Payment Processing Optimization: How to Leverage Software to Maximize Revenue

In my years as a fractional CFO, I’ve watched promising companies hit a wall. It typically happens around the $5M ARR mark – the payment infrastructure that seemed robust at startup begins buckling under the weight of scale. The symptoms are similar: finance teams drowning in reconciliation, revenue leaking through failed payments, and customer churn […]

From Too Many Messaging Apps to Just One

Taming Messaging App Sprawl 2024 has been a year of heavy networking, and too many messaging apps became a problem for me. This messaging app sprawl was an unintended consequence of my efforts to network and build my services practice. After all of my productive networking, I found myself drowning in a sea of notifications, […]

My Experience with AI-Powered Excel Tools: Numerous.ai VS Excel Formula Bot

I’m always on the hunt for tools that can help me work more efficiently and effectively. Recently, I had the opportunity to test out two of the most talked-about AI-powered Excel tools on the market: numerous.ai VS Excel Formula Bot. After putting both tools through their paces, I’m excited to share my thoughts and experiences […]

When to Say Goodbye: Managing High-Cost Customers in Ecommerce

In the world of ecommerce, the customer is king. But what happens when the king becomes too costly? As counterintuitive as it may seem, there are times when an ecommerce business needs to consider “firing” certain customers to maintain profitability and operational efficiency. This strategy, while controversial, can be crucial for long-term success, especially when […]

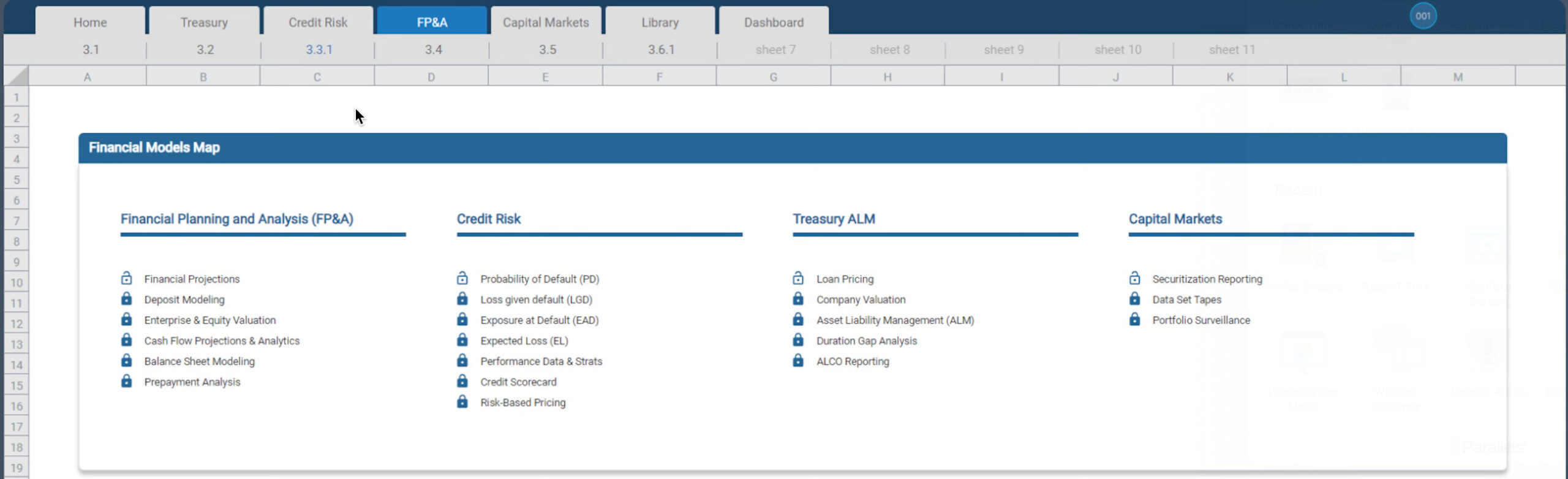

How a Financial Model Serves as Your North Star

A financial model roadmap is a helpful rubric for any founder or entrepreneur. I’ve witnessed firsthand the transformative power of a sound financial model. It’s not just a set of spreadsheets; it’s the North Star that guides a business through the unpredictable seas, even in the startup world, but especially as your business grows and […]

The Hidden and Visible Sources of Truth in Olympic Competition Data

The Olympic Games are the pinnacle of athletic achievement, where fractions of a second or millimeters can separate gold from silver. I was wondering how this all gets done. So many competitions, so many competitors, so many judges. It’s a large-scale real-time data mash-up. Behind the scenes, a complex network of measurement systems and protocols. […]

CrowdStrike’s Patch Debacle and the Impact on Business Intelligence Systems

For business intelligence, the CrowdStrike patch debacle had far-reaching consequences for across different layers of the data stack. For businesses relying on external data sources, such as travel companies or services like TripIt that depend on, say, Delta Airlines’ data, the CrowdStrike incident could have caused significant disruptions to their users and to the internal […]

Bridging the Gap: How Fractional CFOs Can Help Microcaps with Their Unique Challenges

Fractional CFO can help microcaps with their unique challenges using many of the same techniques applicable to private companies. A little bit of a tangent this week from financial analytics topics and a dive into the practicalities of CFO work and how it integrates into investor relations and value creation. I’ve worked with private companies […]

TikTok vs Meta Are A Worthy Comparison of AI Advertising Platforms

In the ever-evolving landscape of digital advertising, TikTok vs Meta platforms are a worthy comparison of AI Advertising Platforms. Meta’s Advantage+ advertising platform stands out as a prime example of this trend, offering automated solutions that leverage machine learning to optimize ad performance. TikTok has been evolving its strategy for over 2 years and now […]

Using ChatGPT for Data Cleaning

I’m always on the lookout for tools that can streamline financial analysis and provide valuable insights. One such tool that has caught my attention is ChatGPT’s data analysis features. In this blog post, I’ll explore how these features can be applied in day-to-day financial analysis and provide a comparison with PowerQuery’s data cleaning capabilities. Data […]

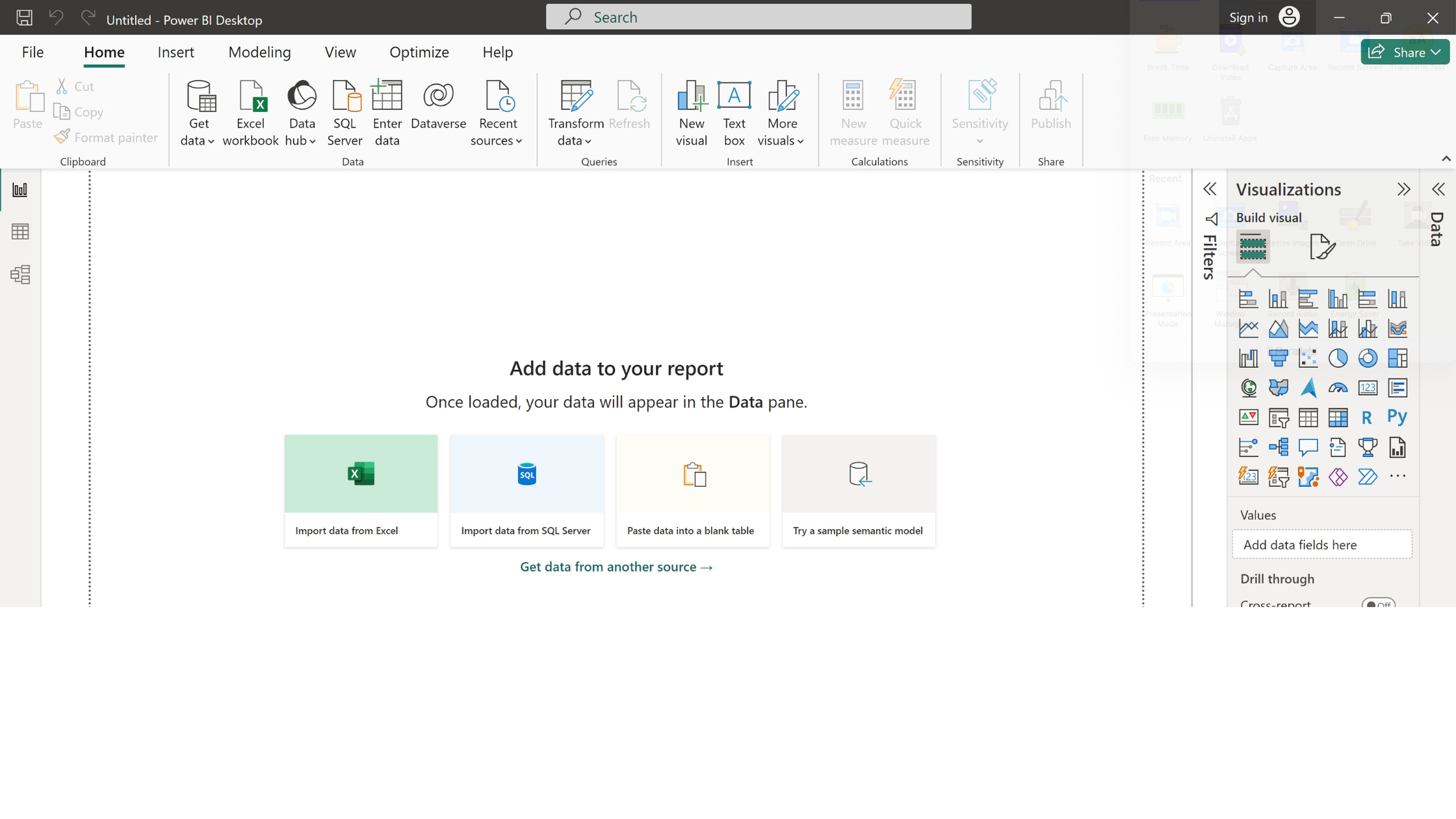

The Convergence of Excel and Power BI

I eagerly await each new step in the convergence of Excel and PowerBI. More efficiency and productivity are the gains I foresee as a result. As some of you know, I have designed and built full PowerBI systems with the requisite personnel to create a true business intelligence consulting service inside organizations. It goes without […]

PowerQuery can Elevate QuickBooks Analysis in Excel

For those of you that know me, I am an efficiency seeker and delegator in the best (worst) possible way. I want processes that are repeatable and easy to understand. PowerQuery can elevate QuickBooks Analysis in Excel by streamlining QuickBooks reports that are not Excel Table friendly. This kind of data manipulation has become crucial […]

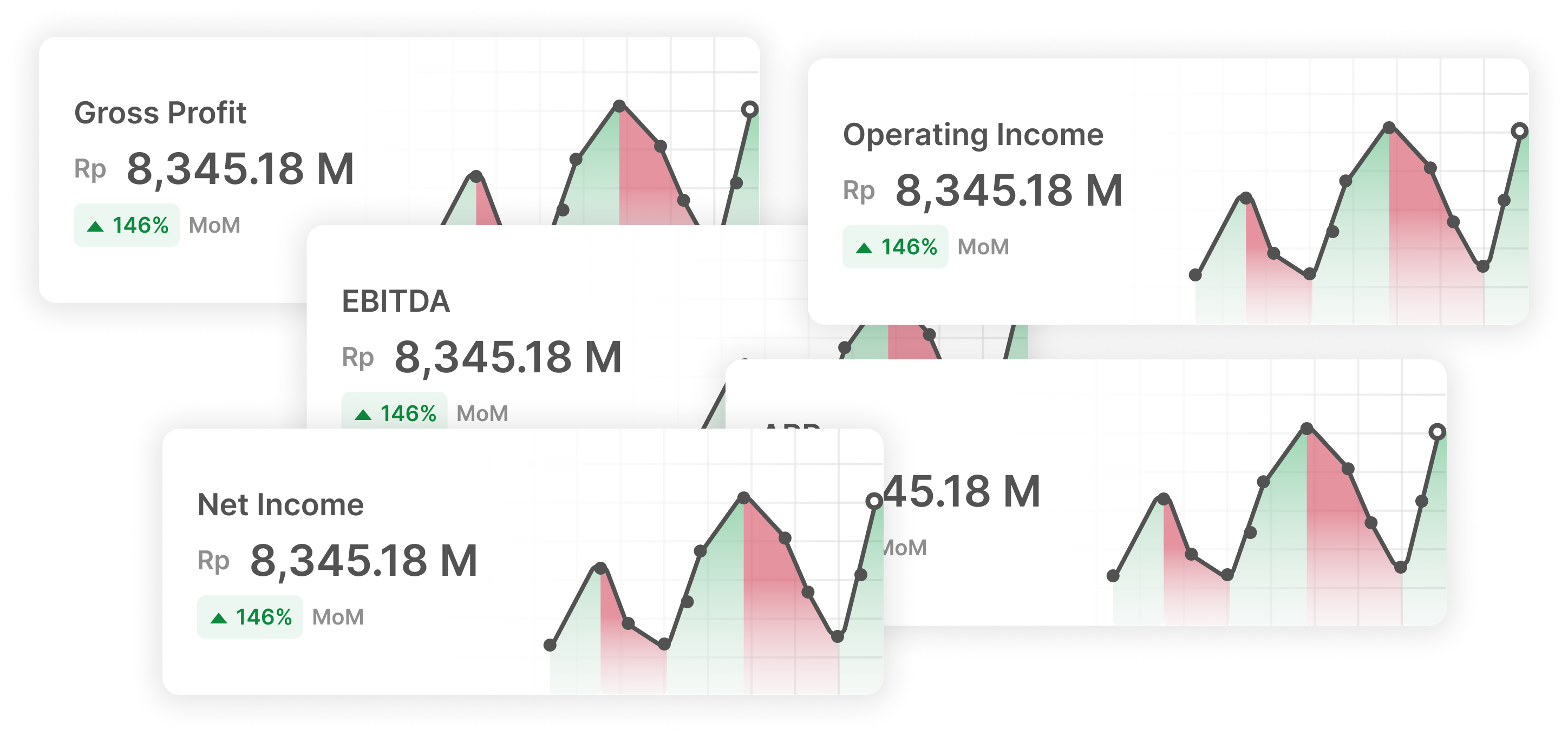

SAAS Revenue KPI Alignment: Creating Compelling Financial Narratives, A Fractional CFO Perspective

In the dynamic landscape of SaaS business growth, SAAS Revenue KPI alignment and the resulting ability to present a clear and compelling financial narrative to potential investors is paramount. This narrative is underpinned by the strategic alignment of key revenue growth, customer retention and customer acquisition cost KPIs, which serve as indicators of the company’s […]

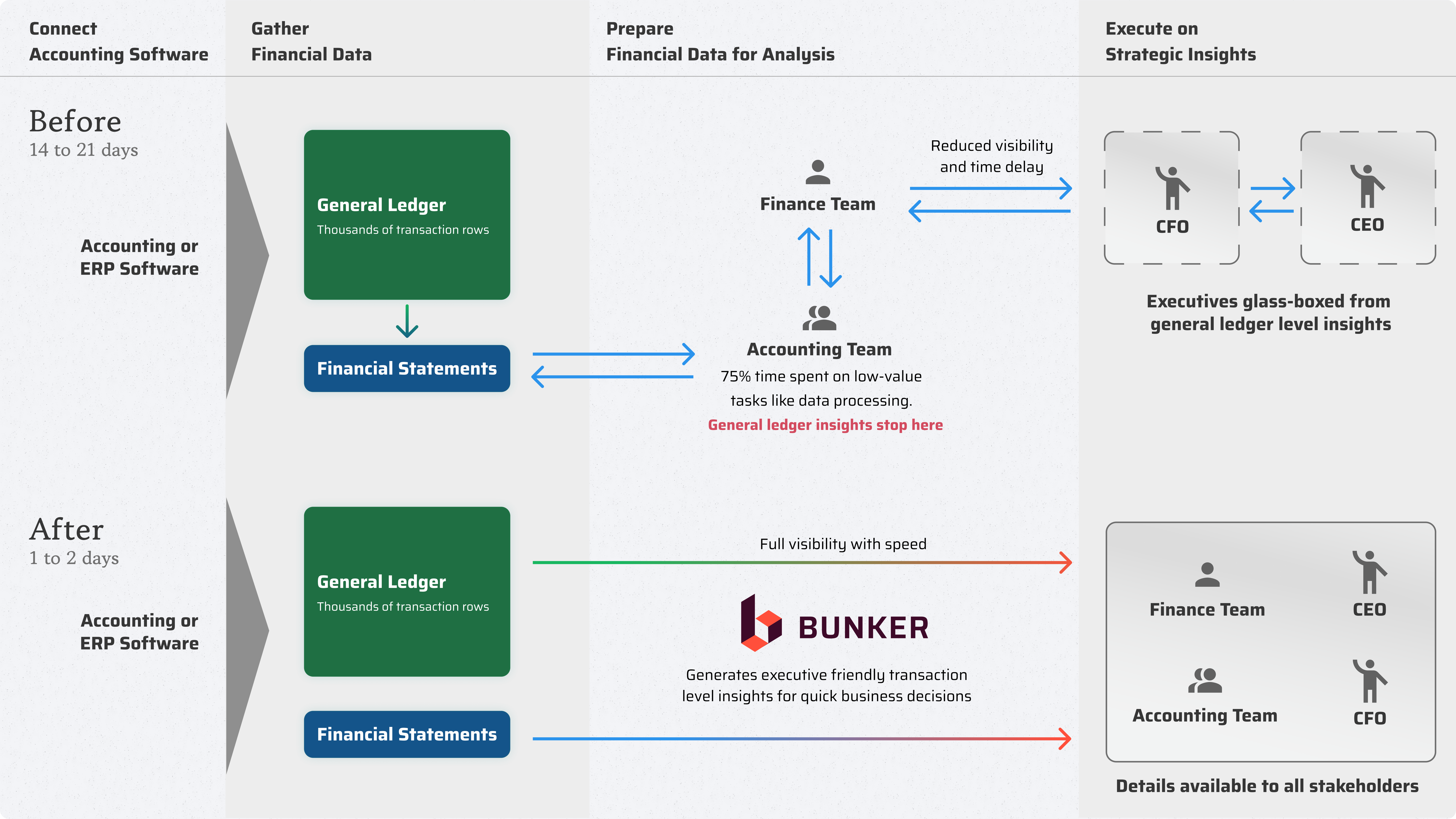

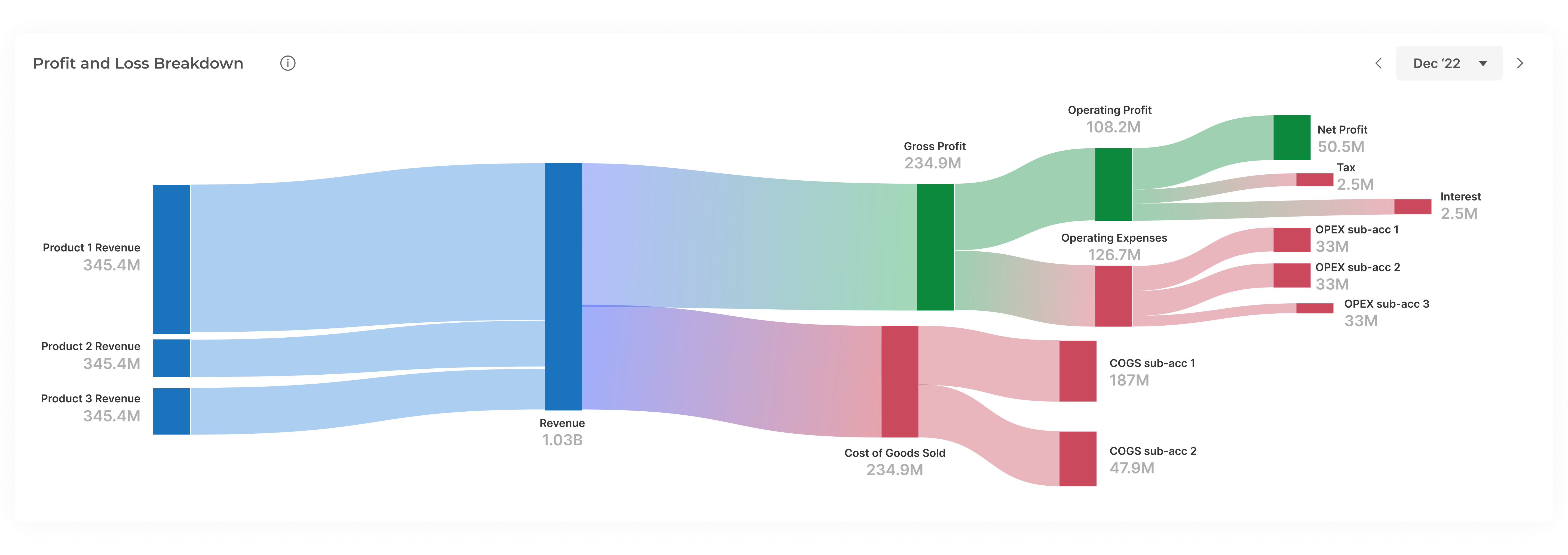

Tools for a Fractional CFO, Bunker vs. Reach Reporting for FP&A and Accounting

This year, I launched a Fractional CFO Services business. As part of my effort to steam line the financial reporting at my clients, I started using a software platform called Bunker, an innovative software company that provides great software for a Fractional CFO driving FP&A reporting, among other things. In order to settle on Bunker, […]

Wondering about machine learning in your efforts? Let’s talk the basics about Random Forest and XGBoost.

The business generalist or expert in a specific aspect of business operations might wonder about machine learning and data science. Random Forest and XGBoost are two techniques that are related and commonly used in business predictive modeling. I want to give you some basics for these frequently used techniques so you can be sharp enough […]

Revolutionizing Consumer Loan Financial Reporting and Analysis

Our use of Vector ML Analytics’ financial analytics platform significantly enhanced our loan portfolio management by integrating customizable behavioral assumptions, generating comprehensive financial projections, and offering advanced securitization reporting. This resulted in improved accuracy in financial planning, informed strategic decision-making, and robust risk management. By leveraging Vector’s dynamic forecasting and optimization reports, we achieved a marked improvement in our reporting processes and operational efficiency, demonstrating the platform’s value in adapting to complex financial environments.

LCV is for client unit economics, True Profitability is for product unit economics and another approach to drive value in your SaaS business.

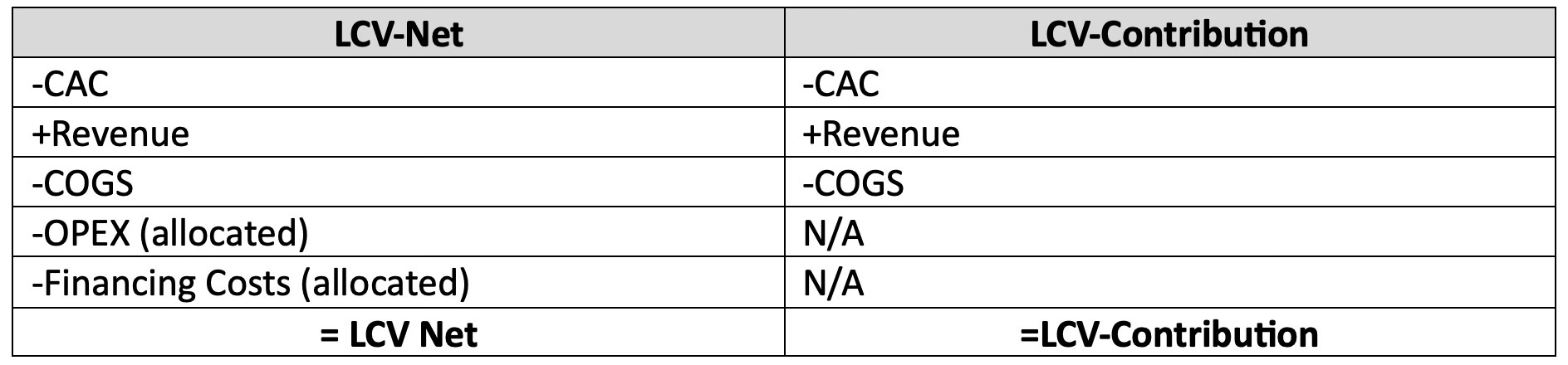

Living in a SaaS world, we are often focused on LCV (Lifetime Customer Value) for a critical unit measurement of profitability. But, it’s also important to understand your product unit economics. True Profitability, a term and methodology developed by Pedro Ferro and described in his book by the same name, determines the specific unit economic […]

Can I pay you to stop using TikTok? Or, will you pay to stop your whole friend group from using TikTok?

Is social media a product status trap? What is the price to stop using TikTok? This week is a little turn away from my typical analytics discussion. We are going to talk about product economics and how consumers get value out of social media. While reading, you can ask yourself questions about the products in […]

Managing a Loan Portfolio with Great Analytical Tools

Partnering with Vector ML Analytics, my team transformed our consumer loan portfolio’s financial reporting, emphasizing advanced analytics for precision and efficiency. This collaboration covered data integration and deployment, improving reporting through automation, resulting in speed, accuracy, cost savings, and better decision-making. Our enhanced reporting capabilities now include detailed asset and liability insights, weekly cash flow forecasts, and scenario shock tests to aid strategic planning and portfolio management.

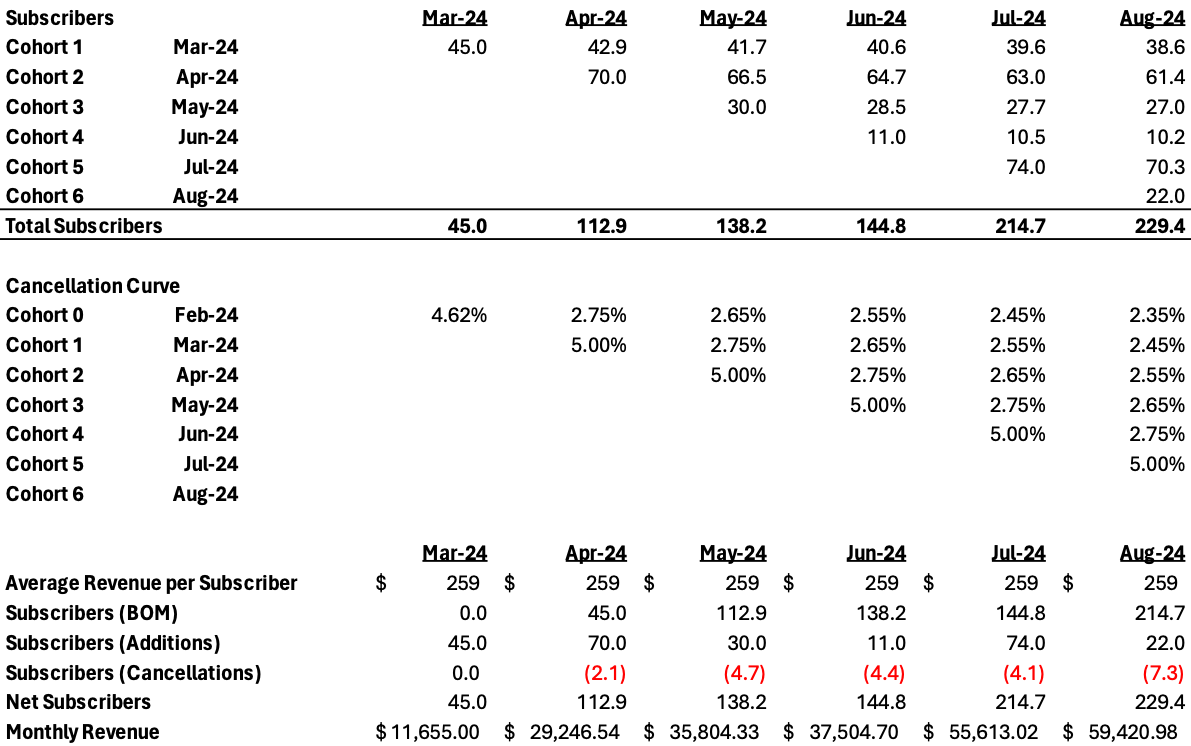

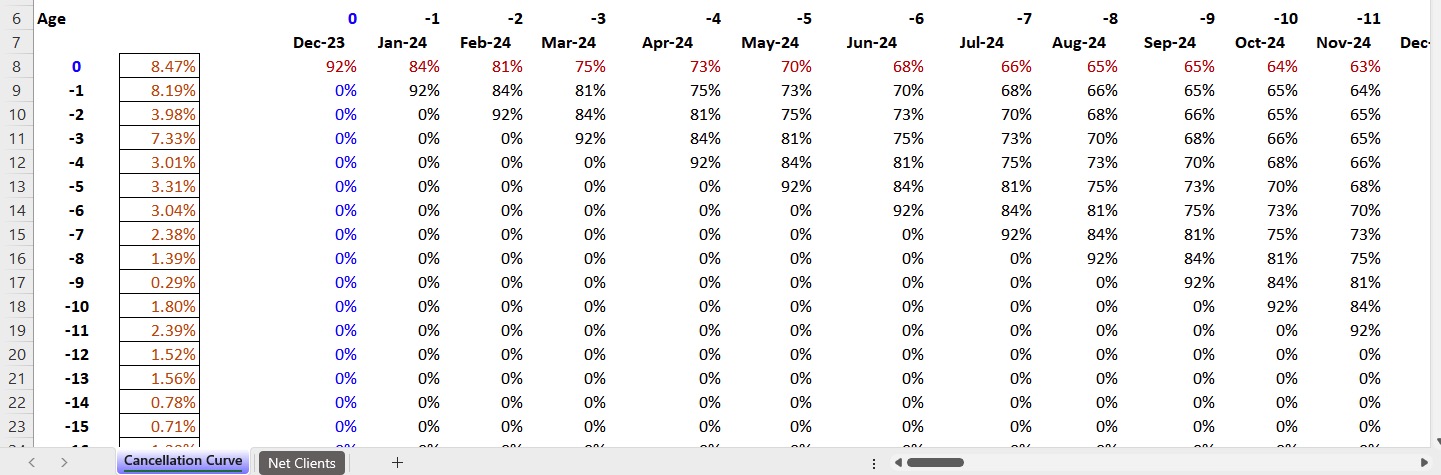

Recurring revenue modeling can be tricky, using cancellation curves can improve precision and results

In a recent post on SaaS financial modeling, I covered some of the main drivers that play a role in the construction of financial forecasts for SaaS and related business models. One of the most important aspects of such financial forecasts is the build out of contracted revenues. In general contracted revenues can be quite […]

Crypto futures trading can produce serious returns with predictive algorithms

Predictive models underpin many trading systems. In this post, I discuss the application to the emerging world of crypto futures. Tradery LabsI recently had the pleasure of doing some advisory and coaching work with a startup called Tradery Labs. Tradery Labs is bringing futuristic predictive-modeling techniques into a highly honed system that will democratize the […]

Key considerations for SaaS (or any recurring revenue) financial models

Build your components so the are easily expandable in time and detail In SaaS, decoding revenue dynamics is pivotal for pushing the business forward. Let’s talk about the elements of financial modeling tailored for SaaS companies: 1. Revenue Insights: MRR (Monthly Recurring Revenue): This quantifies the predictable monthly revenue, offering immediate insights into short-term revenue […]

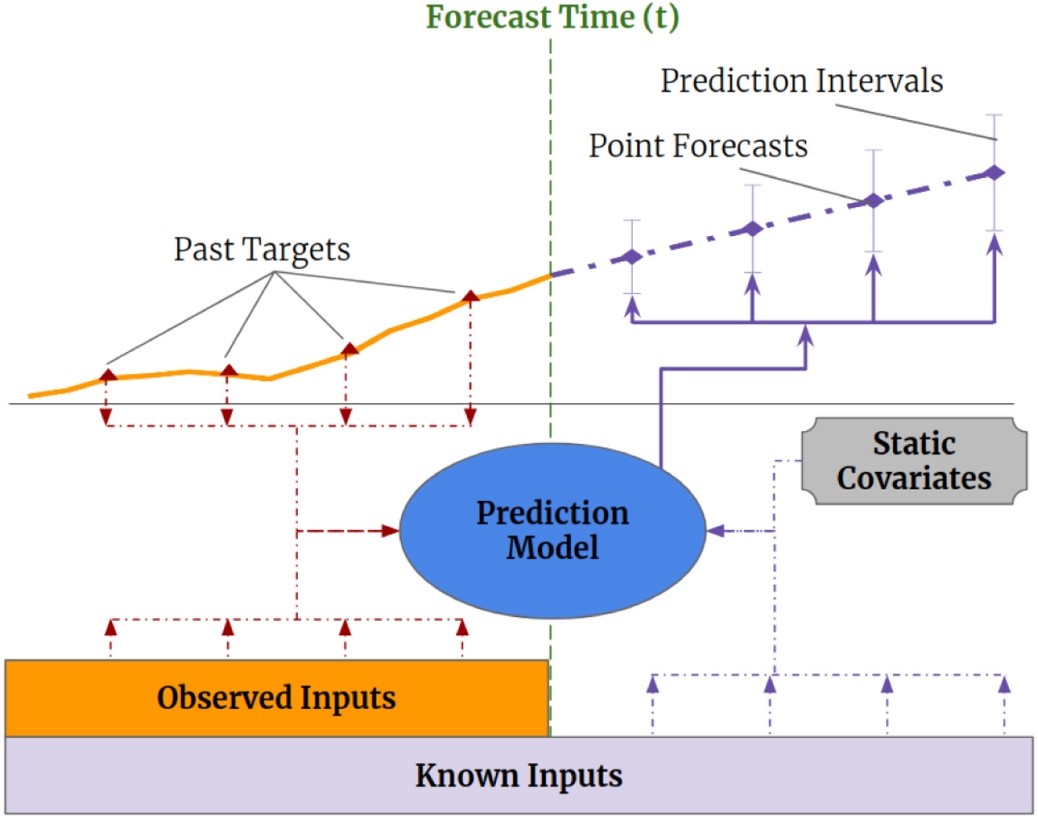

An AI Crystal Ball? How We Predict Future Outcomes Using a Temporal Fusion Transformer Model

Our data science and analytics teams handle and apply lots of data for insightful decision-making. Last year, I presented the data science team with a challenge: use historical data to predict a key business driver for each of the next 8 periods. We wanted to have a data-driven preview of what we might see in […]

Unlocking Value Creation: The Power of Lifetime Customer Value in Operational Execution

You might see it in various places as CLV (Customer Lifetime Value) or LTV (Lifetime Value). Lifetime Customer Value, or LCV, is what I call this metric. Fairly interchangeable in my experience, people who use these metrics regularly will know what you mean when you refer to any one of them. LCV’s compact measurement of […]

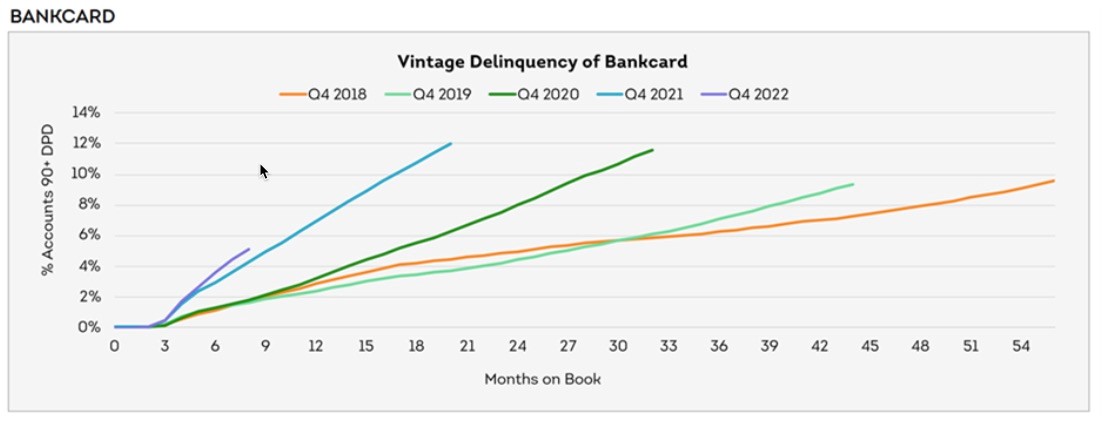

Unveiling the Enigma: Contrasting Consumer Cash Reserves with Escalating Credit Card Delinquencies

A recent analysis sheds light on the intriguing interplay between burgeoning consumer cash reserves and the surprising surge in credit card delinquencies. Despite the Federal Reserve’s reports revealing a remarkable 2.5x increase in cash holdings for the bottom 50% of households, a deeper dive into Transunion’s credit data exposes an unexpected trend in delinquency rates […]

Unlocking Synergies: Elevating Data Science with Operations Research Expertise

**Introduction:** Who’s on a quest to develop advanced data science capabilities? One of my analytics team’s strategic expansion brought together diverse talents in statistics, applied math, and engineering. This case study explores the integration of operations research, fostering collaboration and knowledge diversity within analytics. **Objective:** Our primary goal was to blend diverse skill sets, creating […]

Decoding Consumer Balance Sheets: A Deeper Dive Beyond Savings Rates

Navigating the landscape of consumer finance, especially in the realm of excessive debt, prompts questions about the financial robustness of consumers and its potential impact on economic trends. In the post-COVID era, media discussions often revolve around the consumer savings rate, a metric influenced by stimulus measures and changing consumption patterns. However, a recent revelation, […]

How We Replaced an Implementation of Workday Adaptive Enterprise Planning Management with Microsoft’s PowerBI Tailored for FP&A Reporting

Excel’s powerful capabilities, integrations and flexibility make it a favored tool for all financial and accounting professionals. Like many middle market companies, we considered moving from an Excel dominated financial planning and reporting process to an “enterprise grade” solution. A very difficult decision, we set aside Excel for a unified financial planning tool, also known […]

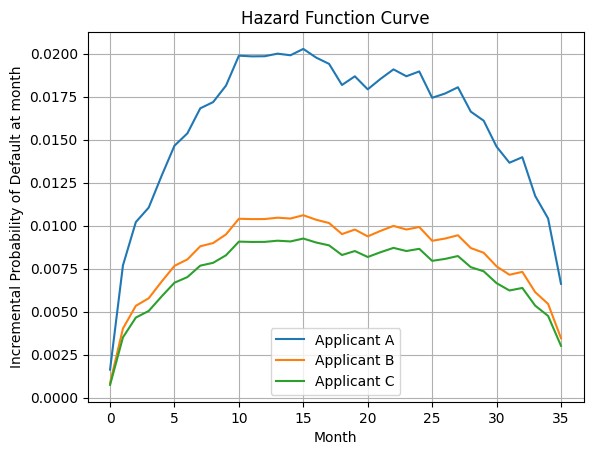

Unlocking Consumer Loan Pricing: A Deep Dive into Survival Regression Algorithms

In the evolving landscape of consumer lending, fintech companies have revolutionized borrower experiences, introducing real-time approvals and swift fund transfers. While tree-based classification models like XGBoost currently dominate credit scoring, survival regression algorithms are an intriguing alternative. (Quick note: These survival algorithms extend beyond consumer credit to products with recurring payments, such as subscriptions or […]