Methodology & Background

CFO Pro+Analytics Delivers Transformative Financial Leadership Through a Proven Three-Driver Methodology

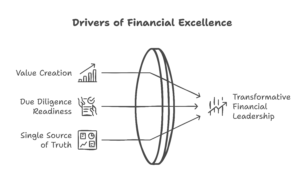

How CFO Pro+Analytics Delivers Results

CFO Pro+Analytics provides boutique fractional CFO services that deliver strategic and financial leadership tailored specifically for venture-backed startups, family and founder-owned businesses and other types of businesses. The firm works closely with founders and owners to deliver actionable strategies for immediate impact while building sustainable financial infrastructure for long-term success.

The firm’s service delivery is built on three core principles that have proven successful across multiple companies and funding rounds:

Single Source of Truth: CFO Pro+Analytics creates integrated data systems for confident decision-making where everyone in the organization speaks from the same financial data and metrics.

Due Diligence Readiness: The firm builds robust financial infrastructure that enables companies to impress investors in due diligence with less than 48 hours notice.

Value Creation Focus: All strategic finance decisions are underpinned by measurable value creation for shareholders and growth metrics that VCs require.

CFO Pro+Analytics serves a diverse range of businesses, from venture-backed startups to established family-owned enterprises and founder-led companies across multiple industries. For cash-flowing businesses, the firm structures tax-advantageous solutions including captive insurance programs, state tax credits, and Employee Stock Ownership Programs. For founder and family-owned businesses, CFO Pro+Analytics addresses unique challenges such as succession planning, family governance structures, generational wealth transfer strategies, and balancing growth investments with family distributions.

The firm’s expertise extends across critical business challenges including merger and acquisition preparation, operational efficiency optimization, capital structure planning, risk management frameworks, and strategic growth initiatives. Whether clients need support with fundraising readiness, exit planning, operational scaling, or complex financial restructuring, CFO Pro+Analytics delivers tailored solutions that address each company’s specific circumstances and objectives.

The team includes professionals with diverse backgrounds spanning venture-backed startups, private equity portfolio companies, family offices, and established enterprises. This includes former startup CFOs who have guided companies through multiple funding rounds, finance professionals with VC and PE experience who understand investor expectations, family business advisors experienced in multi-generational planning, and data analysts specializing in metrics across various business models. This breadth of expertise enables CFO Pro+Analytics to provide executive-level financial guidance at a fraction of the cost of hiring a full-time CFO, regardless of company stage or structure.

Professional Background

Salvatore Tirabassi brings over twenty years of strategic financial leadership experience, combining deep venture capital expertise with hands-on fractional CFO services for high-growth companies. His track record includes facilitating over $400 million in equity and debt fundraising and successfully leading the strategic purchase and sale of 12 companies across multiple exits.

With fifteen years of venture capital and private equity experience, Salvatore has developed specialized expertise in investment strategies and value creation across various sectors. As a former VC and professional CFO, he understands both sides of the fundraising equation—what investors expect and how companies can deliver compelling financial narratives that drive successful funding rounds.

His educational foundation includes an MBA from the Wharton School, an MSE in Telecommunications and Networking Engineering from the University of Pennsylvania, and a BA from Harvard University. This combination of rigorous academic training and extensive real-world experience informs his practical approach to strategic finance.