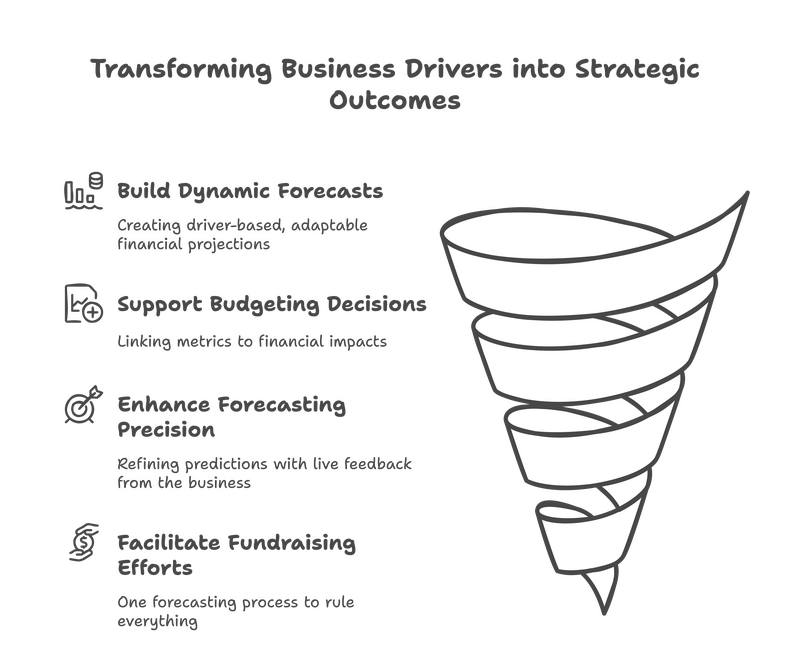

Building comprehensive financial models to guide your business can be a challenge. By bringing together your sales, operational and accounting data you can have a budget forecast that is reliable and flexible.

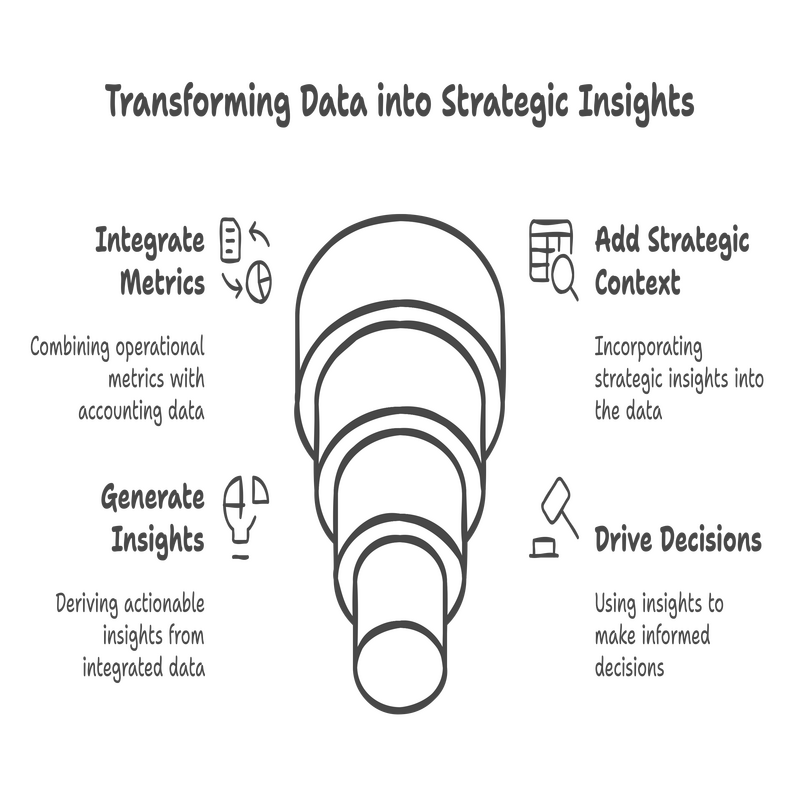

Accounting data often lacks the context for decision making. To have financial data at your finger tips for decision making requires analysis of trends, patterns and changes to your business. Say goodbye to the back-and-forth between accounting and finance to get the information you need to drive results.

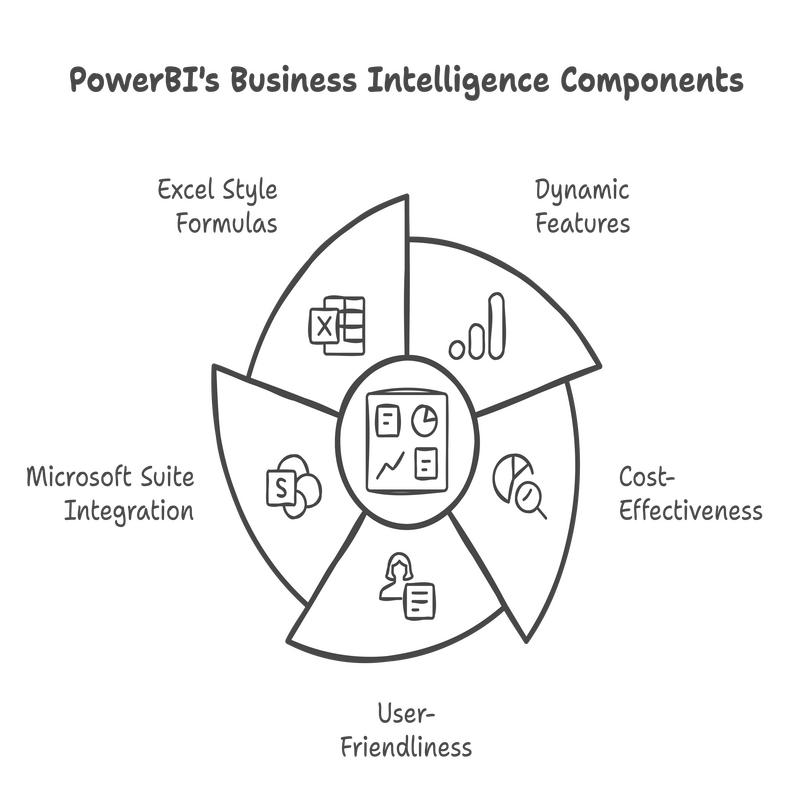

PowerBI is the most dynamic, cost effective and user friendly analytics business intelligence system on the market. Leveraging the Microsoft suite and Excel style formula writing, it can become a powerful new tool for your business.

Leveraging data science to predict what happens next in your business enables better, more effective decision making today. This way tomorrow you are better prepared for the unexpected.

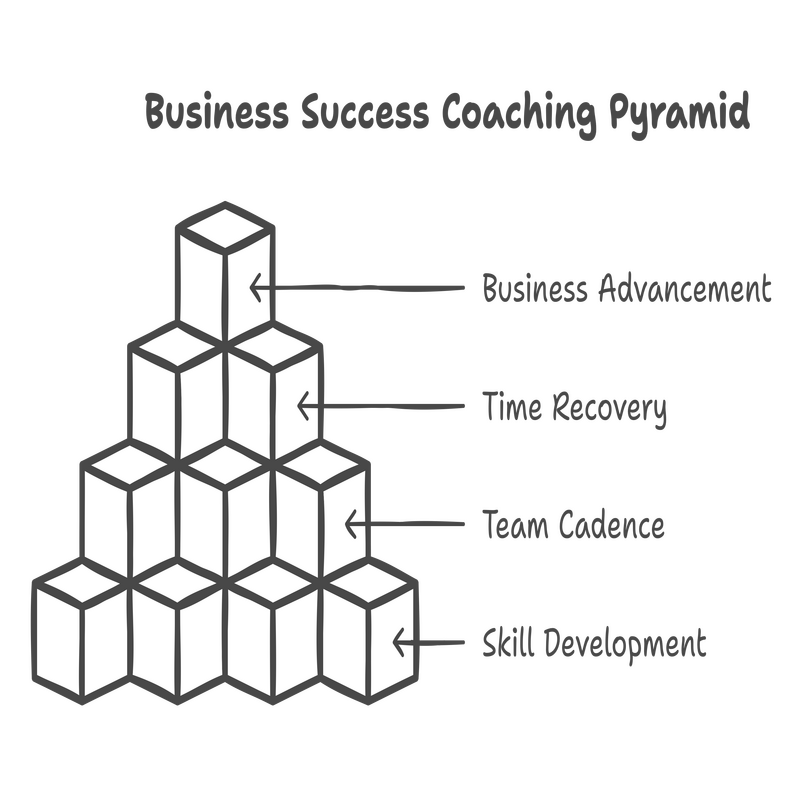

Our coaching program will help you develop and cultivate the skills necessary to lead your business to success. By helping you establish a cadence of team planning and meetings you will gain back time and quickly drive the business forward.

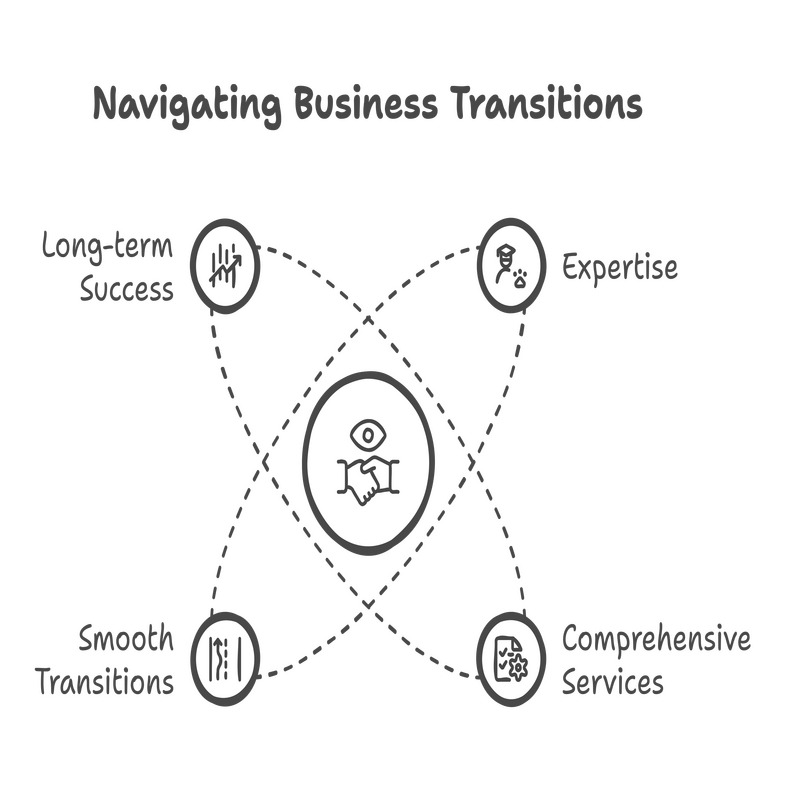

With years of expertise in capital raising and M&A, we offer comprehensive services to help you successfully navigate the complex process of capital raising and M&A, ensuring a smooth transition and long-term success.